That Was The Week The FED Got Spicy

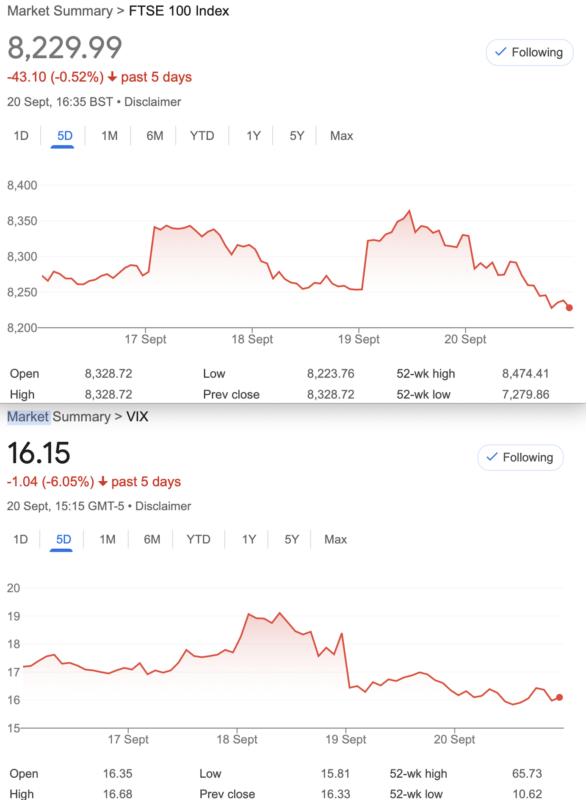

So, bewilderingly, the US interest rate is 4.75%-5.0%. We had our own rate cut by 0.25% to 5% as our readers know fully well. The Federal Reserve delighted the market albeit briefly. The level of consumer confidence dropped https://www.bbc.co.uk/news/articles/cje39kw1281o as the UK faces a winter of malcontents (see what I did there!). We know luxury goods are not flying off the shelves, electric cars are not setting the world alight,( no pun intended) and even classic cars are going for rock bottom prices. It’d be nice to think people are simply being more prudent but these may be the signs of the turbulence in the ‘soft landing‘ that is overdue. Footsie had a rocky week and while we don’t like to predict, it might be wise to take a moment to ponder the US market’s dizzy heights. Of course the US sneezes, the rest of the world catches a cold.

However making sense of any metric involving the government is always problematic as they are so far behind the curve, they’re still behind last year’s curve. Ouch! https://www.bbc.co.uk/news/business-12196322

I’m reliably informed by a close and trusted source that air fryers are no longer the darling of the kitchen and may have run their frenzied course of adoption. They are decent enough but they are no longer the ‘hot ticket’ item. Prices are dropping as with all new tech. So, it’s bizarre to see our glorious leaders make bewildering changes in the items in the basket for inflation calculations. Hand sanitiser? That was the ‘must have’ in 2020 and here at HQ we even had a bottle of it from a gin distiller. Seems like another world now.

Why Investing is Horrible

It’s wise to spread risk around, right? So, a review of this month’s options trades was entertaining. 4 wins, one break even. Not an idle boast but an idiot’s trades making money. With barely a glance at a chart, and scant regard for the musing of the financial media.With basic understanding of options and public domain calculator. OPTIONS MAKE MONEY

So if we’d bet the farm on this month’s trades we’d, as with every month, be very handsomely rewarded. Yours truly has a couple of share ISAs that have just been rubbish -for a few years. Nothing wrong with talking advantage of a tiny tax break, but frankly investing in the UK market is rubbish. The US has done extremely well but their markets always outshine ours as they are comfortable with those hefty P/E valuations. S&P 500: 27.45 against FTSE100: 14.2 Americans also have 401Ks -their pension funds. The UK pensions industry is a crusty desolate place.

Distraction Trades

ADA was $0.3551 now $0.3535

XRP was $0.5870 now $0.5824 Ripple still ahead of our preferred Cardano but these are both still looking rangebound.

DAX 3 break evens (30×3) 1 no entry, 1 win +100 Not the worst but seems lacklustre.

UK Gilts were £17.18 now £16.99 A painful week. The fund that I use, like actual gilts, pays dividends at around 3.8% so like all investments you sit placidly regretting them!

EXPIRY WINS AND ONE BREAK EVEN AND …..TRADE 383

Trade 378 Cheap as Chips

Ugly trade, and honestly it’s not in my recommended playbook, but in this low vol market we need to be careful with risk. This trade is the iron butterfly, and ‘iron’ means you are using both puts and calls. A butterfly is either calls or puts.

Here we see the prices for September: 8200 put, 57.5, 8300 put 89.5, 8300 call 127, 8400 call 75.

How does it work? Typically you would buy the ‘wings’, the outer strikes, and sell the body- the at-the-money straddle. So the wings 57.5+75= 132.5. The body 89.5+127= 216.5.

Thus: 216.5-132.5= 84. This is a credit the trade pays us and worst way it can only be wrong on one side. Example, FTSE goes to 8000, the spread between the 8300 put you sold and the 8200 you bought, is 100. ( we took in 84, remember) We risk losing a maximum of 16 to get a maximum profit 84. We need the expiry at 8300 -what are the chances?

Previous week 121.5+69 = 190.5 minus 40.5+67.5= 108, give us 82.5 We took 84 credit so it’s not a disaster this week!

