That Was The Week. Teetering at the Top?

The US sees another all time high, and yet again each day that starts with a drop sees magical buying coming in,later in the day, often around 4.30 UK time. We’ve mentioned this a few times: ‘BTFD’ as it is crudely put. Buy the ******** dip. Quite who or what is buying is not clear. Again personal bias should not be a factor, but some cynicism is healthy. Covid has been gearing up for another feeding frenzy, so it’s hard to see how things, in any way shape or form, are getting better. Smarter people than I have bigger wallets, and a divergent view.

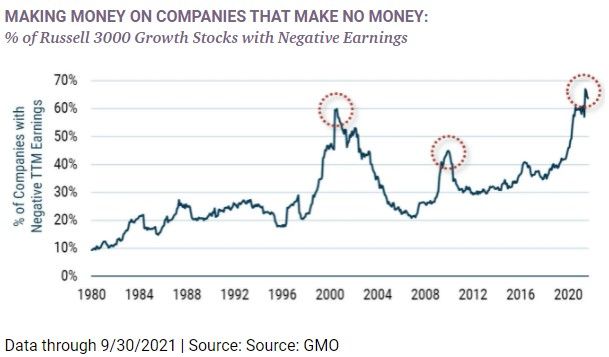

Here’s a fun graphic:

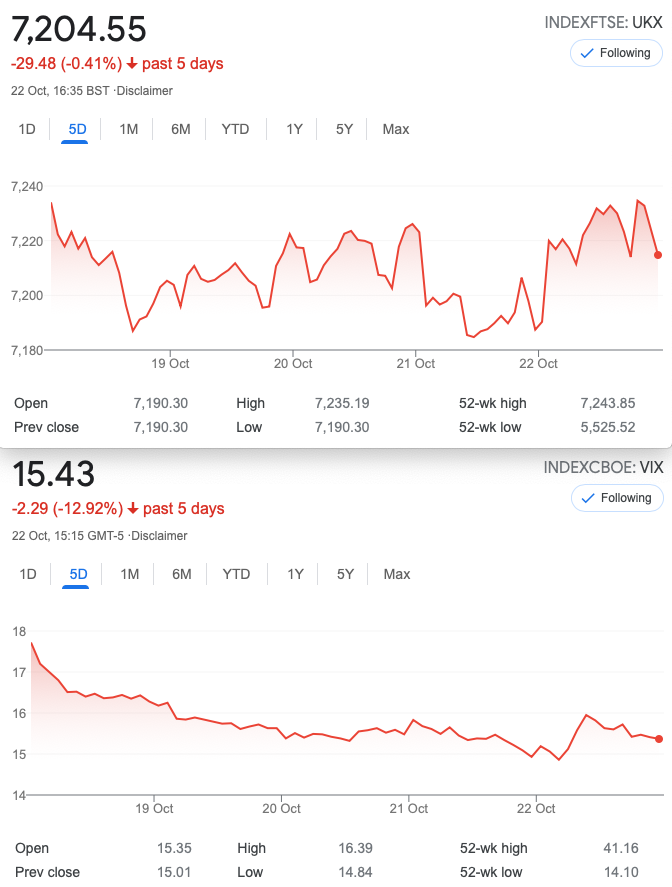

Being out of touch means looking at metrics like P/E which curiously for FTSE is about right in the 14 range : https://markets.ft.com/data/indices/tearsheet/summary?s=UKX.P:FSI

Other indexes may not show such restraint! I was not able to find this sort of data for FTSE but would be grateful, if possible.

Distraction Trades

A bleak week- not one entry on DAX Perhaps the system is working to protect us, as the market looked more flakey than we’d like.

XRPUSD 1.09 a rather curious week, seeming to be on the up, but then no. Cryptos are in a bit of a bind it seems though Ethereum went ballistic as yours truly was reading about buying Ethereum. It’s back down again.

Legacy trade and 240 -Finding a Gem in the Rubble

Followers will know that recently we had 3 losers and 1 winner in the last month. Losses are kept small and our win more than compensated for those 3 trades, that frankly, as stated at the time, were not hopeful. We are not here for bragging rights but this brings home the concept of keeping losses small.

Trade 239 New Expiry

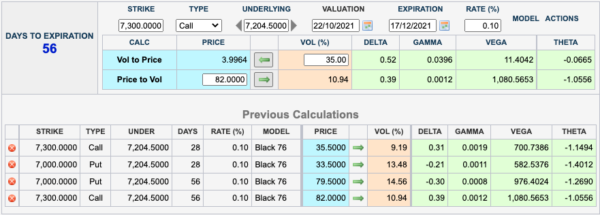

Jade Lizard anyone? OK let’s go with: selling the 7300/7350 call spread and a naked 6900 put. 56.5-37= 19.5 for the call spread and 30.5 for the put. Maths PhDs will know that this equals a credit of 50. Risk of loss is therefore at 6850

Now 22.5+ (35.5-20.5)=37.5 We could close out and make 12.5 or £125 on about £3000 on margin= 4%(annualised that’s 200% ) Yeah- we don’t do that. Of course you could not do this trade every week, but it illustrates the concept. Options are as much about concept as risk management. A good understanding of the concepts is vital. You don’t need that to buy Tesla.

Trade240 Big Spender

Yikes! Again with this drifting moribund volatility (makes me laugh when the ‘experts’ talk about this volatile market, when they are selling something!) Fact is: Vol is low. Here’s some Greeks.

We sell the Oct 7000 put and 7300 call, taking in 69, we then have to pay 92.5 to buy the far month(Dec) same strikes. Frankly, looking at a diagonal ( selling further out of the money) would be crazy money. We remain unconvinced and may come back to compare this with a diagonal. It’s all a bit pricey for us.