That Was The Week

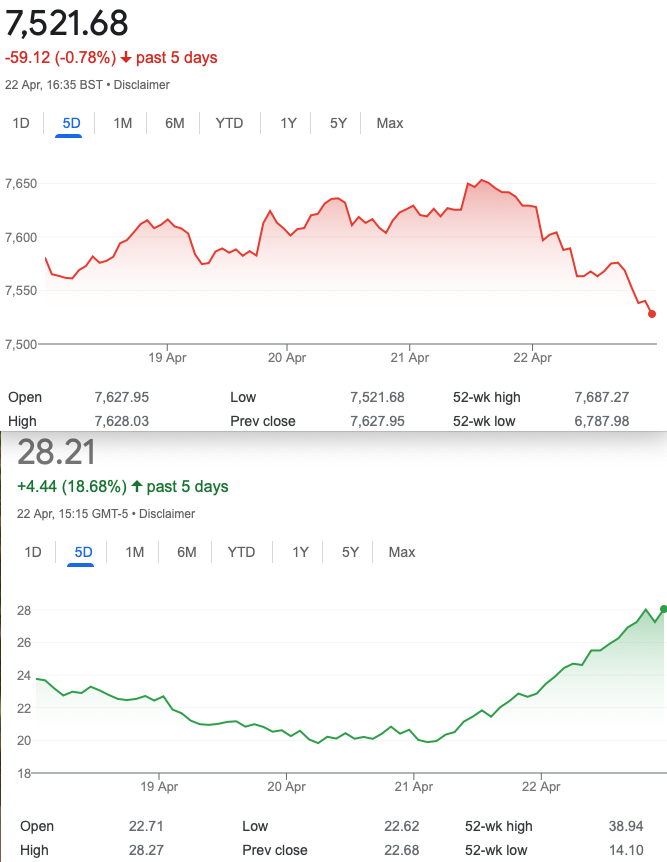

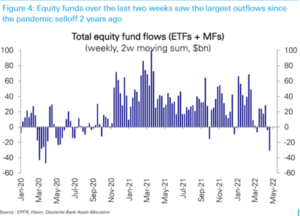

FTSE had a big down day on Friday does this presage a new downtrend? This from Twitter: The biggest bond bubble in 800yrs continues to deflate as hawkish Fed comments shake up the bond markets. The value of global bonds has dropped by another $524bn this week, bringing total loss from ATH to $6.9tn.And:U.S. equity funds have recorded $30 billion of outflows over past two weeks, the largest since March 2020 market crash -Deutsche Bank. So, time to panic? This trader is coincidentally sidelined while taking a break. I have taken a break in the past while away from home and found it uncomfortable. However not having any positions is almost equally uncomfortable.

Twitter seems to be the home of extreme punditry but here’s the link to the bond chart: https://twitter.com/Schuldensuehner/status/1517774776193847299?s=20&t=nXrkgyC7Q-DLH4cmERGvug

You may find further doom and gloom on that feed. Personally I don’t know what to make of it, as the warning signs have been in place for a while. Smart traders should be ahead of the game, but perhaps the market is behind its own valuation. VIX, as the chart shows has made a vertiginous climb. Bollinger bands may tell us how ‘spikey’ that is-worth a try using 2, 3, and 4 deviations. FTSE, one might argue double topped perfectly at 7650±. I’m no technical analyst, so DYOR as always.

Distraction Trades

DAX 1 win 200, 1 no trade, one loss-30 one break even +30. Ticking over

ADA $0.90 not looking great

XRP $0.71 not looking any better than ADA-is crypto dying?

264 and Legacy Trade 263 May Expiry

7550 /7700 call ratio buying one 7550(155) and selling two 7700(73) calls. Debit 155-(73×2) =9.

Risky? Not in the way you think it might be. Max profit 150-9=141 Risk at 7850

Rationale of this trade- market seems to be inching higher despite the headwinds so we could do very well here and the downside risk is maximum of our cost= 9.

This week: 99 minus 37×2= 25

264 Is the Downside Already Being Overstated?

Arguably the top is in-and the worst thing one can do is make a prediction! Hey let’s just take a view and protect the upside by revisiting our old friend the Jade Lizard. It gives a fair bit of downside risk protection, and it’s rock solid to the upside.

Sell : 7600 call 74.5 buy: 7650call 54 gives us 20.5 and sell 7075 put 30.5 Total credit 51

So we have risk at 7025 but no upside risk as our premium = the value of the spread.(OK we get 1 !)

Remember we don’t include commissions as these are pure demonstration trades. We have no interest in bragging rights.

However, there will be no missive next week.(29 Apr)