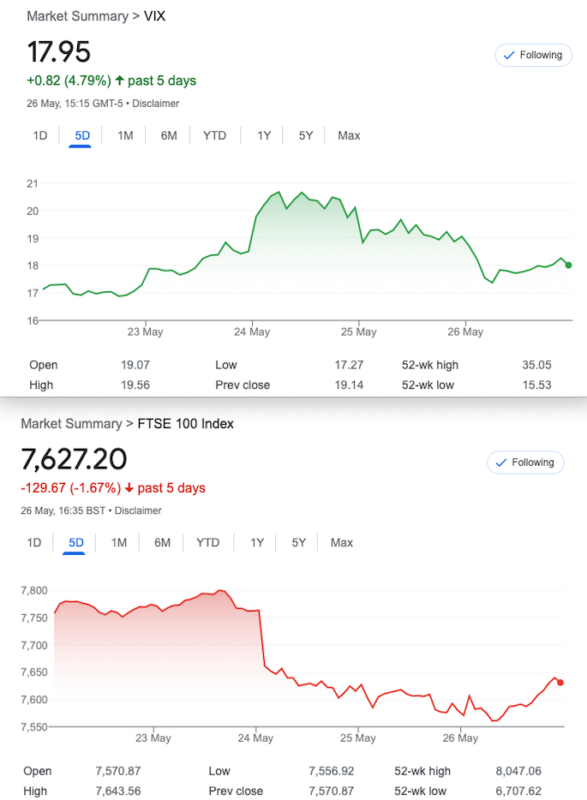

That Was The Week We Saw a Big Dip

Friday we saw the FTSE drag herself back up out of the mire, to record a weekly drop of 130 points. We suspect, however that being a public holiday long weekend meant that the bosses were away on a beach. Leaving the ‘weak hands’ in charge. So it’s maybe wise to consider this a blip and step back, casting a keen eye over the chart. FTSE seemed to put in a level of support bringing it back over 7600. Curiously certain levels seem to be ‘magnets’ and that is something we watch. Fibonacci and Gann traders like levels determined by their calculations. A trading buddy sends me daily pivots, which once upon a time I took very seriously. Rigid maths, however may apply in engineering, but the market is the ‘slithey tove’ to borrow from the Jabberwocky. Quantum Physics rather than geometry, in my opinion.

Recession Still Looming?

Mortgage rates have bumped up and inflation refuses to lie down. Your aged writer remembers the late 70s when inflation went skywards, and heralded the Thatcher era. Financial prudence was the mantra, while selling off the nation’s dubious assets. This time, there’s nothing left to privatise. We should not be too downcast as the future is bursting with innovation, nuclear fusion and AI may help us to achieve a whole other level of prosperity. New solutions to old problems, new jobs, so much to anticipate. Archaeologists are finding new sites almost daily. Revisions to old thinking about the past are being made with alarming regularity. Neanderthal man was not a knuckle dragging imbecile, far from it. Perhaps history will not be so kind to our own era!

It may be somewhat churlish to say that we can generate profits in all market conditions, so recession is not a problem for us. Of course it’s a problem in the wider sense but we cannot change those things, but we can change our trading. We can be kinder to others with our profits. Just a thought.

Distraction Trades

ADA $0.3633

XRP $0.47202 Crypto, doldrums? Surely not.

DAX – Staggering! Not one trade entry – not a one. Statistically this was probably overdue, so not overly worried. We need a fun instrument to trade, help!

Legacy and new Trade, How to Read The Debt Ceiling

Trade 317 It Was A New Expiry Month

A homage to Liz and Jenny once more as we borrow from the esteemed Tasty Traders, the strategy known as the Jade Lizard. This trade has no upside risk, as we perceive the danger may lie that way. June expiry. We sell a call spread: Sell the 7800 call for 68.5 and buy the 7850 call for 45. We sell the 7550 put for 27.5. Maths scholars will note the call spread credits us with 23.5, add this to the credit for the put we sold, gives us 51. Figured out the upside potential loss? It’s the value of the call spread,which is 50. Downside risk at 7550 minus the credit 51= 7499

So, the drop was unexpected but we now have 53.5 for the 7550 put and 7.5 for the call spread. Gives us: 61, a loss of 10. I had messaged during the week about my concerns and possible adjustments, then this appeared somewhere in my ‘net travels:

So, with this in mind it may be prudent to see how things pan out during the short week ahead. Adjustment should not be a knee jerk, we need a plan. We have so many ways to adjust and opportunities will present themselves. We are the polar opposite of predictors, we are active/reactive traders. Although having a view on the market is part of the process, it is in a state of flux, like our options. Constant change is part of the process, and using the interaction of options is how we roll.

Trade 318 Time for One of Our Hybrids

We are going to sell a put in the June series and buy a put spread in the July series. June 7400 put 28.5 July 7550 put 101 and the 7400 put is 70. So we pay 101 for the 7550 put and for the 2 puts we sell, we get 70+28.5= 98.5. 101-98.5= 2.5 so that is our cost. We are short at 7400 in June and July, but long the 7550 put in July. The logic of the trade is that we will have a ‘free’ put spread for July, so long as June expiry is above 7400. We have risk at 7400-150(the value of the put spread). This means we have risk of loss at 7250. Max reward is 150 minus our cost 2.5.

Caveat: I have tried this before and it was not a success, but volatility means we need to create theta rich trades, while limiting risk.