That Was The Week Crazy Got Dialled Down, For Now

So, with the shock of the US election now diminished a kind of bizarre lull has descended on the markets. However poor old Blighty is still the sick man of the EU, but as we’re not in that club, we’re doing great. While ‘growth’ is anaemic we’re told the signs are encouraging. It’s worth bearing in mind that the first 2 years of any administration are purely legacy. Labour cannot magic up a bold new economy. I am optimistic that we will muddle through. Here’s the future: https://www.statista.com/https://www.statista.com/statistics/959301/gdp-of-europes-biggest-economies/#:~:text=Since%20Soviet%20dissolution%2C%20Germany%20has,economy%20depending%20on%20the%20year./959301/gdp-of-europes-biggest-economies/#:~:text=Since%20Soviet%20dissolution%2C%20Germany%20has,economy%20depending%20on%20the%20year.

So, it may be naive optimism or a reasonable assumption that growth is still in prospect.Imagine having the financial tools to handle all scenarios…..

Expiry And Why We Never Worry About It

So last week we took a random walk into selling calls and we showed that what is essentially a daft trade could still make a profit. However trading a future long or short would require a cast iron stomach and of course when you roll, it does you no favours. So options win. While we trade intra day DAX as a distraction, it’s not central to our trading. In fact it has been the only index we’ve traded with some degree of success. However while we’ve seen a winning (hot) streak recently, we know it can get ugly. When stats tell us a losing streak of 10 trades is likely, we’re reminded of the roulette wheel at MonteCarlo run of black –26 times. But, even if you run in-the-money options to expiry, chances are good that you can collect more premium for the same trade. Not a recommendation!

On the Expiry Theme, And an Old Site Resurfaces

We have long ago explained the expiry process but for those who wish to know the absolute unadulterated version, it’s here: https://www.lseg.com/content/dam/ftse-russell/en_us/documents/ground-rules/ftse-uk-expiry-indices-ground-rules.pdf

And an old resource that these days has options prices, and some useful data: https://www.barchart.com/futures/quotes/XZ24/options/dec-24?futuresOptionsView=merged&moneyness=allRows

The little nuggets of info at the bottom of the page-. like put/call ratio are interesting. So curiously, the value of calls, while fewer in number have far greater value. Go figure!

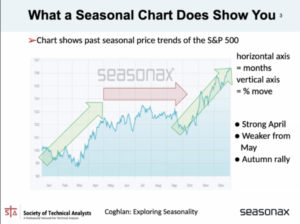

A rare treat from the STA, the Zoom meet was self explanatory, this site is about data.

There is a free trial for Seasonax.com which of course I cannot praise highly enough. https://www.technicalanalysts.com/sta-blog/seasonality-cyclicals-and-statistics-probability-rules/

Looks like the Santa rally is due. And- buy silver on Christmas Eve! (a bizarre stat)

Distraction Trades

ADA was $0.4390 now $0.7787 Another bounce, is this the new ‘must have’ crypto?

XRP was $0.5493 now $1.0651 Ripple gets some considerable love. Who knows what’s going on?

DAX : Last week Nett 1,11o This week 2 losers, 2 no entries, 2 wins +300 nett Our entry system missed a couple of monster moves but Tuesday was huge.

UK Gilts were £16.31 now £16.22 The budget and US election battered bonds. What will it take to see them back in favour ?

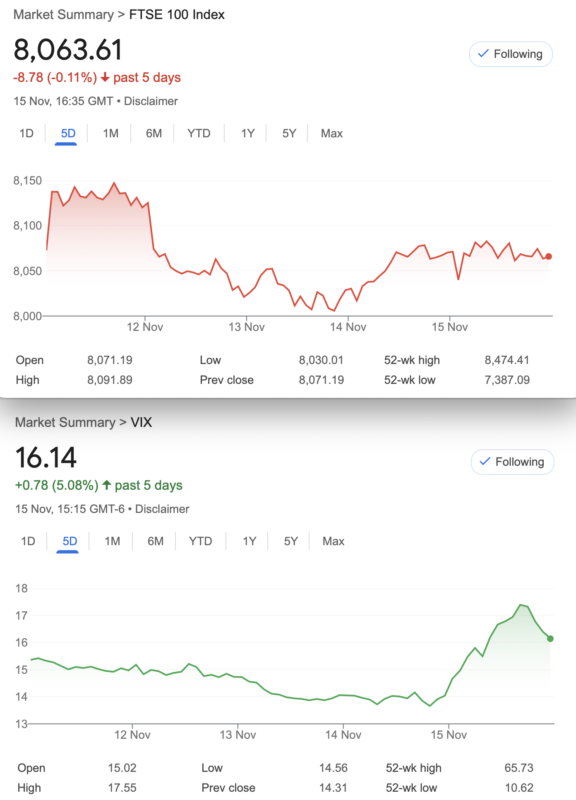

Legacy Trades, and 390 – Expiry we Assume at 8080(sorry it’s a guess but in the ball park)

Trade 386 November And The Ominous US Election Cloud

Sticking to the knitting, and regulars here know we love a put ratio spread. The choices are huge but trade selection comes down to: Do you want a big chunk of premium? Are you happy to place a low or zero cost trade that could give bigger rewards?. Where do you think is an acceptable level at which to have risk that needs to be managed.? This time it’s a low cost 8200/8000 put ratio spread and as it is long at 8200 and short x2 at 8000 this means risk is at 7800, currently about 6% below the futures price. We pay 85.5 for the 8200 put and collect 40.5 x2 for the short 8000 puts. Our cost is thus 4.5 with risk 6% below the market, zero risk from 7801 upwards. Should the market go very South, we’ll look at adjustments.

