That Was The Week

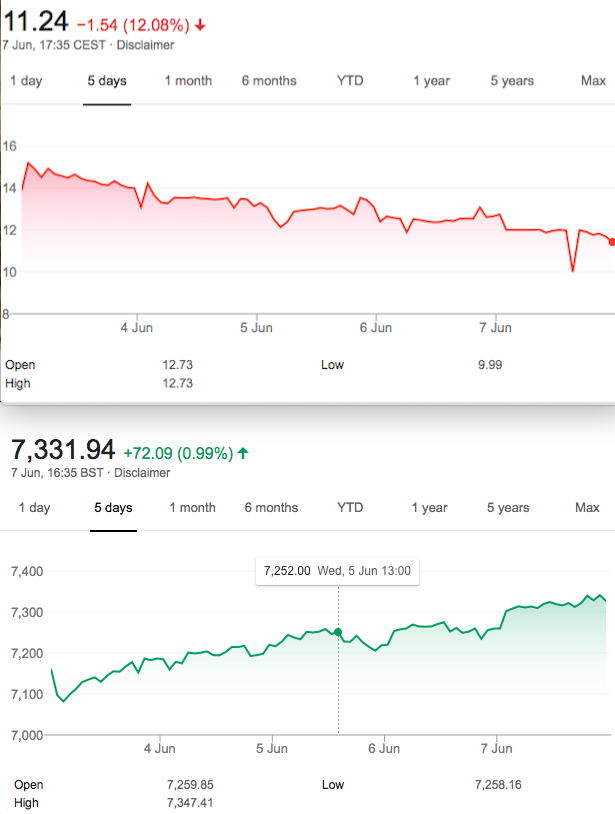

FTSE Up almost 2.5% But,…………………………… SPX up 4.4% based on rumours of the FED softening and cutting rates. I think personally that they wanted to show how good things are when the commander-in-chief is out of the US!

Actually bad news is good news. Good news is good news. Indifferent news is, well, a clear buy signal. Thus SPX is a smidge away again from the all time high. Volatility is vanquished. Curiously VIX had spiked up on Friday. Spooky action.

So, what’s going on? Non Farm payrolls 75k against a forecast 177k. UK retail sales are really in the doldrums as many stores threaten to close along with motor manufacturers. You have to think these sectors need a change of tack. Oil is still a darling, pricing based as much on political instability as availability. World consumption surely is fairly constant. Can we still see a time when fossil oil is relevant, along with high street shops and car ownership? Does the economy matter to the stockmarket?

Trading as an Art

The internet has some amazing resources. I was recently invited to an online course about financial markets. This sentence caused me to halt and think for a while. ‘Behavioral finance is the application of psychology,sociology, other social sciences to understanding financial events.’ This seems at face value to be a rather academic exercise. But what are the drivers of markets? Can we use behavioural finance in our trading?

To answer this I think boils down to one word: PRICE. A settlement price is just an opinion, within certain bounds of course, but price is the summation of all opinions.That is not a predictive science, it’s retrospective. We need to arrive at a price in the future based on what we have today. That is art. We see a ‘head and shoulders’ pattern in FTSE, and expect the neckline to mean something.

Who can make a confident prediction from the price action alone? Some people can and apparently they make profits consistently. I salute them for their insights into interpreting such small data.(Note tiny volume)

Thus again we come back to the complexities of options, and how we can gain further insights. While we may have issues determining direction, we know the Greeks can still mitigate in our favour. We know we can confidently sell more options than we own in high volatility. In low volatility we can wait for another entry, or take a position that will gain from the vol increase. We may even gain insights from the amount of options traded at certain strikes- open interest.

The artful part- determining what is high vol.

The Options Bit- Our Running trades- Trade 132: Closed

So, we bought the 7200 put(50.5) and sold two of the 7000 puts(20.5) for June Expiry. Thus our median buy price was 11.5. Tuesday was a close for 31. I reiterate – exit is everything.

Remember this was for 10 lots- Thus we have £3,100 -(£1,150 plus commissions, lets say £300)-nett profit £1650.

Trade 133 Update: Closed

Our strangle. Originally:

Sell 7550 call for 8, 6700 put for 9.5. Reality check- margin of say £1500 you collect (8+9.5=17.5) £170,risk at 7567, and 6683

20 lots of Trade 133.( Sell7550call for 8, 6700 put for 9.5.) Now 2.5 for the call 0.5 for the put= 3.

I reiterate – exit is everything.

We thus take the hit of paying 3 to exit giving us 17.5-3 =14.5 x20 =£2900 minus say £200 comms Nett £2700

Trade134- When We had no margin Left: Update

7100/7200/7300 call butterfly paid 20. Now 15. Exit? Take a small hit? We’ve done well to date, but this costs us only premiums, no margin.

Trade 135 Let’s Get Some Risk On, Now We have Margin

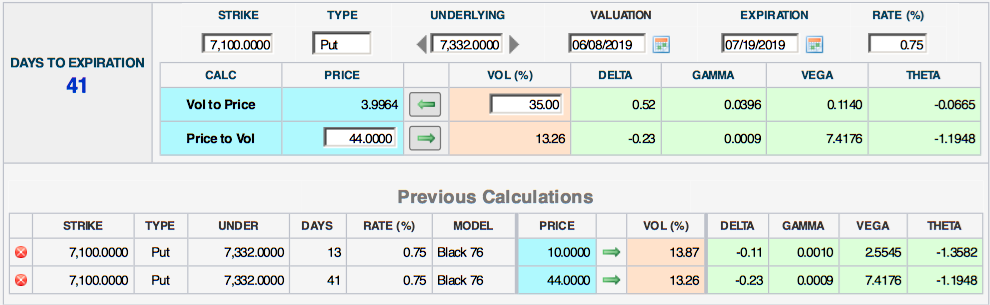

Selling 3 Jun7100 puts(10) buying 1 July 7100 put(44). 44-(10×3)= 14.

This is sadly a debit trade for 14 but a quick look at theta…..2.8798. (Do the math!)

Yes it’s risky but check out the rest of the Greeks remembering it’s 3×1. This is not a confident trade, but shows ‘support’ around 7100. Artful? We’ll see-and yes we should trade 10 lots here.