It’s The End of May- See What I did There!

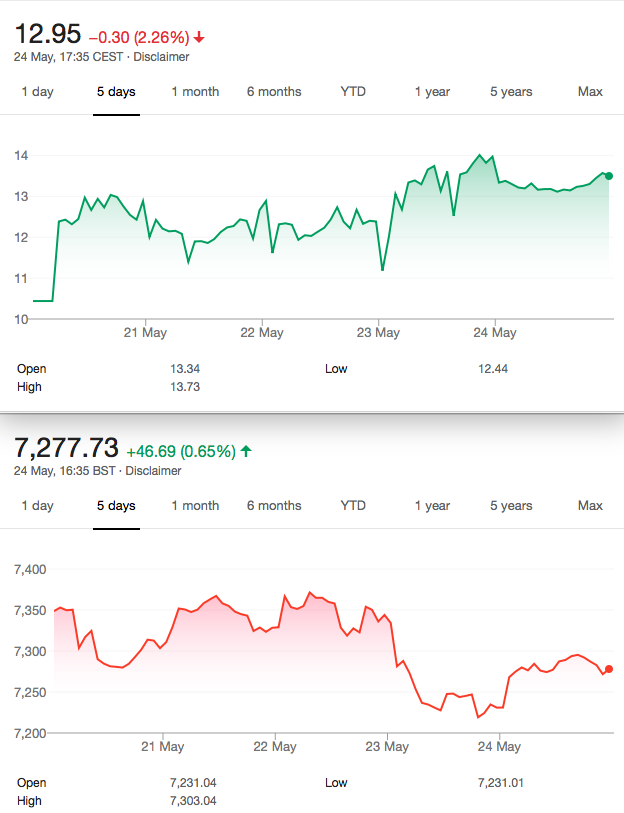

What happened this week? We saw a 1% drop in FTSE but since the start of May GBPUSD has dropped about 4%. Typically this is said to boost FTSE as our exports become cheaper due to the exchange rate. Though I suspect these are deals that are hedged, but who knows? Pundits are always willing to offer an explanation for market moves. FTSE has lost about 2% since the start of May. Random. Probably. Thursday was interesting but the drop did not materialise into anything more serious.

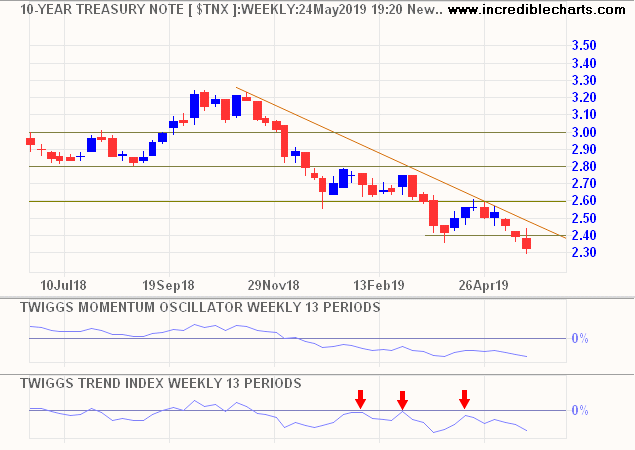

Meanwhile the wider picture is one of dwindling confidence as bond yields creep lower. Again this is due to bond buying and withdrawing from stock markets. Allegedly. It’s worth noting such events and applying one’s own personal weighting to the value of these moves. Thanks to incrediblecharts for this ( I’ve given the link in the past to this excellent service).

Politics and Markets

Citizens are now told that the UK is a nation in crisis according to a poll. We seem adrift as so many key issues are left unresolved, and we had to vote in the EU election. I am personally concerned about the environment, but this is not the place for politicking. We aim to make sense of options trading in our tiny niche. As traders we need to keep a sense of perspective and drill down from the global view to our own take. Our profits can be used thus to support our political activities,should we so desire.

So, what is noise and what is valuable information? I know what I value: Options Greeks, and a sense of support and resistance in our own FTSE. Buy on the rumour sell on the news, was once the adage. Where would you start with today’s media frenzy?

A newbie starting now would have an edge but would need to be highly selective. Traders at the start mostly shy away from options, yet paper trading is valuable and free. For starters. Our trading here shows each week how prices move. How you can win more with options when markets offer no clues. Direction is not so important to us but it’ll kill you trading futures. The Twitterati traders seem to be mostly winning-after the move. They don’t place the trades in advance- we do. Our record is verifiable. However, we educate, it’s not about winning or losing. We just don’t have big losers. Nobody likes to show those, but we don’t mind. Readers may recall once or twice rolling a position, or just simply closing out for modest loss.

Getting to The Options Bit- Running trades- 132

We bought the 7200 put(50.5) and sold two of the 7000 puts(20.5) for June Expiry. Thus our risk is at……. 6800. Our reward a whopping 200. Of course we needed margin, but our cost was 9.5. Currently about 13 -Imagine a stock trader making 30% in a week – they’d lose their minds

Trade 133 -Get more Trade 132s!

So…… each week is challenge, not just finding a high probability trade, but keeping it fresh. And hopefully mildly amusing and educational. This week -not even sure if we’ve done this before. It’s a strangle. A popular trade for people who are too cheap to hedge! You all know what happens when you sell a call and a put- you have a strangle. When you sell ATM (at the money calls and puts) it’s a …………………..straddle. I love the imagery-it makes sense. You know this stuff!

OK- here we go- vol is not bad, market drifting around-what could go wrong? Sell 7550 call for 8, 6700 put for 9.5. Reality check- margin of say £1500 you collect (8+9.5=17) £170 Expiry in 28 days,risk at 7567, and 6683

Why not? There will be bumps in the road with this but let’s run this puppy! Let’s also imagine we are trading 20 lots, as we cannot trade small. Let’s imagine we traded 10 lots of trade 132. Margin now cranked up to say £50k,so it may resonate with those looking to step up in size.