That Was Xmas Week -Little Action And Trade 200 Made good

Our trading journey continues into the uncharted waters once more. However there may be some radical market moving events again. Lessons from 2020 for this trader would have to include the mantra ‘stick with what works for you’. Having taken a big hit, after scaling into a February trade, my confidence was at a new low. Over the 20 years of my hopelessly inadequate trading, I have always managed to recover losses. Mindset is as much a part of trading as exit. This site is anti cathartic for me as I have traded horribly, and also had long periods of not trading.

The aim here is education, and while the win rate is fantastic it would of course rely on all of those trades being taken. This has never been the case as I do not take a trade every week. I have several stock trades, some of which did nothing this year, following the one large loss. To add insult to injury, the Robin Hood traders gushing about their wins by simply buying calls, has been a hammer blow. I don’t think anyone could predict the $trillions that the US pumped into the stock market. I don’t think anyone thought there was cause for optimism,given the status quo. However,the old saying: money talks,BS walks? In 2020 they went hand in hand.

Distraction Trades Dax But No Other Instruments

Ironically ….you should have seen the ones that got away, but there were winners. The US open at 2.30 is a key time zone along with cash market close at 4.30. The open is always a bit of a jumble sale, some bargains but a lot of argy-bargy.

A Bit of A Bonus:

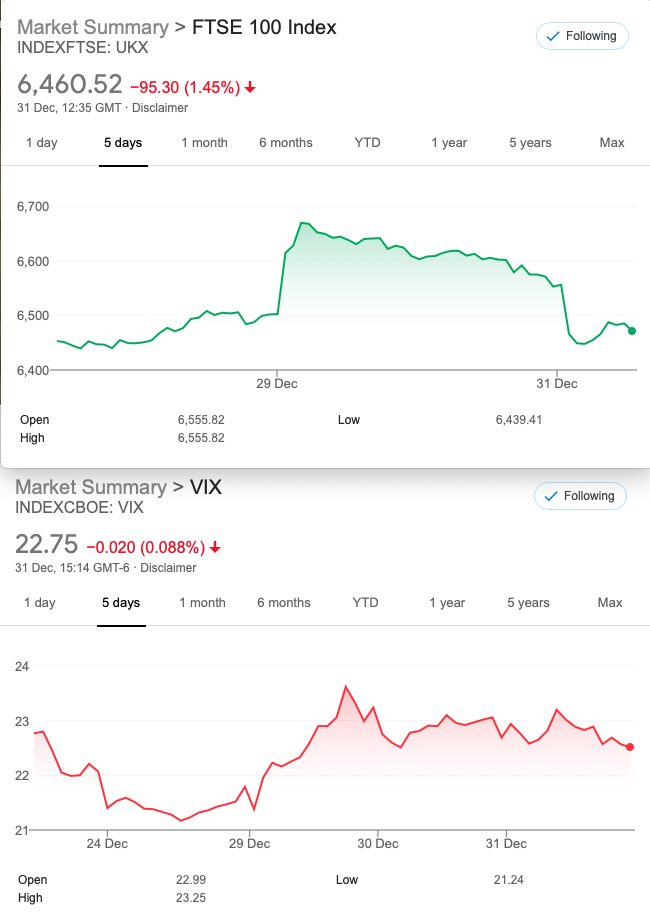

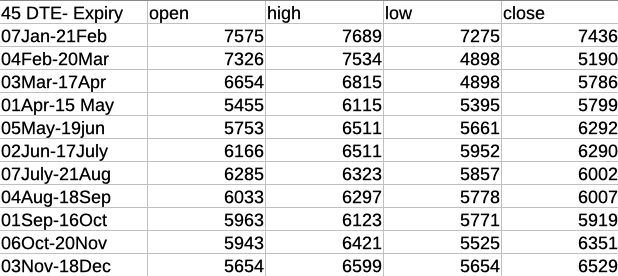

Here’s the (cash) numbers for this horrible year and over the course of these cycles, you’d have needed to be super nimble on the upside as well as the downside. It seems that staying >about ± 6.5% OTM if you are in effect a premium seller, ‘might have’ netted a profit. The journey would have been gut wrenching at times and early exits may have been prudent. I use this only as an example- we may expect more crazy in both directions, I reckon. Any backtests welcomed here- but we like 45 days to expiry.

A bit of a change, for a change: 29/12/2020

Trade Morph

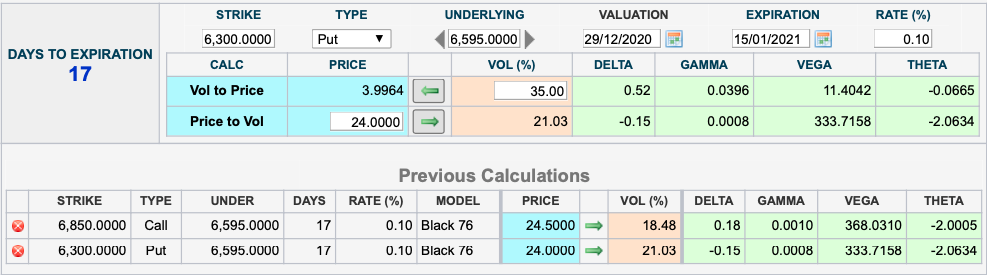

Our image above shows the metrics for a combination trade-selling the 6850 call and buying the 6300 put. The logic of this trade? The FTSE smashed up and formed an ‘island top’ and the expectation was that the gap below would be filled. Clearly the trade is a synthetic future and not far off Delta neutral.

Keen eyed observers will note these were not the best prices on the day and it might have been entered with a credit of 5 or so. However it is good for our purposes, as on 1st Jan those prices now show as 7 and 60.5 due to the big drop in FTSE. We could have found better prices, but no matter. So what’s to do?

We choose to close out and take the (60.5-7) 53.5 credit Job done- but that’s not all as they say in the cheesy ads. What if we morph that trade?

Some choices: Sell the 6500/6400 put ratio spread(1×2) to create a butterfly that might get us another 100. Prices: 130, 88.5×2 gives us 47 credit, pay 7 to close the call, making us bulletproof.

Buy the call spread 6750/6850, thus creating a call ratio spread (16-7) cost us 9. Why do this? FTSE may get a little trip up to 6750 or so. Create a put ratio spread by selling 2×6200 puts at 42.5 x2= 85 credit. We now have an overall credit of 76, risk at 5.6% below( 6100 )and 7.6% above-( 6950), and a chance to make another 100.

3 ways –2 bulletproof, one with manageable risk and considerably bigger reward. Bring on expiry…..

Trade of the Week Number 201 of 2021

I think by necessity this has to be a 2×1 just to keep numerical symmetry. 6350/ 6200 puts buying 1 6350 at 73 and selling 2 of the 6200s at 42.5. January expiry.This gives us a credit of 12 and risk at…… 6050 (The December low was 6135) Should the market take a big tumble,we can look at adjustment and maybe learn a new trick or two.

Remember:

![]()