Was: 71 and 25.5 x2 =20 (we paid 4.5 ) Yes, you could close out having made 300% but as a rule we run these to expiry

This week : 138 and our shorts: 23.5 x2, gives us a great profit 91 -we paid 4.5, so nett 86.5 Close out ( we run it for fun) WIN!

We take 8200-8080= 120 at expiry (would you sweat it out? ) WIN!

Trade387 What to Do With A legacy Trade

We will start from the position of using the spreads we own from trade 385.

8350/8400 calls (109 and 83.5) and 8200/8100 put spread (47 and 30.5)

OK here’s PLAN A. This requires that we sell the long call and long put for 109+47= 156. We BUY the Dec 8300/8400 call spread for 203-143= 60, and the 8200/8100 put spread for 84 -63.5=20.5. Now the short legs of our ratio trades ( effectively a strangle) are in November and the long spreads(effectively a long iron condor) are in December, we have, in addition, a credit of 156- (60+20.5)= 75.5.

Confused? I suggest reading through in stages. 1. Selling the Nov long call and long put and 2. Buying the protective spreads in December. We have risk at 8500 and 8000

Given that we have some mitigation with theta as these are spreads, we could look to time the put side better. Next week may be a very different proposition.

Previous week, we own the Dec 8300/8400 Call spread ( 88.5 and 55.5= 30) and the Dec 8200/8100 put spread (116 and 86= 30) We are short the 8400 call ( 34.5) and 8100 put (42)

NB: We have our credit from trade 385 of 75.5

Last week: the November call 1 and the put 64 (we sold these, remember) Dec spreads that we own: the calls 40-21.5= 18.5, puts 185.5 and 130.5= 55. Overall, the position is : 73.5 minus 65= 8.5

Moving in the right way as theta works hard now.

So- 8100 put was in the money for a loss of 20. Our long spreads in December: 8300/8400 call spread: 30.5-15=15.5, the 8200/8100 put spread 168.5-113.5=53

Choices, choices. Do we just close out everything and collect nett 48.5( remember we already collected 75.5) ? WIN!

Trade 388- The End of The World Strategy!

Ok, maybe an exaggeration but the good old butterfly is a solid trade where your risk is limited to your outlay. We want to buy a November put butterfly

We buy 7700 put 9.5

Sell 2x 7900 puts 17×2= 34

We buy the 8100 put 42

So for the princely sum 0f 17.5 we could, in an extreme drop make 200. Risk as explained is 17.5 as the strategy comprises a short spread and a long spread which, outside of 7700 and 8100 cancel each other out.(200 apiece) Sometimes at expiry the nearest the money strike, the 8100 here, can be closed out with very remote chance of the market dropping 200 points in the 0800-10.20 time period. Buckle up.

This week: WIN! Those prices: 7700 put 3.5, the 7900 puts 9, the 8100 put is 64.5. This gives us 3.5+64.5 = 68, minus 9×2=18= 50. Frankly we’d close out ( we run for fun) and take the very comfortable WIN

Run to expiry would give us 20 so as we paid 17.5 the smart money closed out last week WIN!

Trade 389 What Can We Do In Light of the US election? Get Back To Market Normality

The Xmas effect or Santa rally, is it on this time around? Most market watchers know about this and the markets generally rise as the numbers show the economies are doing ok. We will go with a CALL BUTTERFLY

Here’s the trade: We buy the 8300 call for 40. We sell 2x the 8450 call 16 x2, and we buy the 8600 call for 6.5. Our cost therefore: 40+6.5 minus 32= 14.5

The ONLY risk here is our premium paid 14.5

This week: 30.5, 10.5(x2), 4. Gives us 13.5 Christmas is coming !

Trade390 Can we use Legacy Positions again?

Trade 387 leaves us those two spreads that we own, so we have zero risk and could run them, with one, possibly both making no profit. Or……….

We leave the 8300/8400 call spread for the Santa rally, it’s only worth 15.5 and could make 100.However, the put spread… we sell the 8200 put that we own, for a massive 168.5 and be buy in January the following put spread 8250 216, 8100 137, for 79. So we have a handsome profit(168.5-79= 89.5) still and another spicy calendar ratio trade. Our risk is at 7950 and nothing is set in stone. Santa may not give us the rally this year.

In summary we are long: Dec 8300 call. We are short Dec 8400 call Dec 8100 put. Long Jan 8250 put, short 8100 put.

Here’s the graph of the position https://optioncreator.com/strt35v

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.