Pause or More of The Same?

This week saw a variety of factors affecting the market but as we know the US is the big Kahuna, to use cinematic parlance. The real economies are seeing real concerns, as 44% of Americans are in jobs that keep them below the poverty line, allegedly. They are also working extra hours for no extra pay. In the UK we are seeing Rachel from accounts go on a raiding frenzy for taxes. Property, banking, pensions, savings, they’re all on the table we understand. A.I remains a huge concern as the thief of jobs, and yet also the means of increasing productivity. Tech is on a roll as materials science continues to make leaps and bounds, and discoveries of the secrets of the Universe are taking us into new areas. Then there’s tariffs.

The Demolition of America

So what crazy stuff has he done this week? Assuming things are normal in the US is maybe not the best strategy. However the right wing media, the financial commentators seem more concerned about reprisals than truth. They see the hatred when the job numbers are not massaging the enormous ego of the potus. So the new normal is the kind of dystopia touted by many a sci-fi author. However it is comfortable to see films of a dystopian future knowing it’s fiction, but surely it’s an object lesson to us all. Apparently not. The sight of armed troops, masked immigration people who carry no ID is being normalised and much more is planned. So, while it pains us to see our American cousins’ democracy trampled underfoot we are impotent. The resultant torrents of parody, sarcasm, wit and outrage are keeping Twitter( It’s not ‘X’) the ailing outlet alive.

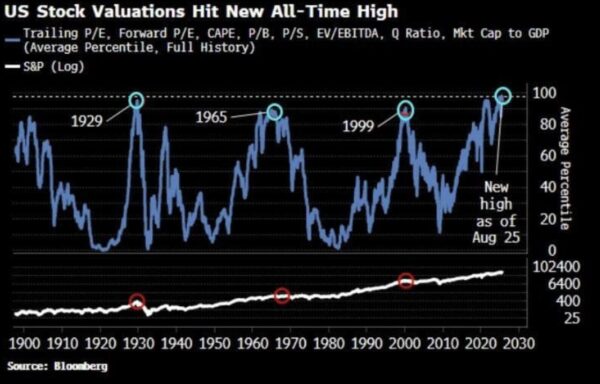

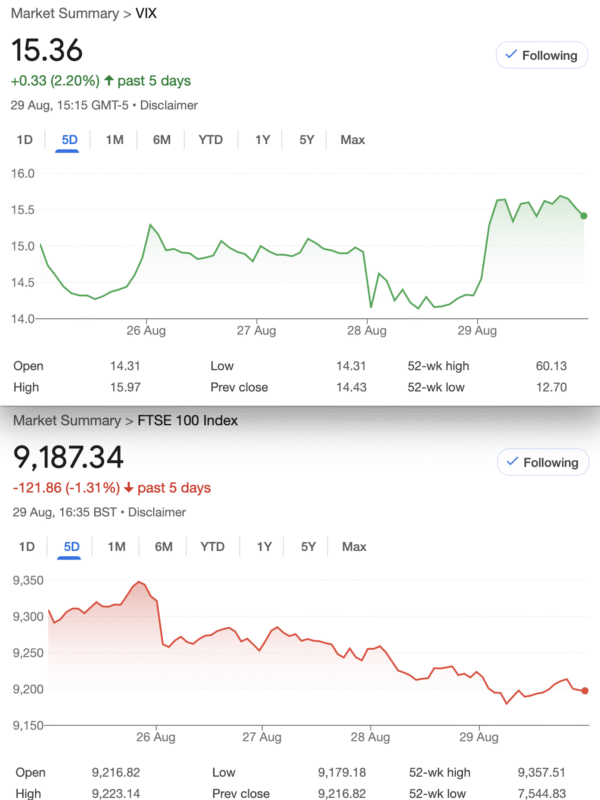

Even our national treasure the BBC is ‘extra’ neutral in case they lay themselves open to the vitriol that always follows reports that fail to flatter. So it’s hard to know what is going on in the real economy (it’s bad I’m told) and the markets- they are fine, we’re told. How does this affect options traders? Fundamental and technical analysis have helped make decisions, but we are now in an era where truth is fake news, and technical analysis indicators cannot help us gain a clearer picture with such instability. Even our own FTSE has seen a drop of 10% and subsequent rise of 23%. Being market neutral may serve us best. And this:

In the Inbox

Cboe again offers some excellent education https://www.cboe.com/optionsinstitute/events/?utm_source=mcae&utm_medium=email&utm_campaign=traders_edge&utm_content=email_type-newsletter-access_now

So this is aimed at people with a fair understanding of options but there is a ton of good stuff on their website, AND it’s not politically motivated!

The society of Technical Analysts are offering a deal: https://mailchi.mp/technicalanalysts.com/sta-agm-papers-4966304?e=4e8dea4756

You will actually meet industry professionals at meetings so if that’s your area of interest, £68 is a deal.

