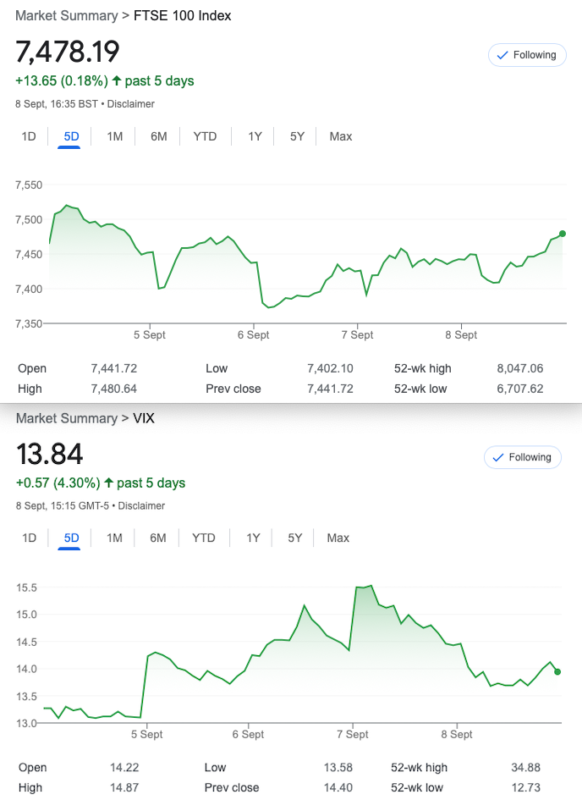

That Was The Week, FTSE Did Zip,as Usual. Everything Else is Falling to Bits!

I think back in our day we would have welcomed the raac(crumbly concrete) induced school closures! However the lockdowns from Covid have not served our youngsters well. And with more bad news for schools this may be a timebomb, in 10-20 years time. Education is our mantra here at OptionsInvesting.co.uk and it is placed front and centre of our existence. We never stop learning and with options there’s always another strategy we have yet to try out. Americans are urging their youth to learn a trade, avoid massive debt from college and earn as much as a graduate. What can be more satisfying than to build, or fix things?

My own internet history,aside from a keen interest in American politics, shows a bit of a thing for construction. Options trading keeps me at the screen maybe <10% of the time. So, lighter diversions are always welcome, with France and Sicily featuring old properties ripe for renovation. Your intrepid author likes Greece for a bargain, but with the climate emergency the UK could well become climatically perfect. A quick search reveals that here, there are few bargains.

Wall Street Took A Pasting:It’s Not Funny

This appeared in one of the many missives in my inbox:

Regulatory sheriffs await Robinhood’s latest UK foray; Meme stock platform faces hurdles to trading method behind US growth

Rafe Uddin and Jennifer Hughes – Financial Times

[When US share-trading app Robinhood made its first attempt at launching in the UK in 2020, it generated considerable excitement – and a waiting list of 250,000 would-be users. But a two-day failure of the company’s US platform in March that year and the subsequent coronavirus pandemic forced the company to abandon plans.]

Remember, the plan was to buy a ton of calls and tell everyone on Reddit to do the same, making traders hedge those short calls by buying stock. A few people made $$$ short term. Trading options properly as we have shown year after year, makes absolute sense. Scheming in this way helps nobody long term. We need another share platform like we need more of this: https://www.theguardian.com/business/2021/jan/27/gamestop-stock-market-retail-wall-street

What we DO need is engagement in sensible options trading.

Distraction Trades, Not Doing Well

ADA $0.2546

XRP $0.50331 Again Ripple is holding its own while Cardano looks as popular as a Tory MP

DAX Oh dear! 1 win +50, 2 losses -30 x2, 2 no entries.

UK Gilts were £16.34 now £16.34 (I’m beginning to think Premium bonds are better!)

Those Legacy Trades and 333, Can We Stop Winning?

Trade 328 Put Spreads, the Long and the Short

In conversation with a very smart, and risk averse trader, his research had led him to an interesting proposition. Seemingly the max theta is to be found in the 20/13 delta spread. Combined with TastyTrade’s 45 DTE(days to expiry) this is the optimum place for a short put spread. Let’s see the graphic:

We were a little late to the party but perhaps that’s fortuitous, given the drop this week. So the short put spread, selling the 7250 put (delta 20) and buying the 7100 put (delta13) gives us a credit of 16.5. Now I’m going to be Devilled Avocado here and say I’d rather go with a put ratio spread. But it’s important to understand the difference. Margin for both trades will be required but fixed for the short spread and bigger and variable/possibly brutal for the ratio spread. A big drop would see the ratio spread in trouble but the ratio spread doesn’t get ugly until 6950.

