That Was The Week- Confusion Reigns

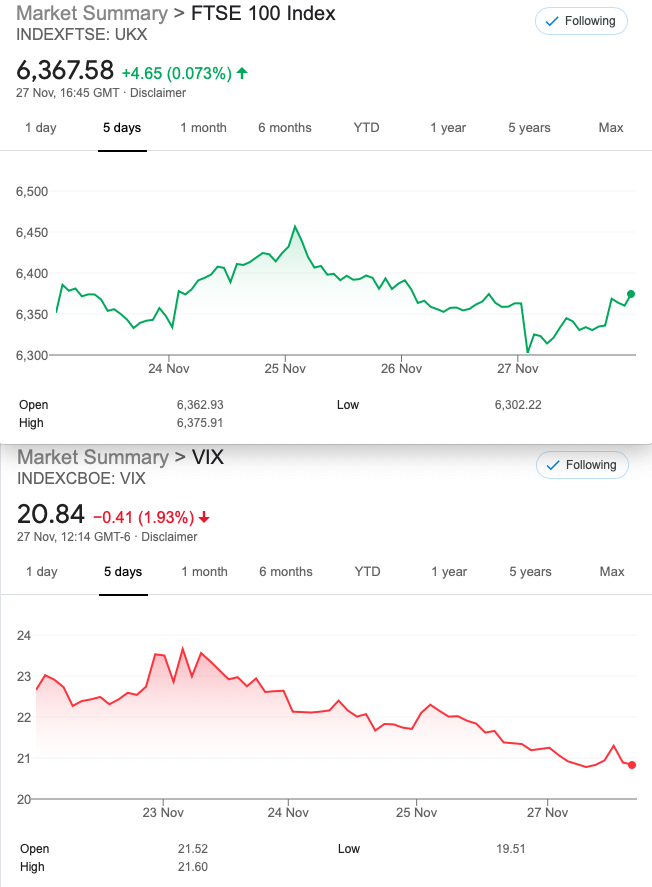

So, unsurprisingly we saw another week of nothing much. US markets bumped up >2% though with so much liquidity from QE, that money has to go somewhere. Investors oddly like to see new record highs. But unless you are selling it’s irrelevant.

Brexiteers may have concerns as we veer towards the hard shoulder of no deal. Silver took a big hit down 7.43%, and I take this personally, with a few hundred quid in an ETF! Diversification is vital in any portfolio we’re told. So, I thought silver was cheap, like me. However it’s a bit of a fun trade and like a stopped clock when it tells you the right time you cash in. Cable strengthened recently- or is that USD weakness? £ against € hardly goes very far, staying in a tight range all year. Currency hedging makes a bit of sense for retail traders, as cash on deposit loses value.

Distraction Trades

Oh me miserum! As our esteemed leader Bojo may exclaim. Latin scholars not required, I’m sure as it is painfully obvious the moves are glacial.

In the last 2 weeks nothing has happened. So where’s the fear? Where’s the anticipation?(That’s a 4 hour chart!)

About the Week’s Title- India?

We may reveal more in due course but this is not some esoteric cyber/spreadbet type venture. This is a highly regulated well ordered exchange, and the Nifty has exchange traded options same as FTSE. However it’s early days but the website is well laid out with better features that the ICE.com. The keen-eyed among you will note that ITM is denoted by a colour/shade and flips at around 13,000. How many among us can determine the value of an underlying asset when given the options chain? Not hard to do.

AFAIK anyone can trade the Indian markets, but not clear what is required to trade options. We’ll get back to you. What does chime with this trader is the nice look and the useful information of the site. Another moan? Probably! Oh and by the way- these are weekly options so you can pick your expiry according to your required DTE.(Days to expiry) Of course it’s all in English too.

https://www.nseindia.com/option-chain

Legacy Trades and 197 -a spicy strategy

Trade196 We Abandoned the Weekend Strangle for a 2-3 week Time Horizon

We sold the Dec FTSE 6600 Call for 25.5 and the 5850 Put for 25 Credit therefore of 50.5. Here’s the spin. We ‘cautiously’ looking at closing out at 25% of premium and 50%.

Now? 20.5 for the call 16 for the put Win, by 28% of premium or around 5% of margin employed- simple isn’t it? Until it isn’t.

Trade 197 Spicy as we can handle

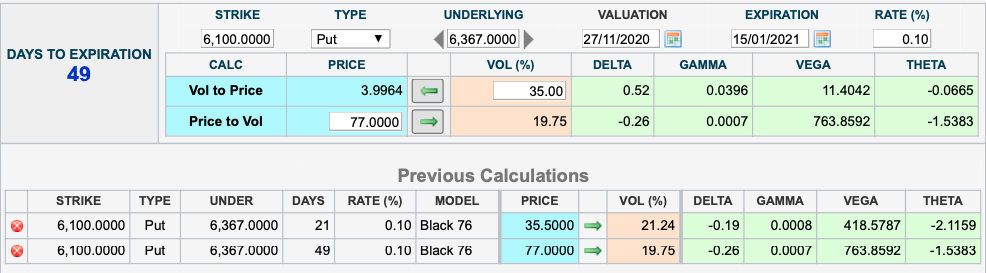

Here’s the calculation, can you guess what it is?

It’s a ratio calendar and it’s a bit spicy as we are selling 2x the 19 delta 6100 Dec Puts and buying 1 Jan 6100 Put, for a debit of 77-(35.5×2)= 6

Note the sold puts have 21 DTE . Thus the theta is high and this is the focus of this trade. Should it go wrong, we’ll adjust, though we never ever seem to have to worry about that. Idle boast it’s not, if you look at the track record. My selection of trades is based on having no bias, and a quick scan of the options chain, and…………………………… nothing more.

Options give you WINS!