That Was The Week

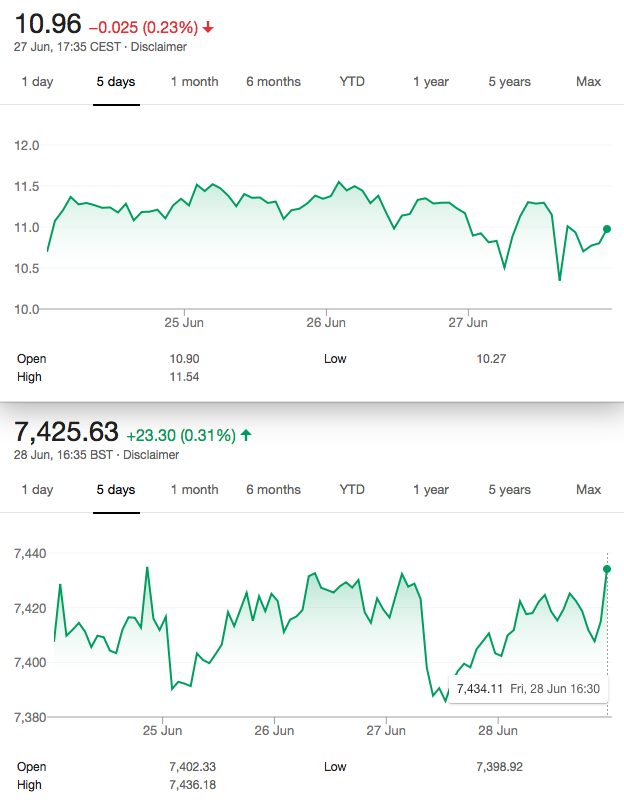

FTSE barely moved- up 18 and intraday moves ±0.5%. So, indecision is the order of the day but we may see some crazy next week. Trumpenomics tend to say one thing and then reverse. We were told that 5 key PMI indexes in the US were hitting lows not seen for 10 years. No matter, share buybacks keep the show on the road, fuelled by easy money. Any readers have a view on what could derail this train?

Meanwhile one cause to celebrate-my thanks to the internet.

Some Observations from a Frustrating Week

This ‘optionista’ recently had an expiry of an in-the-money butterfly with all options negating each other. I was prompted to look again at expiry. Traders typically hold the common belief that 90% of options expire worthless, but the reality is somewhat different. https://www.fxempire.com/education/article/7-myths-options-trading-debunked-366390

I can summarise- only 30-35% of options expire worthless, but in the life of the option it might be traded as a part of a complex trade or in isolation, having reached its profit (or loss) target. We may adjust or add an additional leg to a trade, depending on the bigger picture. Readers here have not been over burdened with such activity as our trades seem to have ok outcomes. Our mission is barely compromised, however as the strategies used have been mostly simple and easy to ‘get yer head around’.

Our Two legacy trades:

Trade 136

Now 83.5 ( ( 7350 straddle 126+36.5) 7250 put 7450 call 19.5+ 59.5 ).

Trade 137

So, we bought the July 7150 puts(21) and sold twice the amount of the 7000 put (10). Debit 1. But it’s now worth zero.

This Week’s Proposed Trade 138

Though it’s in an ugly market, that may tear away. It’s…….

Box of frogs time! We sell 7250 put buy 7550 call– a risk reversal or combo, as it’s known. Both options are worth 19.5 so the cost is zero. Seemingly, this market knows no downside- no headwinds everything is ‘just peachy’. Caveat-we are naked remember!

Another Trader Quirk

I like to keep track of up days against down days, as the median is:51% up days, per year. Though currently we are very skewed with about 17 more up days than should be. In my own humble estimation and based on year to date. This means no more than a coin toss. But then again………

TRADE138- win and close- we’d have done 5-10 lots. So from a cost of 0 the trade went to 34 for the calls and 7 for the puts= 27. Even on a modest 5 lots after comms this would be about £1200 in the back pocket. (720 Duchy Original golden ales!).

The market may do more but these are ‘box of frogs ‘ trades -hop in and hop out