That Was The Week FTSE Found New Interest

Can you say man, ip, ulation? If you expected person woman man camera tv, well done you! So as you know it’s a 10 minute auction to establish the expiry level, however as this was quad witching it was of considerable importance to us all. Thus the ‘influencers’ need to ‘influence’ the expiry level to best suit their own interests. Curiously expiry was at 8200.5. Anyone have short puts at 8200? We did in various iterations and strategies, never naked. So, this may have been mentioned before but Fisher Black, of Black- Scholes fame, when questioned at a conference about managing PIN risk said ” put your head between your knees and hang on to your b*lls! ” It is a gamble if naked, but if part of a calendar trade for example it’s fine, your short put might expire 25 points in the money but your long put gains.

So, I will share that some of my historic trades were converted to butterflies having given good premiums at the trade open, and with an adjustment. Both call and put butterflies had the extreme legs at 8000, so it was good to check my account and see how the prices at expiry netted to zero. I STILL have trust issues! However had expiry been at 7800 it would have been a very handsome payout. Anyone else have difficulty explaining such things to non traders? Never try to do this in the pub, you may cause utter bamboozelement and gnashing of teeth. People who don’t know trading cannot understand how you can sell something you don’t own. Those people may have credit cards……

Market Predictions, We Don’t Even Know Where it Won’t Be!

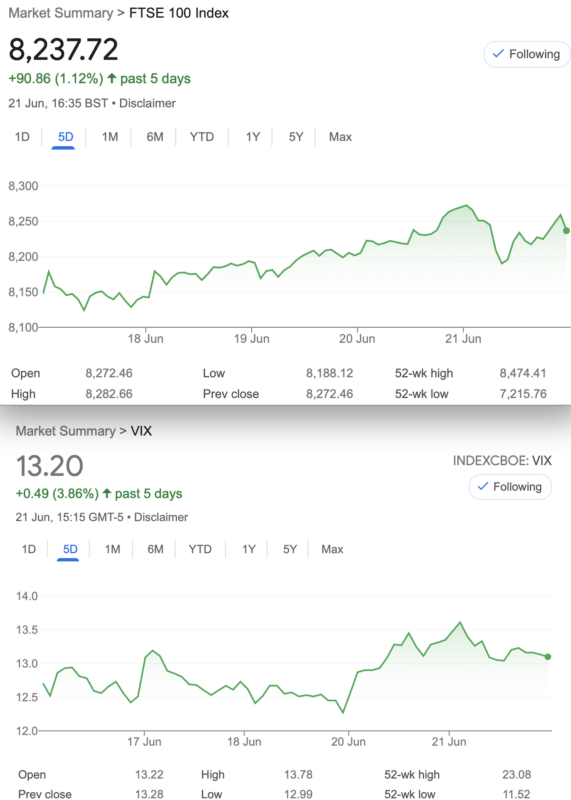

More machinations, more economists, bankers deign to grace my inbox with their missives. So far, inflation will be up /down, interest rates may be cut/stay the same. The UK economy is flat, in recession, or according to retail sales, it’s all peachy. Somewhere far down our list of trading parameters is where the market will be in n months. At the top: Where is my risk? What if x happens? Can I adjust, close out and rearrange without too much damage? So can we assume that not much is going to happen, given global events, elections, let alone the Euros! A flat market generally suits us but here’s monthly data https://uk.investing.com/indices/uk-100-historical-data What it doesn’t address, is options expiry to the next expiry, which, perhaps I should look at in a future edition. Bear in mind I’m not a techie guy.

Distraction Trades

ADA was $0.4112 now $0.3762

XRP was $0.4798 now $0.4855 diverging from Cardano again, which is clearly out of favour.

DAX 3 no entries 2 wins +50, and +80 -Please note data from CMC shows some massive drops late at night, but these are transient 5 minute events.

UK Gilts were £16.76 now £16.72 Hard to contain my disinterest!

Legacy Trades 363- 369 And… 370, something interesting

Trade363 Can we Find something not totally rubbish?

It’s unseasonal but it’s a pitchfork!

Ok so here’s the trade, and everything is wrong about this which might serve us well. We sell one call and 3 puts at the strike which is the value of the ATM straddle subtracted from the ATM (Futures) price, 8256. This gives us nothing much in the call but the put is all extrinsic value, ie if the put options expired today, they’d have no value.

