That Was The Week, Who Pulled the Plug?

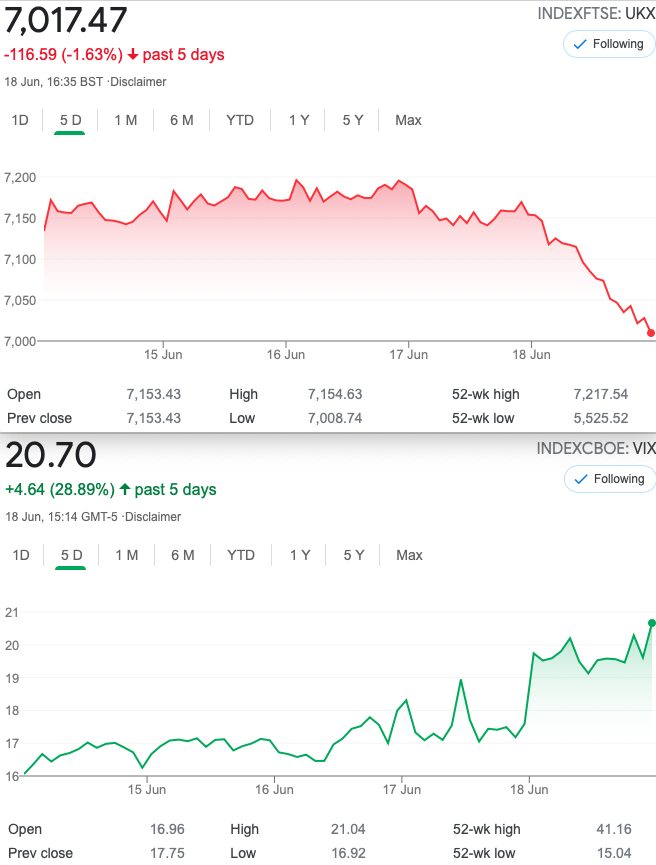

So, the eagerly awaited FOMC meeting was a bit of a nothing, until it became something. However the ‘hawkish’ message seemed to strengthen the $USD and tank markets both sides of the Atlantic. Additionally precious metals tanked, while the oil price creeps up. https://www.marketwatch.com/story/markets-are-sending-peculiar-signals-as-fed-tune-changes-heres-what-they-mean-11624046114?mod=home-page

Dismal news with Covid infections but we kind of knew there’d be a 3rd wave. However the stats are more nuanced than we thought. Tests are not terribly reliable and deaths are often not due to Covid but the patient has a positive Covid test. All too complicated for this derivatives trader- and people say options are too complicated!

The recent deluge of good information relevant to our community continues apace. Here are a couple of links that are self explanatory, more or less.

https://www.theoptionsinsider.com/show-spotlight/ It’s a freebie with some nuggets of helpful stuff

Here Larry bares his soul- well his trading results at least: https://www.optionstrategist.com/blog/2021/06/option-strategist-newsletter-2020-profitloss-summary?utm_source=Email+Updater&utm_campaign=ef8d76183e-Weekly_Blog_Roundup10_1_2014&utm_medium=email&utm_term=0_2f928c56ef-ef8d76183e-401810697&mc_cid=ef8d76183e&mc_eid=5f15d5ff5d

Distraction Trades,and Whither Crypto?

Let’s kick off with my worst possible investment of 2021. XRP= $0.796. Grim reading for this idiot when I paid $1.03. Normally I would think about taking the hit and moving on, but this is crypto and XRP does have a business model. One might argue for pound cost averaging- buying on drip as price dictates.

DAX….. Break even on Tuesday and almost 200 point on Friday as DAX was a straightforward downwards slope, though we could have hung on for more.

Legacy Trades and This Week’s Offering

221 crazy ratio reverse calendar

We sold 1xJuly 6600 put and bought 4(four) June 6600 puts. Debit 7.5

now 6.5×4= 26,July 6600put= 32.5 One of the worst trades ever attempted. GOOD! We won’t do this again!

However, we morphed this by selling the 4 long puts at 26 and buying a July 6800/6600 put spread(55.5-32.5= 23) giving us a big put ratio spread, and enough left over to make it a low cost trade at 4.5.

Was 31 and 18= 5 Debit, not too shabby, it owes us the 4.5 debit too

Now 64.5 and 37.5 x2= Debit 10.5+ entry cost 4.5 = 15 we run this

222 Something more traditional…….. as if!

So, we speculated that a vol spike is coming

Here’s a strangle with a protective put spread, or put another way a put spread financed by a strangle. Max profit 50, risk at 6600 and 7250-actually ∞ !

We bought the June 7050/7000 put spread 60-44=16 We sold the 6650 put and 7250 call both at 8= 16. Zero cost trade(margin req’d)

So- our long put spread is now 5 7250 call=6.5 the 6650 put= 1.5 We had a tiny loss 3

However, it’s now a NOTHING TRADE!

223 Expiry Week- A Freebie and a Crazy

So, a tad of latitude here-as we know that Vol drops on a Friday>80% of the time, we look to enter our trades by close on Thursday. Thus we have

2 choices: Zero cost 6950/6850 put ratio spread and 7200/7250 call ratio spread. DID NOTHING

Psychotic choice: 7200/7100 put ratio debit 13, and 7000/7100 call ratio 27 debit. Total debit 40.

At close of play on Friday…….. 1. Zero cost trade puts -1 Zero cost calls +1.5

2. Psycho trade last week …. puts 28.5 a profit of 15.5 calls…… 23 a loss of 4 ( We paid 40 for this madness remember!)

OK- Thursday would have been good the calls (152- (56.5×2) ) = 39, puts 52- (5×2)= 42. So 81. We doubled our money, and could have made maybe much more at expiry. Caveat- PIN risk is excruciating and you don’t really want to sit through expiry. WIN

We had fun with these during expiry week but paying zero and expecting big ££££ was not a likely prospect.

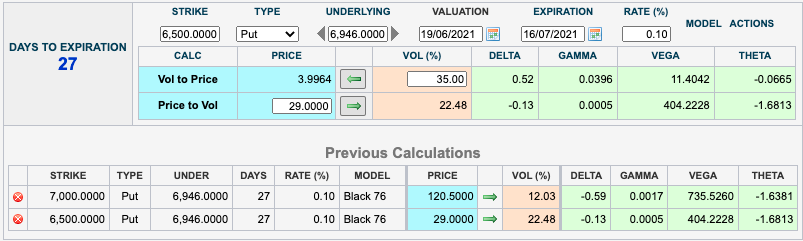

Trade 224 A New Expiry, July, And Increased Vol at last

Howsabout we go for more crazy? 223 was an object lesson*, and could, with careful monitoring have been really super profitable. Nobody got rich taking no risk, but this is NOT, repeat NOT for the faint-hearted. We are selling 4(four) 6500 puts and buying only 1 solitary 7000 put. Those prices: 29×4, 120.5. Debit 4.5 . So, our risk? Nothing of course to the upside, but to the downside….. We have a problem at 6337.5 This is not recommended and the strategy here is to take advantage of Vol, which hopefully will contract, plus theta. Here’s the big picture:

*So was 221 – a lesson in hopeless!