Apologies for incorrect VIX chart last week

That Was The Week, Some Trading Opportunities Weekly It Seems

The recent high of ±7140 may be a new lower high. What really moves the markets, though is the FED. Quietly enriching shareholders for no apparent reason. For so long it’s been better to buy back your own shares than actually do anything. However our remit remains- to trade profitably, to continue the journey and learn.

Our very own Plague Island is now (per capita), the worst nation on the planet for Covid infections- racking up about 1/4 million each week. India has now imposed restrictions on UK visitors, and rightly so. Other nations have made huge strides in curbing infection rates. The US remains in 2nd place with 700,000 deaths. Hard to comprehend how our economies are ‘roaring back’.

We cannot fix that, however. Stay safe,and be smarter than the herd.

This gent is quite interesting if a little ‘doomy’ https://youtu.be/h-4DEF3eZCQ

I never dismiss anyone’s commentary on the market, becasue frankly, they all know more than I do. I just ‘know’ options!

The Call Enigma

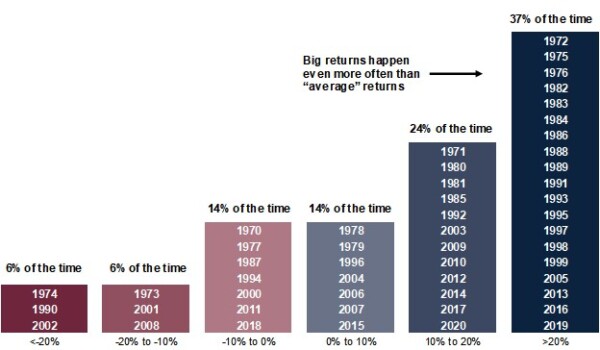

Margin rates for calls are ±2.5 times that for puts. We know the market can go to infinity and beyond, but perhaps there’s a better explanation in this graphic. The surprises to the upside are far more prevalent than we think. Who knew?

This is somewhat simplistic and based on annual figures but it makes interesting reading and insights for those LEAPS trades.

Distraction Trades

DAX ………………………………………….. Not ONE trade entry. Zip, nada, nil. The market changes and morphs, the strategy is fixed. Time to tweak, abandon? Watch this space.

XRPUSD low of $0.886 now $1.036 The Cryptos are looking too wobbly for this idiot. I’d have been a buyer around $0.70 The August price.

Those Legacy Trades- Looking a bit Lame,plus 237 Theta Monster

Trade 235 October Expiry

Time to buckle up and play safe?

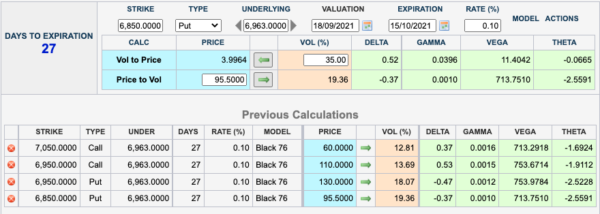

What could be safer* than an iron butterfly? We sell the straddle, buy the strangle and hope our strikes hit the sweet spot, as this may not do much in the meanwhile. We take in…… and our risk is 100 minus our credit Near expiry we may be able to have some fun with it too, morphing, rolling and maybe a ratio here or there. Here’s the graphic:

OK it’s 110+130 minus 60+95.5 I’m really not doing that for you!

* Is anything safe?

Currently 87.5 maybe not time to panic

Now 84 -we know how this goes as the Greeks effectively make this a nothing trade until expiry.

Trade 236 Ugly Trade Following Bizarre Week

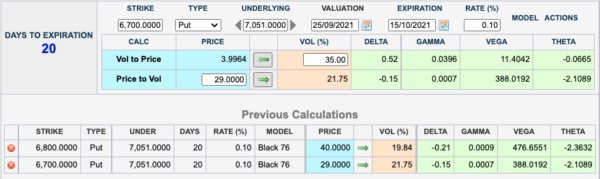

Here’s the Greeks:

We are selling……. yes selling the 6800 and ….buying 2x the 6700 puts

Thus we have a debit trade, costing (29×2)- 40 =18

This trade only makes money when the Vol kicks up a fair bit, it’s not attractive as theta works against us and we really need a good drop. It’s safer though in the event of a catastrophe as we can only lose the value of the short spread, and let’s say we drop to 6800, it would make a good return. That, however also depends on the speed of the market drop. Slow burn will kill us, if boredom doesn’t get us first!

No, we don’t like it but Murphy’s law says we are wrong. Whatever the outcome it will be a good lesson.

Currently 11 looking very ugly as we started from a low point on the FTSE and we are virtually back where we started 7027 now 7051 at trade entry.

Trade 237 Last Oct Expiry Trade?

Given the revelation of the propensity for upside surprises, let’s get brutal with a 3×1 calendar. We are selling 3×6800 Oct puts to buy 1(one) Nov 6800 put. Theta is our motivation here- yuge for Oct- check out the Greeks:

Yes it’s ugly on Deltas and of course Gamma- which gets spicier the nearer to expiry. The simple ratio of 3 to 1 could of course be moderated to 2 x1, 5×2 etc