The Week of Uncertainty and More Twentytwentyness

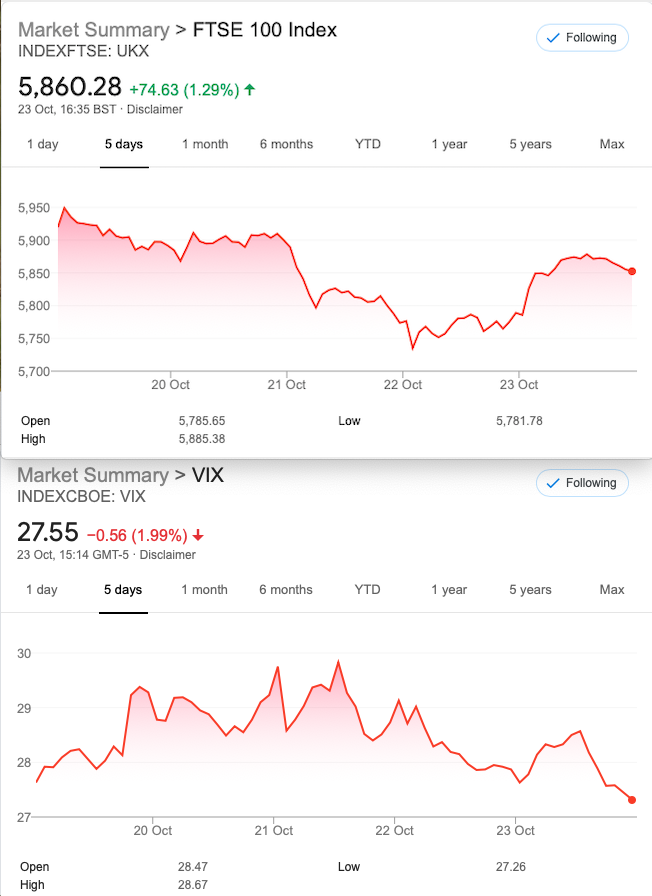

GBPUSD blipped up 2cents, FTSE took a dip. BOE talking about negative interest rates. US job numbers. Election mania. Stimulus packages. Tiers ( no jokes please) and, a big spike in Covid numbers. Biden’s debate with fewer interruptions, Bojo’s lectern waffles- (Even Margaret Thatcher was coached). Bojo’s spattering of noise is not helpful. School dinners- some of us thrived on them, free or not.

Aside from the politics, the pandemic, pub closures, even the mighty Space-X couldn’t get off the ground this week. However, we reckon tech will be our salvation in all its forms, and the future beyond Covid is bright, for most of us. Hopefully some of us are looking beyond the grimness, the shops are doing ok, so there’s the proof!

Distraction Trades

A picture speaks 1,000 words:

However, this may merit a few more words. Keen eyed chartists will note the MA cross. Closer inspection reveals the huge miss. The market took off and the MA cross was nowhere. This numpty has struggled to find trades for the last 2 weeks. This simple method proved itself worthy for several weeks. So what is going on? Van Tharp whose wisdom we hold in high regard, talks about the prevailing market condition such as ‘Bull Quiet’ https://www.vantharp.com/trading/september-2020-system-quality-number-report-the-sqn-report-by-van-k-tharp-phdz/

Paid for courses are on offer always but the free stuff is excellent, in our view. Thus the point of assigning a value to current markets makes sense as the ‘character’ of the market changes. We place our trade and often after a few days, the unexpected happens. The market changes. We need to keep up and assuming the same method will always work is the definition of bonkers! Therefore with the flexibility of options, we have the best of all possible worlds.

Scam Warning

There’s one born every minute and according to BBC‘s Money Box on Radio 4 Infinox enabled a £4 million scam. You’d think something that appears on Instagram is obviously a joke. Caveat Emptor. We trade exchange traded options- fully regulated, via a regulated broker. With clarity, we are solely responible for our own trading in a legally protected environment. We don’t tell people how to trade, we promise nothing more than education and proof of how things work.

Legacy Trades and Weekend Strangler

last week 6100 call 63 5600 put 61.5 = 124.5 becomes 52 and 68.5 =120.5 a wash- on Monday remember.

w/e strangler, remember we sell 6000 call 69 5600 put 71.5

Trade 193 That Skewed Ratio Straddle

Initially this options risk graph seemed to be a tad suspect. http://OptionCreator.com/stg60ei Actually it’s not bad! So, to reiterate our trade. We sold the NOV 6000 straddle (293.5)x3 and bought DEC6000 straddle(395)x2

Those prices 293.5(x3)and 395 (x2) 880.5 and 790 a credit of 90.5

Though I don’t like this as I don’t understand the nuances*, it is now 84 . However this is meant to run and ideally we’d like the Nov expiry at 6000 * It’s a volatility/theta play of sorts

Trade194 4 Weeks to Expiry Sell A Put, Then Another Then Another. Oh, And Buy One Put

No clues, no excuses- we sell 3x 5600 puts but….. we buy one 5950 put, those premiums 71.5 x3, -201=13.5 credit

We have no idea how crazy or flat things are about to get leading up to the US election. Risk at 5425 looks as if this is the calm before the storm.

Maybe this is giving us a clue……. https://vlab.stern.nyu.edu/analysis/VOL.UKX:IND-R.GARCH