Last week we saw : 39.5 and 24 ( started at 45 and 28.5) so the credit spread was a tiny credit of 1, the ratio spread took in 12, now 8.5 -early doors of course.

Last week :The straight spread=5.5 the ratio spread gives a Credit 1

Now: 7250 put=4.5 and the 7100 put= 2 So it is a win all round and the straight spread here actually did fine,making 14, while the ratio did at best 17.5 IF we had taken action 2 weeks ago. Not thesmae trade, remember.

Trade 330 We Don’t Take a Loss Lying Down

We carry on the position and break the golden rule: A calendar trade runs at best to expiry, anything else is a new trade. So let’s say we are in debit 255 we own a 7500 put. How can we redeem this position? MAJOR ALERT: We NEVER accept a big loss, we always look to mitigate this with a new expiry month. Here’s what we do: We sell 2×7650 puts, and buy a 7800 put. You’ve guessed, right? We now have a bulletproof rock solid 22 carat gold butterfly. Those prices for the 7650s we get 383.5×2= 767, we pay 528 for the 7800 put. Gives a credit 239, and our loss was 255. So, we are in a loss of 16, but wait………. we OWN a huge butterfly with max poss gain of 150.

Last week: Of course there’s no free lunch, our butterfly is currently worth 16 but Trade 329 cost 57 and we want it back!

Losses.

Can we make good? We need the market to rise in the next 4 weeks. Likely? Who knows, but our position cannot worsen much, we are locked in safely.

Was 173, 302(x2), 446.5=16 exactly the same as last week!

Was: 7800 put =321, 7650s 180.5(x2), 7500 put 71 Gives us 31 Credit

Now: 7800 put 315, 7650 puts 169.5 (x2)=339. 7500 put 56 Gives us 32 Credit (Remember we want to get our 57 loss back)

Trade 331 Futures Go Skywards After The Cash Close (7375 )

We have seen this before but does it presage a rise on Tuesday? Let’s get bullish and BUY the 7375 /7475 call spread(74-35) and sell the 7200 put(36) to pay for it, minus 3. Logic of the trade being that the next couple of weeks may be positive, and the trade could make 100 for a cost of 3. We reckon there’s support around 7250, but we are selling a naked put if things do go south, the call spread may not be a lot of help. Again we could have some valuable education with that.

Last week: 7375call=132, 7475 call 65, and the 7200put=7.5. WIN! 59.5 -3 trade cost=56.5 Close out for big profit, run for fun to expiry. So, we’ll take that, and watch to see if it does make the max 100.

This week: the call spread = 125- 53.5 =71.5 and the 7200 put now 3, plus trade cost 3 gives us 65.5 Profit

Trade 332 Let’s Break Something

Here’s a fun trade with 2 naked elements, a risk reversal. We sell the call and buy a put. 7600 call for 20 and the 7350 put for 21, costs us 1. So, some may scoff and this really is not recommended but the logic of the trade is simply this: We have had to date 99 up days and 74 down days and the old logic was that if this got too out of wack you’d go that route. So, a surfeit of up days tells us to go short. OK, hands up, there’s no real logic to this but let’s see where it goes.

These trades made ££££ in 2008/9

and the joke was, we’d wait for 2 consecutive up days if there were such a thing, to place these. Since then aside from the obvious 2020, we’ve seen an endless stream of BTFD.- buy the freakin’ dip

this week: Best we could do was win of about 20, theta crushed these to a credit of 1 by Friday WIN!

Trade 333 – Triple Nelson Should we be Scared?

It’s expiry next Friday and we need a calendar trade but don’t want to get too ugly. We BUY a 7550/7450 October put spread and against it we SELL a Sept 7450 put. Those prices: 135, 91 and 34. Gives us a debit of 10. We hope the spread is worth >10 at expiry and the Sept 7450 expires worthless. So, we will have fun adjusting if it goes to h*ll.

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.