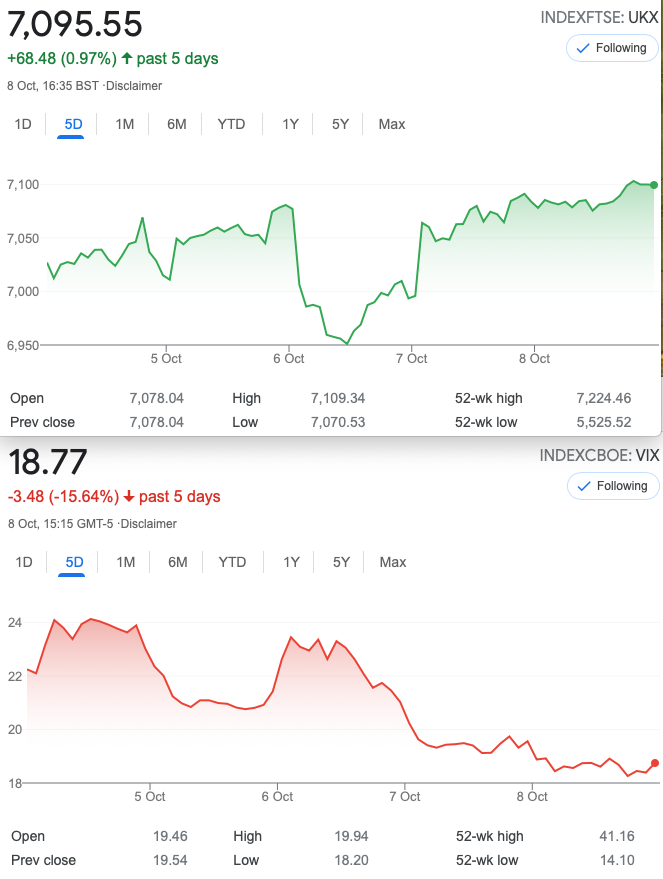

That Was The Week Wednesday Plummeted

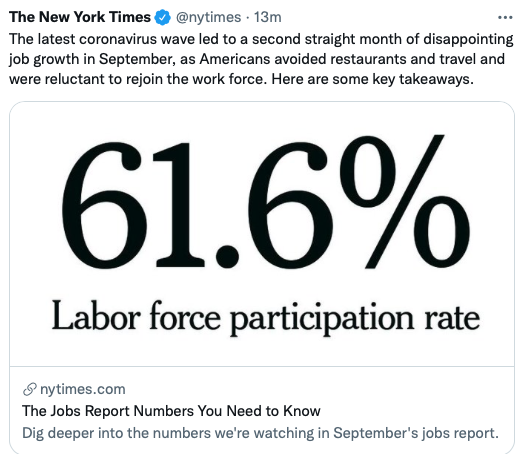

No worries -the buyers soon step up. We are back at the BTFD- buy the f******* dip. A frequent and reliable feature of last year. Market pundits keep telling us FTSE is cheap, but you have to wonder if they actually live in Plague Island. Woefully handled, the UK economy may seem to have a veneer of functionality. People seem busy, jobs are plentiful yet applicants are not. Nobody wants to do the tough jobs, when they can aspire to being a TikTok influencer. Non farm payrolls were ugly- and then there’s this:

https://www.statista.com/statistics/191734/us-civilian-labor-force-participation-rate-since-1990/

It peaked in 2000– around 66%, so what does it mean? More people supported by fewer taxpayers, boomers retiring early?

In Other News

Facebook and Instagram and even Twitter went down and few of us were bothered much. Us oldies like FB for keeping in touch with family, mostly. When Ebay shot itself in the foot by punishing sellers*, Facebook marketplace stepped up.Smart move.

The highspot of the week, however when it was announced nonegenarian Captain James Tiberius Kirk, is due to visit the final frontier. I’m not going to split that infinitive here, but he is bold.

*Many buyers claimed the goods didn’t arrive or were broken or not as described when this was not true. Ebay would not support the genuine sellers.

Distraction Trades

DAX– Yes! Yuuuge win- 250+ on Wednesday but again there were no other entries. We are avoiding losers, but barely generating one trade a week. The market’s character has changed in recent months.

