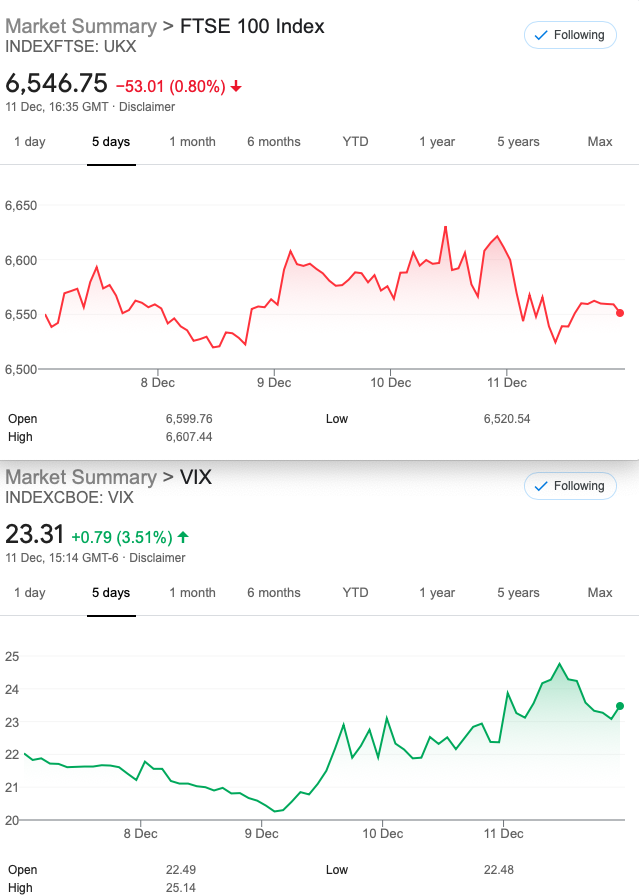

That Was The Week -FTSE Went Nowhere, Same As Brexit Negotiations

Keen observers of normal market activity will note how out of whack things are. FTSE rose ‘bigly’ from the start of November, but so did GBPUSD. Whatever mechanisms are in play here, it seems political activities are trivialised. Mainstream economics too- GDP and employment have taken a battering, and if credible sources are correct, the US is in a parlous state. American householders have no fallback, and the welfare benefits seem so variable. 2021 may see a worsening state of affairs but …….. We trade the stock market, and we have control over our trading while the economy does another thing altogether.

Over the years I have contemplated the wisdom of keeping a put spread tucked away,and this could be financed as a calendar trade. Typically there used to be at least two 6%+ drops in a year. Of course the problem is…. ………. timing. Patience and smart research would doubtless produce an edge. However I have yet to find any such research that could be useful.( If you have that, we will pay handsomely!)

Distraction Trades

A couple of good results, but it is not clear why things have changed and produced these easy trade entries. Easy, you’d think but so hard to hang on for more than 100 points. Followers will know that for several weeks there have been no signals. Would you bother? Really? Maybe this needs a diferent approach, but frankly it needs more input than I am prepared to donate.

Legacy Trades,196, 197, and 198

Trade196 We Abandoned the Weekend Strangle for a 2-3 week Time Horizon

We sold the Dec FTSE 6600 Call for 25.5 and the 5850 Put for 25 Credit therefore of 50.5. Here’s the spin. We ‘cautiously’ looking at closing out at 25% of premium and 50%.

Week one? 20.5 for the call 16 for the put Win, by 28% of premium or around 5% of margin employed- simple isn’t it? Until it isn’t. The picture changed, but we didn’t. OK We got more than the first target of 25%. Then we ran it:

Last(2nd) week– 6600 call 74.5 the 5850 put 11 –ugly loss 35

6600 call now 50 5850 put 5 still in loss- the lesson was…take the 25%!

But, we had a chance to adjust. Shifting our strikes up. 6700 call 40.5 6300 put 35.5.(Credit 76) =9.5 debit. Our credit however remained 50.5-9.5 =41 Now 6700 call (18)and 6300 put (20.5) (Remember we have only a credit of 41 ) So a small credit 41-(18+20.5)= 2.5

Trade 197 Spicy as we could handle

Our ratio calendar : we sold 2x the 19 delta 6100 Dec Puts and bought 1 Jan 6100 Put, for a debit of 77-(35.5×2)= 6

Last week 18.5 for the Dec put and 51 for the Jan so 51-(18.5×2)= 14 Credit

Now 9.5 for Dec put and Jan put 51 -Nice! (OK I’m bewildered as there has been zero theta decay on the Jan put) Credit 32 Close out or run? WIN

Trade198

The trade is simple- take in a credit of 50 and risk 50 to the upside. Ugly part…the naked put. We sell 6600 call and buy the 6650 creating the short spread for (74.5- 55.5)= 19. We then need to sell a put worth 31…. 6275 at 32. Risk therefore to the downside at 6224.(We took in 51)

And now, the 6600/6650 call spread ( 50 – 31 ) 19 6275 put 18.5 so it’s made 12.5, but we sit tight. WIN

Trade 199 Getting close to the 200 Mark. How many losses? <20.(it’s a pain to check!)

Let’s spend a little cash and ignore the normal Santa rally, on the basis that nothing is normal in 2020.

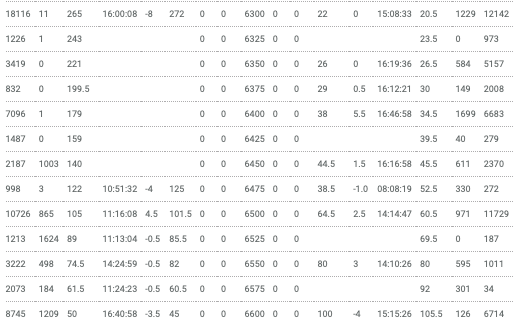

It’s a regular butterfly we buy the 6600 put , sell 2x 6500 puts and for protection buy the 6400 put. Prices as shown 105.5+34.5= 140 minus 60.5×2=121. Our debit, therefore is 19, for a max score of 100. We might take anything over 40 prior to expiry, but this cheapskate might sell a very far OTM strangle to reduce our cost. EG: 6750 call 6150 put for credit 21. There would be no protection at these strikes, note.

Options give you WINS!