That Was The Week History Was Made

Over 1,000 years of monarchy, like it or loathe it, it’s been a part of British history. The Queen was a figure of dependability, when things went awry, and we are thankful for her service. We have a patchy history with monarchs but we maybe saw the best.

https://www.bbc.co.uk/history/historic_figures/athelstan.shtml

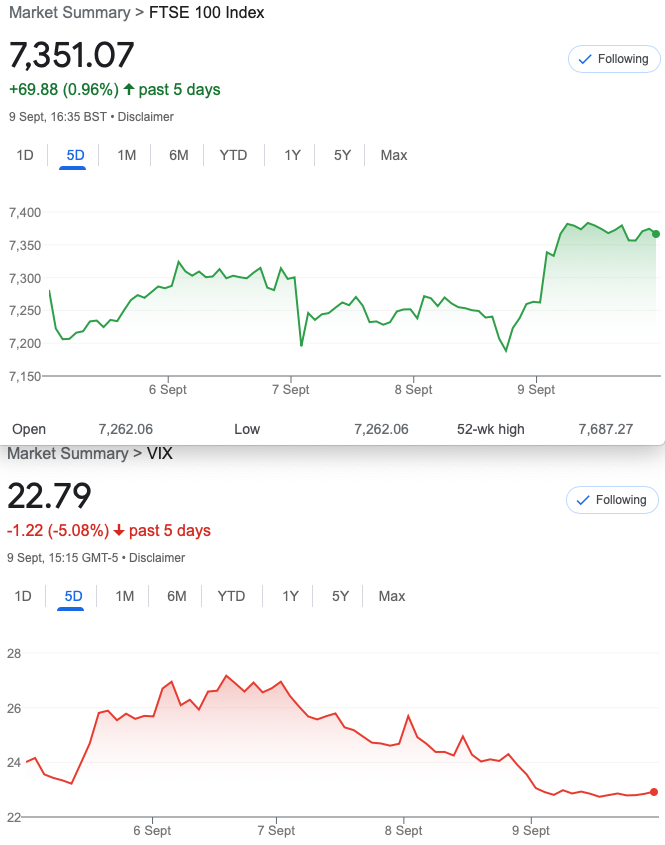

So, the stockmarket did not close, but it was business as usual as it roared upwards. Fuelled by commodities and soft data on Chinese inflation, allegedly. Sterling has rallied, which should make the market drop. On a personal note this was of great annoyance as several positions in substantial profit have, overall, lost 20% . However this is a new era, using far dated strategies which are very far from losing. I cannot know the optimum exit but Thursday would have been peachy! These trades still have a few months’ life in them, and to say that as of Thursday they had returned 50% based on capital employed, that is monster. Maximum return would be in the order of 300%+ .

Sometimes it pays to cash out and go back in. I mulled this over, and indecision won the day. Same with Trade 282 I am often a rubbish trader and yet, options forgive me time and again.

In Other News

Fellow doom mongers might like this: https://youtu.be/i09XkB8gx10

Though a personal favourite on Youtube is the guys fixing written off cars. Some parallels with options, picking through the mayhem of a car crash (a metaphor for the info overload?). The end result is a pristine repair, often using second hand spare parts. So it’s green too! I’m >carbon neutral thanks to inadvertently being signed up to 100% renewable utility provider.

Distraction Trades

ADA $0.5117 on the rise-is this just a blip or upwards momentum?

XRP $0.35342 still in the doldrums

DAX 2 no entry, 1 loser 1 break even(+30) 1 win 100+ Missed monster moves, however.

Legacy Trades and 283

Trade281 That wide ‘fly

Here’s our trade, a large butterfly buying the Sept 7350 put, selling 2 7150 puts and buying one 6950 put. Those prices: 81.5,38,19 gives us 100.5- (38×2) =76 thus: 24.5 Risk is limited to premium paid. However we will do this with a twist, and do some adjustments on the way so it’s not totally boring. These may be mid-week and we’ll try to keep you posted.(Sorry this did not happen in real time)

Here’s what we saw:

Last Thursday’s big drop made the 6950 put worth 54.5 and the remaining parts 7350, and short 7150 x2, for zero. Close out the whole deal? OK- nice profit 30. WIN! But wait….. sell that 6950 put and buy it back next day for 17.5. Nice profit 27 WIN! But here’s the kicker- we are still in the same bulletproof trade and it costs us minus 2.5 Still on board? Oh yes, and we saved a bundle on commissions.

On this Thursday the ‘fly was worth 60, but the 6950 puts only 9, so not worth tinkering, but closing* out was plan A. By Friday the rotten market melted up and now it’s worth 35.5

*indecision- see earlier paragraphs.

Trade 282 Variation of a Crazy Trade

We have, in the past, featured a trade that used straddles –buying 3 near month and selling 2 next month. You may recall it was rubbish last time.So, why do it now? Quite simply as the prices are so far apart we can buy 2 near month and sell 1 next month. We get the moves without the price, if the market moves either way. Theta is brutal but gamma is our ally.

So, our near month purchase 185.5×2=371. Our far month sale 368.5 Gamma is monster so one good day is all we need, while our premiums melt away if we hold for too long.

Posted on 5th Sept:

So, we paid 2.5 for the crazy straddle and it made the best price of 27, while the FTSE then limped back upstairs and the vol drifted sideways not giving us the front month skew we need to make 100+ which this thing does, when it works. Not happy to persist and at close it is now back around 4. Hand on heart we’d have closed this out this morning around 10.30 when it looked like the selling was over. Had we run this to Thursday or Friday we’d be looking at a loss of around 50.As we know you do NOT hang on to this, but on Monday we had a good drop of 70 points- 100 would have been ideal, but the buying came in- plus ca change. BTFD as our Americans cousins would say.

282 The Revenge Trade(Joking!!!!)

Apologies that I am using prices retrospectively but we know 100% that near month premiums shrink like a gent entering a cold swimming pool in January. We have shown this time and again that using the Thursday before expiry week gives us the optimum trades. Thus we sell the 7200 put x3(49.5×3)= 148.5 and buy the Oct 7200 put 147.5 Essentially a zero cost trade. However Friday’s melt up in concert with the vol crush made this trade a profit (106-( 17.5 x3) ) 53.5

This was not intended to be any kind of fudge to massage the win rate and apologies that events overtook me on Thursday. There is no way we could take this trade on Friday so let’s spice it up and place a call 3×1 selling 3x 7400 calls for Sept at 48, and buying 1 7400 call for Oct 48×3= 144 paying 152= Debit(we pay) 8.