XRPUSD is now $1.111 recent buying this morning keeps me out of this still, but maybe there’s crypto news. Oh wait:

https://insidebitcoins.com/news/ripple-price-prediction-xrp-usd-touches-1-171-resistance

Remember we sold at $1.18

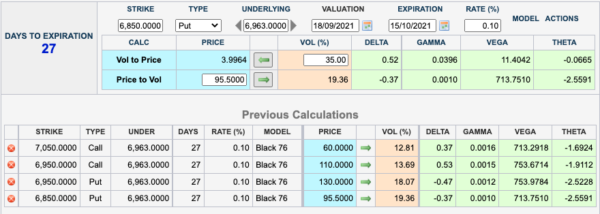

Those Legacy Trades- Looking a bit Lame,plus 237 Theta Monster

Trade 235 October Expiry

Time to buckle up and play safe?

What could be safer* than an iron butterfly? We sell the straddle, buy the strangle and hope our strikes hit the sweet spot, as this may not do much in the meanwhile. We take in…… and our risk is 100 minus our credit Near expiry we may be able to have some fun with it too, morphing, rolling and maybe a ratio here or there. Here’s the graphic:

OK it’s 110+130 minus 60+95.5 I’m really not doing that for you!

* Is anything safe?

Currently 87.5 maybe not time to panic

Was 84 -we know how this goes as the Greeks effectively make this a nothing trade until expiry.

Now 88.5 -we hold to expiry and gain from a drop. Remember our loss is limited to 15, our gain a max of 100

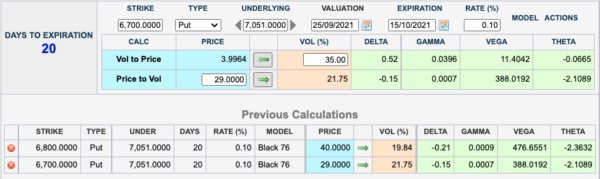

Trade 236 Ugly Trade Following Bizarre Week

Here’s the Greeks:

We are selling……. yes selling the 6800 and ….buying 2x the 6700 puts

Thus we have a debit trade, costing (29×2)- 40 =18

This trade only makes money when the Vol kicks up a fair bit, it’s not attractive as theta works against us and we really need a good drop. It’s safer though in the event of a catastrophe as we can only lose the value of the short spread, and let’s say we drop to 6800, it would make a good return. That, however also depends on the speed of the market drop. Slow burn will kill us, if boredom doesn’t get us first!

No, we don’t like it but Murphy’s law says we are wrong. Whatever the outcome it will be a good lesson.

Currently 11 looking very ugly as we started from a low point on the FTSE and we are virtually back where we started 7027 now 7051 at trade entry.

Now it’s rubbish- we’ve lost our debit -a loser but might as well morph into a forlorn looking put ratio spread. We buy the 6900/6800 put spread for 5 and sell those long 6700 puts, for 5. Maybe we catch a bit of premium on a blip down. Maybe…

Trade 237 Last Oct Expiry Trade?

Given the revelation of the propensity for upside surprises, let’s get brutal with a 3×1 calendar. We are selling 3×6800 Oct puts to buy 1(one) Nov 6800 put. Theta is our motivation here- yuge for Oct- check out the Greeks:

Yes it’s ugly on Deltas and of course Gamma- which gets spicier the nearer to expiry. The simple ratio of 3 to 1 could of course be moderated to 2 x1, 5×2 etc

Here’s where we are our short 6800 Oct puts=4.5×3, the long Nov put= 59

Our initial cost was 104-(33×3)= 5 so 59-18.5= 40.5 Nett profit Win!

Trade 238 Tapping into the last dregs of expiry

Everyone thinks 7000 is the key level so let’s go with a cheap little Xmas tree- we buy the 7000 put 19.5 then sell the 6900 put for 9. We pay in part for this by selling a 6800 put 4.5 now 10.5-4.5= 6 That is our cost and probably our forlorn hope, though we could make £££. Generally speaking if Thursday is an up day it does not bode well for a drop in expiry week.