Hopefully you now have a grasp of the basics. We will now discuss the internal workings of the Greeks and for our purposes we use the Black Scholes calculator https://www.cmegroup.com/tools-information/quikstrike/options-calculator.html?utm_source=LINKEDIN_COMPANY

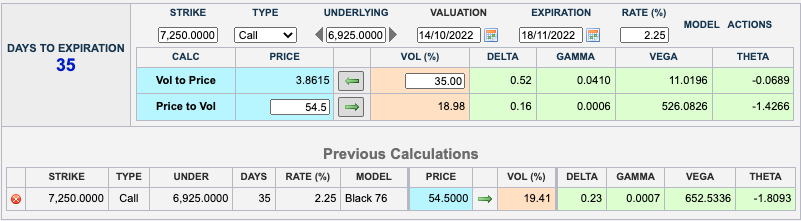

Hopefully you can now interact and generate new calculations, but our example here:

What does it all mean? Top row, left to right-days to expiry, this is deduced from the dates used in valuation and expiration boxes. Strike is the level at which the option is pegged. Type- call or put (also straddle if you want) Underlying -the value of FTSE at that moment, valuation (today’s date) and expiration boxes then rate 2.25% is the bank rate. Now, ignore everything but look at

Previous Calculations:

We have strike, type (call) under(underlying instrument- FTSE) Days(to expiry) Rate% (Bank Rate) Model (Black Scholes formula.)

Price- the 7250 call here is valued at 54.5,at £10 a point= £545. Vol(%) the calculated volatility here it’s 19.41% which means nothing in isolation.

Then we have the Greeks:

Delta which is 0.23 the rate at which the options price changes relative to FTSE. Gamma, rate of change of Delta. Vega– price sensitivity relative to volatility, and then Theta -time decay.

How to interpret the Greeks. The Delta can act as a proxy for likelihood of that option being in the money ie 23%. Theta is next important for me as Gamma and Vega you really have no control over when owning or selling the option in isolation.

In a nutshell, buying this on its own would make little sense- you have a 1 in 4 chance of being right, and it’s a lot of money. How could you mitigate costs? Sell another option, and that is where we get to strategies, the whys and wherefores of options: https://www.theice.com/support/education/trading-derivatives

Each week we show a trade that has some chance of winning. With a little application you could be up and running with a modest account within a few months. However, education is everything, and the best way to learn is by doing. We do, so you can learn.