Distraction Trades

ADA was $0.9132 now $0.8323 ( a high of $1 recently)

XRP was $3.0346 now $2.8095 Some downward action for our chosen Cryptos.

DAX : 3 trades 2 wins 1 loser nett 110

UK Gilts Were £15.75 now £15.72 This is based on the Vanguard ETF, not a lot of love, though of course price goes down, yield goes up. This has traded as high as £27 is it now getting interesting?

Legacy Trades -Mixed/Losses plus new trade 428

Trade 424 High Risk Big Reward

We will roll Trade 415/415b but also instigate a new trade which is long August 8450call short 2 x 8650 call. Those prices: 531 and 342, so as a new trade there’s a CREDIT of 684-531= 153. As a legacy trade there is a small credit 34.5. This as you can see, is deep in the money with risk at 8850 This may be a struggle but what if we can roll, for a credit ad infinitum?

Was 8450 call 652 8650 calls 456.5 x2 Gives us: 913-653= minus 260 We are running this, remember but it’s not pretty right now!

Was August 8450 call 600 8650 call 405.5 =minus 211. Still underwater with both trades but remember we are rolling, as and when it’s optimal.

This week: 8450 call 618 8650 call 419.5 = 221 Worse, and maybe more misery to come, but….. we can roll, and that is what we’re doing, remember

LOSER!

However we are rolling this to show how things can get uglier/ possibly better. How and when to roll? Don’t leave it to expiry, we did this on Thursday:

August: 8450 call 718 8650 call 518 rolled to Sept: 8450 call 759, 8650 call 564.5. We pay 41 for the 8450 roll, but collect 46.5×2 for the 8650, which give us: 42

As legacy trade this has now given us 34.5+ 42= 76.5, as new trade 153+42 =195. (Bear this in mind as it will come right sometime!)

Previous position: 8450 727.5 8650 534×2 = 340.5 Losing more!

Oh dear oh dear: Now, 8450call 905, 8650calls 707.5 x2 gives us: 510 LOSS

This week: 8450 call 772, 8650 call 575(x2) gives us: 378 Still as ugly as expected.

Remember we are running this and against the current market frenzy it will get ugly, but let’s see if this can come right.We can run, AND we can hide!

Trade 428, A Dog’s Breakfast of puts

Well as there is no downside risk whatsoever, we’ll take a bucket load of puts and sell them. We’ll buy a few too.

A quirky put ladder starts with a long 9200 put, 115, short 8950 puts x3, 41=123, long 8850 put, 29×2,=58 short 8600 put x2, 15=30. Debit 20

We have risk at 8600 but that seems as likely as the Loch Ness monster standing for Parliament (Quote me!) Max profit 250-20 =230

Here’s the risk graph: https://optioncreator.com/styasba

Was: 9200 put 39, 8950 puts 15×3 8850 puts 12×2, 8600 puts 7×2 Gives us 4, this is terrible!

Now: 9200 put 73, 8950 puts 20.5,8850 puts 13.5, 8600 puts 7 Gives us 24.5 – well it’s in profit as we paid 20

It could get very ‘energetic’ soon.

Trade 429 Raging Against the Machine

Maybe we get a dip, maybe the Moon is made of cheese. We find a trade that has moderate risk, generally and so we are again going with puts in a calendar ratio spread. Calendar: We sell a Sept 9150 put, 31, sell an October 9150 put, 65.We BUY an October 9250 put, 90.5. This gives us 90.5 minus 65+31= Credit 5.5

Sept 9150 put 55 Oct 9150 put 98.5. 9250 put 137.5 Ouch! That got weird. We are losing 10.5 ( late confession, the prices did NOT meet my usual criteria as we’d expect credit 20 – 30 to open typically)

Erratum: from last week: [ We BUY an October 6250 put,90.5. ] Apologies this should of course have read 9250 NOT 6250

Trade 430 Risk Reversal

A risk reversal? Yes, we sell a call to buy a put on the basis of a dropping market. Having previously stated we try to be market neutral, this will offer some protection for trade 429 should we see a bigger slide. So, those prices: 9300 call 43.5, 9100 put 42 So this gives us a tiny credit 1.5. There’s quite a lot of put exposure although we try to keep trades distinct and separate. Clearly risk to the upside may come back to bite me. It is interesting to note the overall position in the manner of the esteemed Charles Cottle (gotta love his LinkedIn profile listing languages: Options Greek )

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com.

If there is anything you’d like help with, we all started somewhere and yes, it can be baffling. There are no stupid questions

All opinions expressed here are not to be taken too seriously and all of the trades are for educational purposes only.

Trade 430 we could close out for very respectable profit here: 9300 call is 23 the 9100 put is 65, gives us a nice 42, plus our 1.5 credit.

Would YOUY close out or do you think there’s more to come?

Trade 428 now 151-109= 42. but we let it run as we paid 20 and there could be up to ± 250 max profit