Last week 130+ 43, minus 68.5 and 23.5 gives us 81 of course we wouldn’t expect anything dramatic.

Was: 31.5+147.5 minus 12.5 +88=88.5 An ugly week for this trade

Now 106- 37= 69. (Remember this is a credit trade so the lower this number is, the better) Profit 15

Expiry 8262 so how did we do? The calls went out for 0 The 8300 put was worth 38. We took in a credit of 84 46 profit WIN!

Trade 379, Let’s Do the Theta Challenge

We will compare using near month versus far month, but as you can see the premiums are of course much more juicy for October. We will place a strangle – short call and put in September and October. And, all things being unequal in our world, we will see how nothing in options is linear.

Here’s the trade, a bog standard strangle we sell the 8150 put 33 and the 8500 call 31.5. ( September prices ) and October: 72.5 and 59 for the same strike put and call

In 4 weeks the September strangle will expire, it’ll be interesting to see if in cash terms, the October trade does better.

Previously: Sept prices 18 for the put 30 for the call We took in 64.5, so a profit of 16.5

October prices 45.5 and 79.5 we took in 131.5 so a profit of 6.5 so clearly the theta effect in play giving the near month a big advantage. Sometimes, it’s good to confirm what we know.

Was : 66.5 (put) and 5 for Sept =71.5 – a loss of 7. October: 100.5(put) and 27 a small profit 4 (All a bit meaningless as theta will now pick up more quickly)

Was: Sept put: 16 and 3 for the call = 19, we received 64.5 so 45.5 a niceWIN! October: 63.5 for the put, 35.5 for the call. We received 131.5 so, minus 99 gives us 32.5. This simple example shows the power of Theta in the last days of the expiry cycle. Curiously it shows that if we’d done this as a calendar trade, BUYING the October strangle, it would not be total rubbish. However the near term strangle has done much better, though both are ok.

At expiry:

The September strangle made all the money 64.5 WIN! October? We took in 131.5 now the put is 57.5 the call 15.5 -73. Gives us 58.5 WIN! The takeaway in our sample of 1, shows the near month strangle is better, less stress, easier to manage. We just need to do another 99 to make it statistically relevant. Or backtest for 9 years. Note: the calendar trade was a poor performer

Trade 380 Disregard My 1 1 2 paragraph, we Already Have 2 Boring Trades

Well this is fun but looking at ropey prices and 3 weeks to expiry, this could be nuts, but we do a 3×1 ratio. ( What did I say about this? )

We buy the 8300 put for 43 and sell 3 of the 8100 puts at 14.5 x3 =43.5. Cost zero(margin required) Risk at 8000

Was: 8300: 147.5, 8100: 50.5 x3 A tiny loss

Was: 8300 put 64, 8100 puts 10×3, gives us 34, we run to expiry as it could make up to 200

Expiry at 8262 gave us a profit of 38, though during the week we could have closed out for 40 WIN! Confession, I closed out as the expiry was minutes away, for 20 having resigned myself to a nothing trade following the bonkers rise to 8370 on Thursday. It was a zero cost trade, remember but in real terms a 12% gain Pull this off every month and you’d double your money in one year.

Trade 381 Vol has increased, so……. We don’t do the obvious of selling the farm

A combo, (combination or risk reversal) This is a quick flip: We sell 8300 call for 31.5 and buy the 8000 put for 30. Keen eyed observers will note this is bearish and similar to a short future, but as we show the deltas add up to 0.49 whereas a future has a delta of 1. However options delta is not linear, and it’s also dynamic. So effectively we have a half portion of short futures. It’s not a long term trade, theta is brutal so holding on for a market turn in our favour is not a good idea.

This kind of trade can turn ugly so has to be watched and a decision made if it goes against us. Will the FTSE rebound or drop?

Very quickly this turned into a loss 29-17.5= 11.5 on Wednesday. Note to self: This is NOT 2008

Expiry at 8262 was kind to us but you’d not normally run this -we’d say honours about even, but no win. BREAK EVEN

Trade 382 Only 3.2 Trading Days to Expiry

We know that the straddle* is a horrible trade but what if it’s a calendar straddle? We sell the near month 8300 straddle and buy the far month (Oct) Gives us an expensive trade. Oct costs: 228, Sept: 106. So the near month should have massive time decay and give us an easy profit, right? We pay, reluctantly 228-106= 122 We could make ∞ and pigs might fly.

*call and put ATM(at the money)

Expiry at 8262 gives us minus 38 for the put and the October straddle is now 70.5+117.5= 188. Gives us 150, we paid 122 we make 28 WIN!

Trade 383 October Can Get Spicy And The Omens Are…. Oh Wait, We have No idea!

We had a lot of fun with the ludicrous 3×1. Let’s go again and try to keep the risk level out of harm’s way, though venturing in the murky depths can mean missing out on the sunlit uplands of juicy profits. Let’s see. Again we sell 3 puts and buy 1. We sell 3 of the 78000 puts for 15 and buy the 8100 put for 45.5. Where’s our risk? sort of 7500-ish. Now that’s a fair degree of comfort with not a lot of likelihood for success. And, let’s not forget it costs us a ha’penny and requires some margin. Remember a very competent, very large hedge fund got blown up with the 3×1 trades, but with calls

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.