That Was The Week the US Made More Record Highs

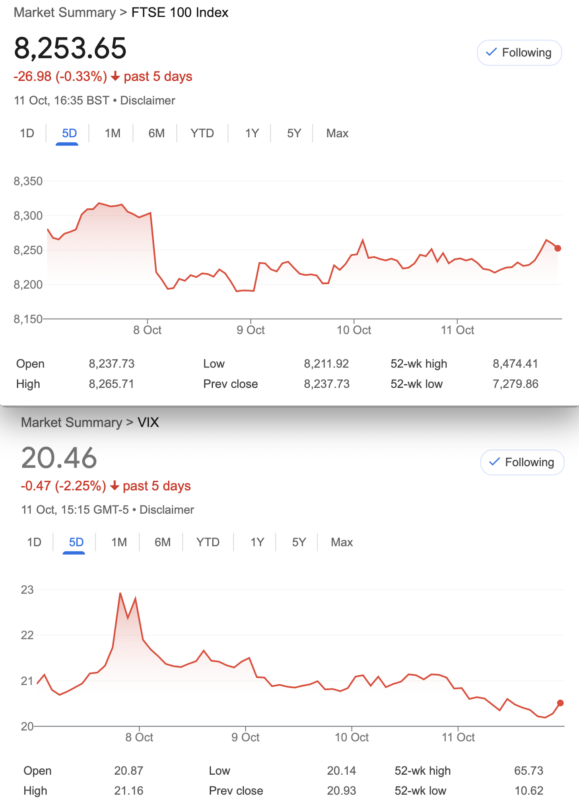

So, year to date the S&P500 is up 22.6%, FTSE 6.89%. This week the word ‘uninvestable’ raised its ugly head again and we hear of outflows from UK focused funds. We seem to have elected the most unpopular PM since the legendary 40 day wonder Liz Truss. Bite me, but I think we have a crop of unelectables like never before. Much talk of US election concerns and to date nobody seems unduly worried. The media of course being totally reliant on advertising revenue are not stating the obvious. There is only one sensible candidate though the Daily Mail are doubtless hellbent on garnering any and all controversies. Kamala’s Vogue cover got the treatment but in fairness they did state she is running against a felon.

We’re told the UK economy ‘bounced back’ though the wider view is that it’s still pretty rubbish. We have the lowest investment of any developed nation ever. What is more concerning is the hefty fine for TD Bank of Canada. $3billion. The level of money laundering must have been industrial, apparently not even questioning people paying in $1 million in cash. This brought to mind a case long ago when a chap changed his name to Inlandi Revendi and opened an account with NatWest who raised no red flags until he tried to pay in something in the order of £1 million in a single cheque, one morning. An eagle eyed teller thought the payee name looked like it had been tampered with. I’m sure it was true, but can find no trace of it, as it dates back to pre-1990.I would not wish to cast nasturtiums, though.

In The Inbox

An interesting take on the collar – a covered call with a protective put. As recently mooted by a smart options trader, the strategy know as the ‘Wheel’ has the big flaw of owning the underlying. A protective put is likely to cost more than the premium generated by selling the call, but a put spread is a happy compromise if you must own stocks. Previously iVolatility provided a lot of free stuff including the options calculator https://www.cmegroup.com/tools-information/quikstrike/options-calculator.htmlwhich was taken over by CME. The put spread strategy here: https://www.ivolatility.com/news/3025

Additionally, these guys send interesting stuff and as always make up your own mind, the options with options are vast, as we know. You can sign up for weekly emails here. http://sjoptions.com

Distraction Trades

ADA was $0.3532 now$0.3550

XRP was $0.5319 now $0.5400 Ripple still ahead of our preferred Cardano but a tiny bit of optimism. My gut tells me Crypto might be going horribly wrong. That is NOT a strategy,

DAX 5 break evens(+30) 2 winners 300, monster week 450. Here’s an example of the trade entries:

UK Gilts were £16.68 now £16.54 Another painful week. The fund that I use, like actual gilts, pays dividends at around 3.8% so like all investments you get buyer’s remorse. The carrot of the yield keeps us captive.

