That Was The Week

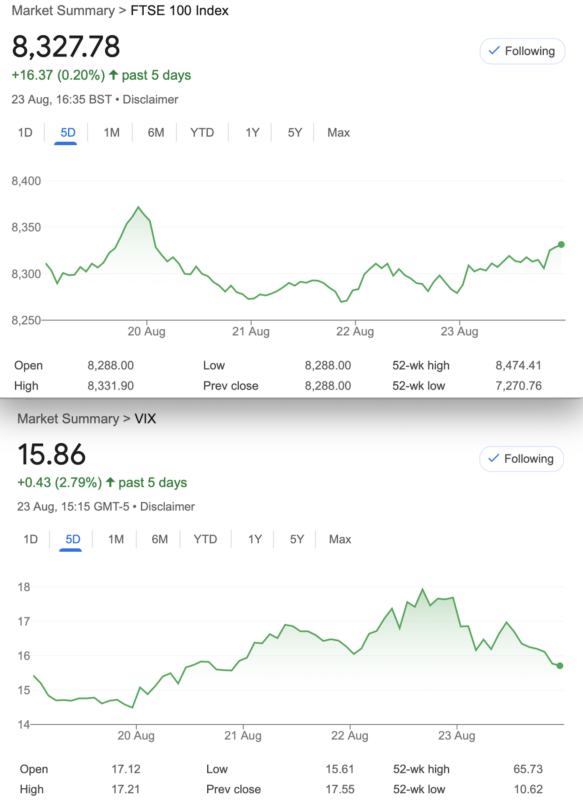

So, we had employment, unemployment, revision of employment numbers Jackson Hole CPI, a lot of data of global significance. And, no major gaffes from our new government, though you have to think there’s an ugly tax burden lurking in the shadows. So, the FTSE was pretty much range bound as the US hung on every word from FED chairman J. Powell. However worrying about a 0.25% interest rate reduction is bit silly. On £1million, that’s £2,500, that’s just a big lunch of most millionaires. Of course the data about the wider economy is conflicting but with energy prices forecast to rise 10% in October you have to think that this will feed into inflation generally. While many of us can change suppliers the poorest will still be on much higher rates. It begs the question of how to calculate inflation sensibly. Funny, this was once not an issue.

US Election Concerns

After Trump stormed out of his interview with Piers Morgan looking for all the world like a decrepit delusional demented oaf, you have to question why he’s still the Republican hope. The US must surely be embarrassed. Yours truly cannot bring to mind any world leader as remotely stupid as Trump. Dubya was not know for his intellect, Reagan was just bewildered. There’s a pattern of using the less mentally gifted to head up the Republicans. Compared to whip smart Clinton, and Obama. Biden was no fool but seemed to own his age related fragility. It may be prudent to load up on some insurance against a crazy November when the US goes to the polls.

Webinar of the Week

Here’s the link to one of CBOE’s educators called betterexplained https://betterexplained.com/wp-content/uploads/cboe/mental-models-for-trading.pdf The content is graphics only but there is some good stuff, including how prices are arrived at, the concept of options and the factors at play. Any questions whizz me an email: surreyhantstraders@gmail.com

Distraction Trades

ADA was $0.3312 now $0.3944

XRP was $0.5635 now $0.6112 Ripple still ahead of our preferred Cardano but both enjoying a little revival

DAX 2 break evens, 1 loser 3 wins nett 250 This is still looking good but these are not taken live, it’s backtesting each week

UK Gilts were £16.93 now £16.99 It’s not an attractive instrument but at £16.99 it sounds like it!

Legacy Trade 378 And new kid 379

Trade 378 Cheap as Chips

Ugly trade, and honestly it’s not in my recommended playbook, but in this low vol market we need to be careful with risk. This trade is the iron butterfly, and ‘iron’ means you are using both puts and calls. A butterfly is either calls or puts.

Here we see the prices for September: 8200 put, 57.5, 8300 put 89.5, 8300 call 127, 8400 call 75.

How does it work? Typically you would buy the ‘wings’, the outer strikes, and sell the body- the at-the-money straddle. So the wings 57.5+75= 132.5. The body 89.5+127= 216.5.

Thus: 216.5-132.5= 84. This is a credit the trade pays us and worst way it can only be wrong on one side. Example, FTSE goes to 8000, the spread between the 8300 put you sold and the 8200 you bought, is 100. ( we took in 84, remember) We risk losing a maximum of 16 to get a maximum profit 84. We need the expiry at 8300 -what are the chances?

This week 121.5+69 = 190.5 minus 40.5+67.5= 108, give us 82.5 We took 84 credit so it’s not a disaster this week!

Trade 379, Let’s Do the Theta Challenge

We will compare using near month versus far month, but as you can see the premiums are of course much more juicy for October. We will place a strangle – short call and put in September and October. And, all things being unequal in our world, we will see how nothing in options is linear.

Here’s the trade, a bog standard strangle we sell the 8150 put 33 and the 8500 call 31.5. ( September prices ) and October: 72.5 and 59 for the same strike put and call

In 4 weeks the September strangle will expire, it’ll be interesting to see if in cash terms, the October trade does better.

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.