That Was The Week Down 0.5% Trouble Ahead?

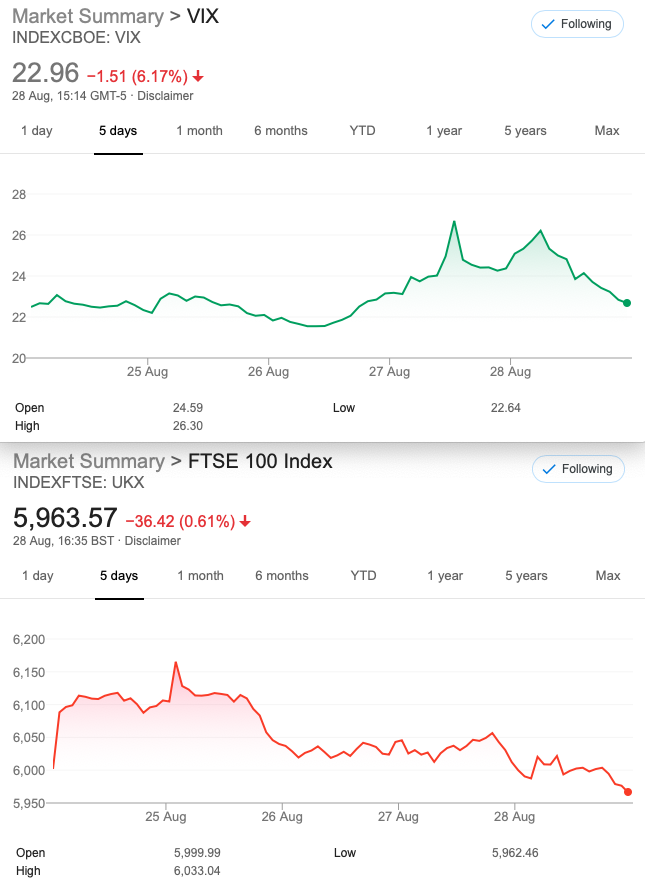

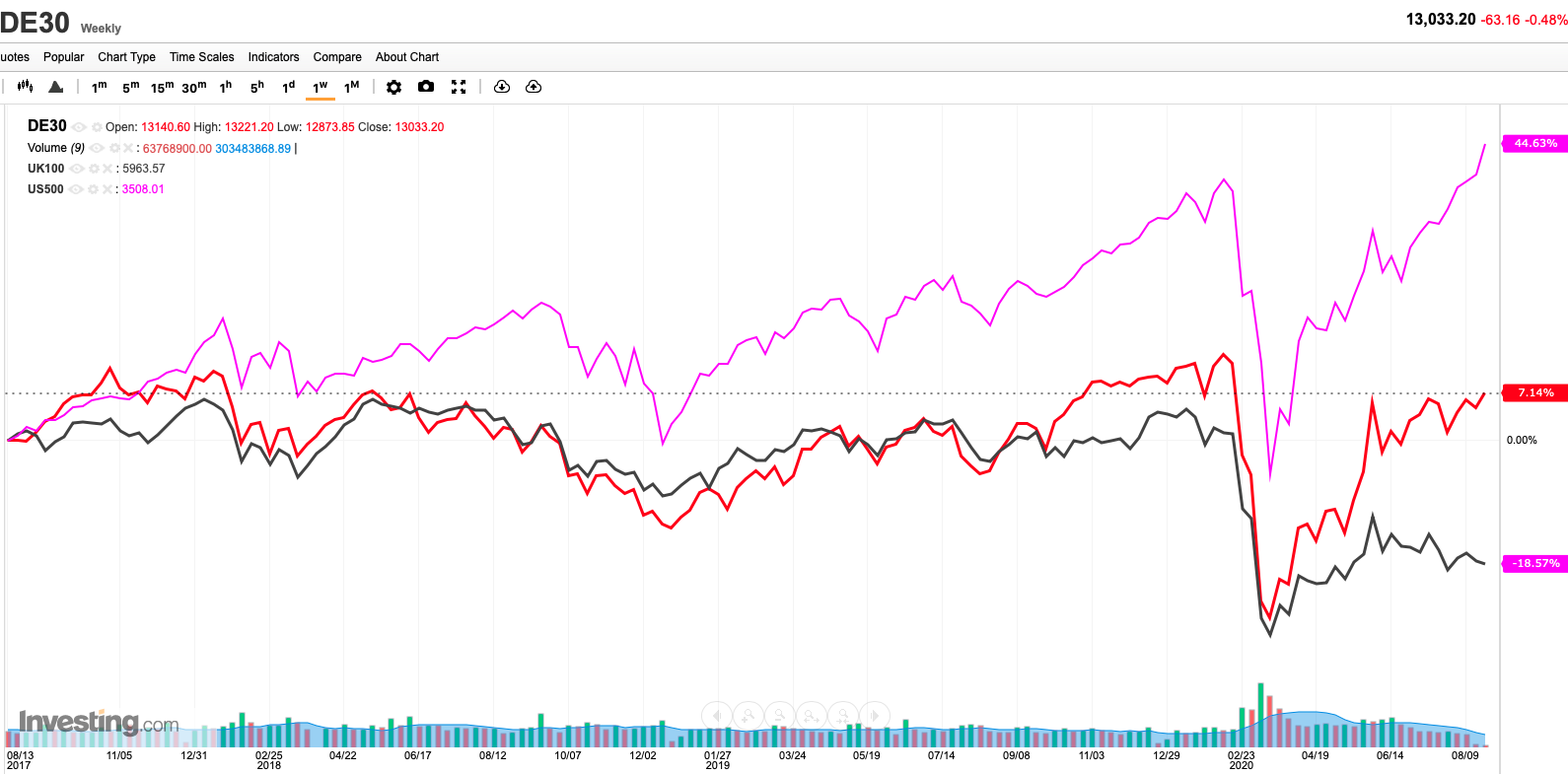

Colleagues have debated recently, the lag of FTSE when other indexes are on fire, and the US making new highs. Conspiracy theorists seem a little thin on the ground, but we’re told that the ECB and the FED are buying directly into their respective stock markets. Additionally there are few, if any, tech stocks in the FTSE100. Apple and Tesla are so huge they have a stock split on Monday, so pay attention, people. Forrest Gump’s naive investment continues to enrich its believers. Quality products produced by well run companies should be doing well, no problem there. Unless you look at Tesla’s valuation and the cost of Apple’s electronics. Just sayin’

Simple eyeballing of the above shows FTSE lagging well behind, as America goes parabolic. Perhaps it’s a comfort for those market neutral traders, maybe we won’t have such a frightful drop. Optimists among us might also say it’s catch- up time and we clearly have plenty of headroom with the previous high some 25% above today’s level. DAX in the middle S&P500 on top- that’s us languishing with the class dunces!