We take in the premiums 271.5+ 50.5×3= 423. The dream is….. the market at 7700- 8300 for June expiry, ideally at exactly 8000!

Was: 466.5 and 18.5 x3 – not unexpected and those puts seem to be heading towards zero. Loss 0f 43 + those puts

Was: Still a loss, but we soldier on, now it’s 489, from our original credit 423

Previous week: 348+16×3 = 396. PROFIT!

Last week : 300.5+ 15×3= 345.5 Still winning but bigger!

Was: 270 and 8×3 = 294. WOW! We took in 423, WIN! Profit 423- 294= 129.

Now – incredibly 94+33.5=194.5 what does this mean when we took in 423? A staggering WIN 228.5

I had stated: Caveat -I have no entry criteria and this may not be typical and yes this profit is extraordinary.

EXPIRY: 8200.5 gaining a profit of 222.5 We already beat this

Trade 364 Back to The Knitting

So, it’s too late to use the May expiry, but June is well within the parameters (<45 days to expiry) and we again choose a ratio spread, which is a firm favourite here. However there’s a twist and a fellow trader has done a lot of homework and come up with the following. Subtract the value of the ATM straddle (8450 for our purposes) gives us ± 8200, and that is where we write the short puts. And for the longs we go 100 points above, giving us 8300/8200 put ratio. Those premiums? 41×2= 82, and 62.5. Earth shattering credit it is not, but it may be in the ballpark for the long spread to produce the goods- a max 100. Risk below 8100. We must endure such horribly, absurdly low prices for now.

Last week 48 and 29×2 gives us debit 10. Our original credit was 19.5

Last week: 75 and 43 x2= 11, our credit was 19.5 So happy days again, will June play nicely?

Last week we had 49.5×2 and 90.5 =8.5 debit, our credit was 19.5 remember.

Now: 152, and 77.5 x2, gives us a small debit of 3

We want 8200 at expiry.

EXPIRY:

We got 8200.5 MAXIMUM!!!!!

Trade 365 Calendar Ratio

Calendar time anyone? You know- sell the near month, buy the far month. We’ll do a simple comparison, between the 1 for 1 and the ratio spread, whereby we have a long spread in the far month.

Here we go: We sell the Jun 8250 put, we buy the 8350/8250 put spread in July. We have theta in our favour with a calendar, we have risk if FTSE drops below 8150, zero risk to the upside

Sorry if it ‘s a rinse and repeat a lot like 364, but as we’ll see the dynamics are different.. Oh, and the prices? Jun 8250 put 37, the July 8350/8250 put spread 88.5-61.5= 27 giving us a small credit of 10. The straight 1 for 1 calendar would cost us 88.5-37= 51.5 CORRECTION!!!!! sell: 8350 jun put 62.5, buy: July 8350 put 88.5= 26

Last week we had the debit in June: 57 and credit 38.5 for the July spread 18.5- 10 credit, gives us a loss 8.5

Was: 23.5 debit overall for the put calendar -jun short 8250 /July long spread 8350/8250

The straight one for one calendar was 127.5 – 97.5 = 30 a small gain from last week as we paid 26. Now 147-119= 28 ( we paid 26)

Last week: 58.5 for Jun 8250, July spread 146.5- 96.5= 50 a tiny gain.

Level calendar 8350 put jun 119, July 146.5 gives us 27.5 -Squeaking by

However, this week: 111.5 for jun put and 216 and 153= 63 for July spread –heavy loss !

Level calendar 196.5 Jun and July 216.5 =20 a small loss

EXPIRY:

Expiry at 8200.5 therefore the June 8250 put is worth 49.5 the 8350/8250 put spread around 60, we had a credit of 10 so we made about 20

The straight calendar? 87.5 -49.5= 28. We paid 26, however at expiry we could have got more as the market dropped –in fact we could have got 60-70 to close out

Trade 366 This Takes some Cojones- it’s called a GUTS.