Legacy Trade 383- 385 And Saucy New Trade 386

Trade 383 October Can Get Spicy And The Omens Are…. Oh Wait, We have No idea!

We had a lot of fun with the ludicrous 3×1. Let’s go again and try to keep the risk level out of harm’s way, though venturing in the murky depths can mean missing out on the sunlit uplands of juicy profits. Let’s see. Again we sell 3 puts and buy 1. We sell 3 of the 7800 puts for 15 and buy the 8100 put for 45.5. Where’s our risk? sort of 7500-ish. Now that’s a fair degree of comfort with not a lot of likelihood for success. And, let’s not forget it costs us a ha’penny and requires some margin. Remember a very competent, very large hedge fund got blown up with the 3×1 trades, but with calls

Previous week: 18 and 6.5×3 Just wait! ………….

Last week: 24 and 7.5 (x3) We’re in profit!

Now: 9 and 2.5(x3)

Trade 384 A multi Leg Classic But Cheesy Trade

In actuality we have 14.2 trading days for the October expiry and things are looking a bit sleepy. We like the idea that FTSE may take a gentle glide down to the 8100-8200 area but of course prediction is silly. Looking at the chances of this, however, the open interest suggests this may be the landing area for expiry. Here’s the strikes and prices for a CALL butterfly.

8100 257.5 8200 170.5 8300 98.5 Remember we buy the wings, sell the body, which is the 8200 strike x2. Thus we have 356- 341 = 15. Expiry at 8200 would give us 100 so it’s not bad reward for a max risk 15

*[ Should you want a bigger bang you can get the 8000/8150/8300 call butterfly for 24.5 ] (305.5, 172(x2), 68 )= 29.5 ( bigger bang for buck) NOW 44 *

Last week: 8100 214.5, 8200 133, 8300 68 Thus 214.5+68 = 282.5, minus 133×2= 266 = 16.5 A 10% profit!Obviously we’re looking for a tad more than a penny ha’penny

This week: 8100 166.5, 8200 81.5(x2), 8300 26 =29.5 100% profit We run to expiry of course. Both of these could get very juicy in expiry week.

Trade 385 – The Calendar Zone

Having a trawl through the options chain https://www.ice.com/report/265 for October and November made me think of the following trade, using the massive time decay of near month and the cost of the next month’s spreads. Here we go: We SELL the October strangle (8100 put for 24 and 8400 call for 28) and we BUY in November the 8200/8100 put spread, those prices 95 and 68.5= 26.5. for the call spread we buy the 8350 call and sell the 8400 call 109- 86= 23. So we have a credit of 24+28= 52, and a cost of 26.5+23= 49.5.

Eagle eyed traders will note this is a small credit 2.5, our risk at 8450 and 8000. We may well close out before expiry if it goes to plan. Max profit 100, or 50.

This week, the October strangle (sounds like a Hitchcock film!) 8100 put 9 and 8400 call 5.5 November IC 8200 put 85.5, 8100 put 58.5 58.5= 27 8350call 74, 8400call 54=20. So, we have a debit for Oct of 14.5 and credit 47 for the November Iron Condor, gives us 32.5 While this is a nice win 30 we will run it though, the October strangle can only lose a maximum 14.5 . I’d be inclined to think that it may be prudent to close out, or roll the strangle, or the entire trade!

Trade 386 November And The Ominous US Election Cloud

Sticking to the knitting, and regulars here know we love a put ratio spread. The choices are huge but trade selection comes down to: Do you want a big chunk of premium? Are you happy to place a low or zero cost trade that could give bigger rewards?. Where do you think is an acceptable level at which to have risk that needs to be managed.? This time it’s a low cost 8200/8000 put ratio spread and as it is long at 8200 and short x2 at 8000 this means risk is at 7800, currently about 6% below the futures price. We pay 85.5 for the 8200 put and collect 40.5 x2 for the short 8000 puts. Our cost is thus 4.5 with risk 6% below the market, zero risk from 7801 upwards. Should the market go very South, we’ll look at adjustments. Let’s hope we get a delicious expiry in the meanwhile.

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.