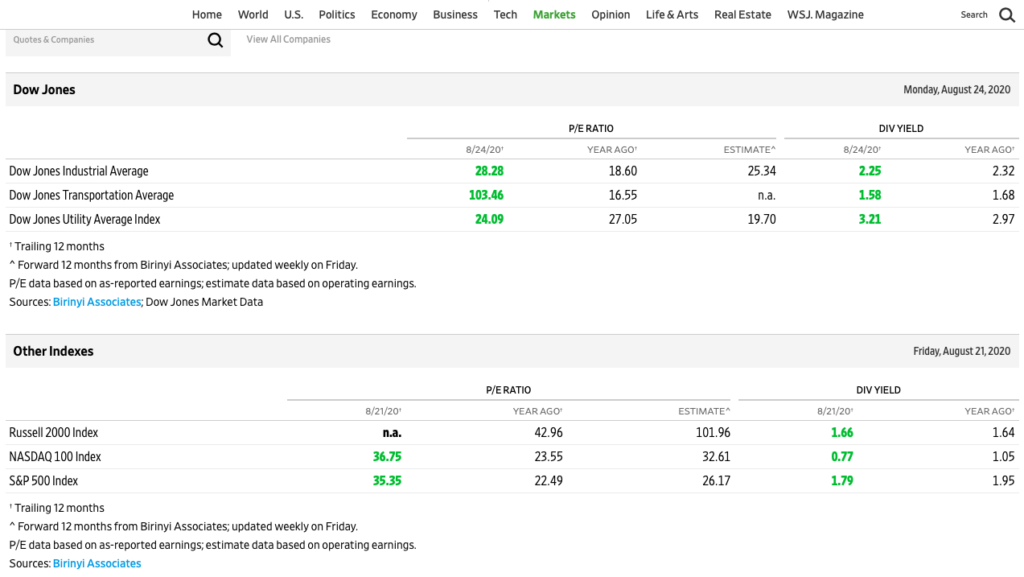

More Reflections on Valuation But Do Old Metrics Still Hold Good?

Ratios seem to be substantially higher than the long term average- and DOW transports? Yikes do they really think things are getting back to normal, or does the online business justify this nosebleed valuation? Hope you can see the prices clearly, in essence S&P last year 22.49, now 35.35, but DOW transport last year 16.55 now 103.46. Presumably the market thinks that airlines will be booming again. Richard Branson once said when asked how to become a millionaire: start off with a billion and buy an airline!

Distraction Trades- No Real Money Yet. We Try To Break Our System

Again some issues with EURUSD as it’s a slow burner but it’s worth a look, modest stops looking to get 20-30 pips before it stops and reverses. However a whole better ball game is DAX which is like a toddler with a litre tub of Ben & Jerrys*- the sugar rushes are apparent- in both directions. 150+ daily range, so if you’re on the right side on a 5 min chart you can ride out the trend for a couple of hours, set your take profit limit or trailing stop and ….breathe.

*other high sugar desserts are available

Legacy Trades

Weekend Strangler

Last week 6200 call 43 and 5650 put 48= 91 Oh! 96 Loser (However drop to 80 on Tuesday )Still not convinced.

This week 6125 call 42 5700 put 42.5 = 84.5

Trade 185 Semi-calendar butterfly The Terrapin Butterfly- or Terrafly, in short!

( Wrongly got this pegged as Trade 186 last week )

Assuming the market doesn’t go the the Moon, this may give us a bit of an edge. The trade is not cheap, however at 186(Sep 6100put)+ 160.5(5900 Oct put), 2x 6000(Sept)put at 137.5=275. Gives us 346.5-275=71.5 This is new territory so wet finger in the wind time. Max profit 200(?) max loss <71.5

So here are the prices-this looks promising Sep 6100put 189. 6000put 132(x2) Oct 5900 put 156.5

Prices now 345.5 -264= 81.5

On the basis this may make weekly gains of about 10 this looks very promising. Risk is max 71.5 remember

Trade186 Are We Seeing Cracks in The Market?

Hmmm market has taken a small tumble, are we bouncing off a Fibonnaci level or has support at 6000 broken?

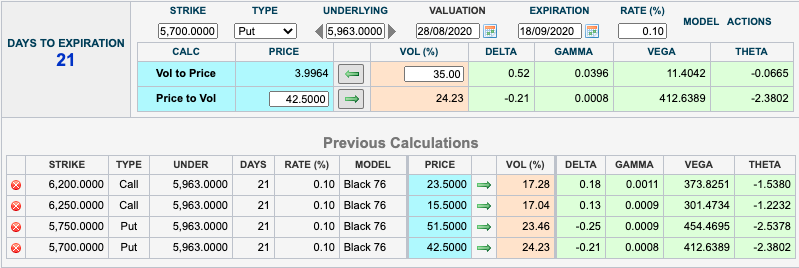

Sell Call spread 6200/6250 23.5 15.5=8 Sell put spread 5750/5700 51.5,42.5 =9 Dreary old Iron Condor for credit of 17– premiums are ok and our risk is max 50-17=33. September expiry with only 21 days to expiry- the Americans like to say’ expiration’ We don’t know why!