Here’s some fun and the GUTS trade is created as a deep ITM (in-the-money) strangle. We sell the 8000 call and the 8500 put. Think about those strikes and all points in between. At expiry they can only add up to 500. Here’s the kicker we sell those 2 options for…..542.5 So assuming FTSE does not exceed the 2 strikes at 8500 and 8000, we make 42.5* Mind boggling isn’t it!

*It’s known as extrinsic premium (where the 500 is intrinsic).

Was : 8500 put 230, 8000 call 300.5= 500.5 and we SOLD it for 542.5. We make 12, but run it of course.

Previous week: 8500 put 244 the 8000 call 270 gives us 514 –we sold it for 542.5

As we can only make another 14 for max profit we have gained the lion’s share of the profit at 28.5. We run it to expiry.

Last week: 341 and 175.5 =516.5 a little less profit but we’re running it to expiry, at least it’s not a loss.

EXPIRY:

8000 call= 200.5, the 8500 put = 299.5= 500 of course. We sold this for 542.5 –WIN!

Trade 367 Trading in a ‘Clueless Void’

We need to be aware that volatility is not helping, the FTSE seems to be flailing like a toy kite in a storm. So, here we go with a least favoured trade, the call butterfly, but here’s the kicker, we will run two. Remember the structure? Sell the body(x2) buy the wings(the middle strike). We have A) 8100/8250/8400, and B) 8200/8350/8500.

Let’s crunch numbers: A)212,103.5(x2) 38.5,= 43.5.

B) 135.5, 56.5(x2), 16.5 = 39.

We should not do too much damage, though delta and theta are no help until expiry week.

Was: A) 178.5 71 x2, 20= 56.5 (cost 43.5)

now: 54 (Trust me!)

B) 101, 31.5×2, 7= 45. 0. (cost 39.0)

Now 25.5 So- this makes the point that choice of strikes is critical. A butterfly OTM or deep ITM will always go to zero.

So far so good.

APOLOGY:Sell the body(x2) buy the wings(the middle strike). Obviously I meant buy the wings, sell the body(middle strike)

So how did we do?

EXPIRY:

A: 8100 call was worth 100.5 the rest expired out of the money -so a nice little earner, but we paid 43.5 WIN!

B. 8200 call is worth a fiver! We paid 39.0. LOSER

Trade 368, finding the Gems in the Rough

There is an expression about selling options : Picking up pennies in front of a steam roller. Let’s do exactly that! We will sell a far OTM Strangle for tiny but probably low risk reward. Here’s the deal: We sell the 7900 June put for 5, and the June 8500 call for 7. We take in 12 (£120) and likely the margin required would be £2,500. Annualise that and you’re looking at 50% return. Thus, we have effectively 9 fun filled trading days to expiry. And, while this is how people blow up from time to time, it’s a set and forget until Friday 21st at 10:00am.

So, how did this go? 7.5 and 1.5 for the call so all to play for at expiry

We got the max 12 WIN!

Note: We didn’t have to be right, we just had to avoid being wrong, the opposite to the butterflies.

Trade369 New Expiry Month Looms as June expires Fri 21st

So, while we are utterly bereft of clues about the market should we try another strangle? Not the trade of choice but it’s hard to see what might work well and July expiry is only 34 days hence. Thus we go with the same strikes as Trade 368. Therefore we are saying we think/believe FTSE will find support higher than 7900 and resistance below 8500. We collect 39.5 for the put and 19.5 for the call We therefore collect 59 and sit on our hands for 33 and a bit days. Apologies if it’s a bit beige but we’ll try something a bit feisty next time.

With not a lot going on with volatility we now have prices: 15 and 20.5=35.5 we collected 59 a great outcome as theta took chunks out of premiums. Yes you could do this whilst lying shipwrecked and comatose drinking fresh mango juice. (Nod to Howard Goodall)

Trade 370 Ladder Not Laddish

Let’s kick the beige into touch and sell a ton of premium and see where it leads us. We use July expiries: buy: 8500 put, 248 sell 2x 8300 puts 110.5×2= 221, buy 8150 put, 53.5, sell 2x 8000 puts 24.5×2= 49

Thus we have a cost of 248+53.5. – (221+49)= 31.5 Logic of the trade? We buy a juicy in the money put spread, we have no upside risk other than the cost 31.5 Downside is a tad skewed giving us a lot of wiggle room just below 8000

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.