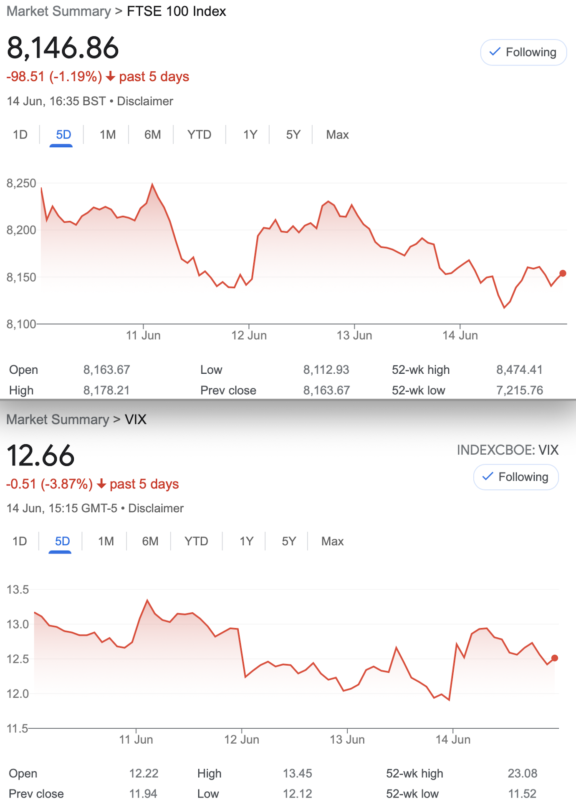

That Was The Week Another Drop, Inflation Moderating

So, it’s not news, it may mean nothing, but so far this year we have had 14 down weeks and only 9 up. It beggars belief after the radical melt up of recent times but another indication we watch, is the up/down day ratio. So, this is a curious thing and usually we get very skewed to an excess of up days relative to down days. Over the course of a year we might generally expect 52% up and 48% down ±. There are of course flat days. Currently we have 56 down, 59 days up.

We like free sensible resources such as https://www.forexfactory.com/calendar for the economic indicators and this week inflation seemed to be moderating. In the UK the big news in that world, the cost of utilities drops 7% in July having already dropped 12% in April. However the ‘illusory’ metric of economic growth shows UK GDP was flat but frankly we have been coasting for many years.

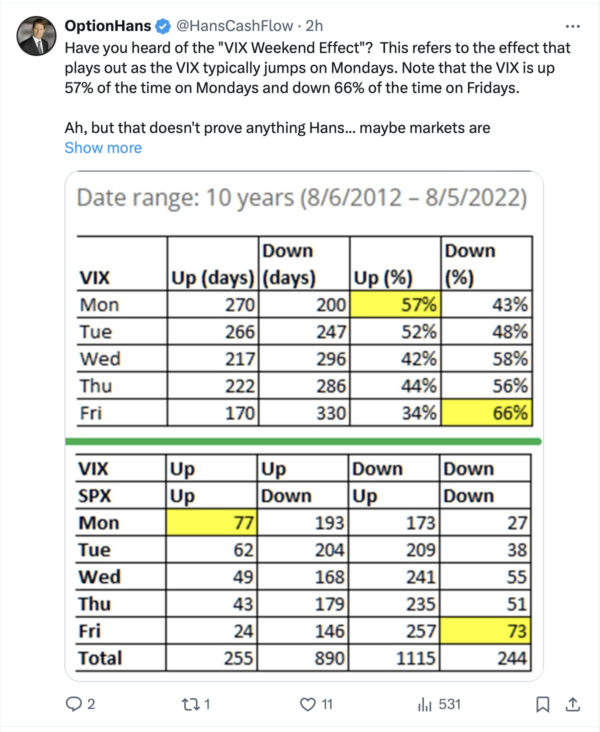

Another Metric To Add To The Mix

Perhaps I should be more aligned to the TA view of chart watching, but often it’s options prices that drive decisions. We can only choose what prices are offered, but we can analyse to arrive at the answers that make the trade a go, or no go. Here’s some fun:

OK, I get it. On a Monday you have the most time and therefore a larger number of variables, so you’d expect more volatility. On a Friday people are closing out for the weekend and maybe taking prices that reflect the simple comfort of simply closing out, and getting the beers in. People take prices that suit them, and I may be talking nonsense! As always, we do the calculations before piling in, an at least have a healthy regard for our deltas.

Why Do We Trade Index Options?

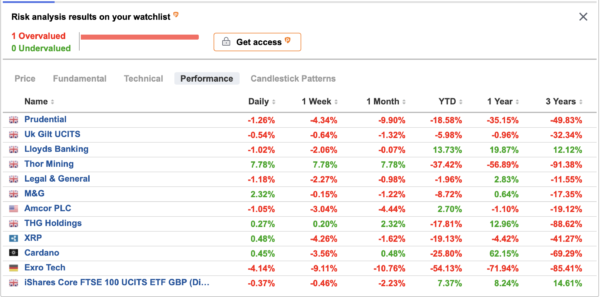

Here’s a painful reminder, though the caveat is that I don’t hold most of these and have bought at very low prices those I do hold. However here’s my watchlist:

Confession -my fun trade Thor, bought for 3p, now about half that. Pru bought for 744, sold for 834. I closed out my position on Cardano a while back and it has never made much of a rise since. Since starting to trade solely FTSE options the returns have been pretty good though 2024 may be an exception due to a combination of poor decisions ( I am fallible ). Personally the upside of stock picking rarely compensates for the long term despair! I had for fun, concocted a portfolio for a finance group and in 14 months it has made just over 1% minus dividends, which made it acceptable, however. Wiser heads than mine are needed for that approach, thus I’m sure many readers here are qualified!

Just One More Thing -Interesting Article

Normally we’d stay away from hedging as our portfolio has balance and some robustness, but this makes good reading. Like any long options strategy you might want to think about spreads rather than buying outrights, but if you go for the penny outliers as a punt then buy cheap, sell high!

https://www.ivolatility.com/news/3000

Distraction Trades

ADA was $0.4414 now $0.4112

XRP was $0.4981 now $0.4798 diverging from Cardano again

DAX 3 no entries one win +200, one loser -30. Sometimes we get these surprises but it’s not automated and perhaps should be.

UK Gilts were £16.53 now £16.76 Hard to contain my disinterest!

Legacy Trades 363- 368 and new kid 369

Trade363 Can we Find something not totally rubbish?

It’s unseasonal but it’s a pitchfork!

Ok so here’s the trade, and everything is wrong about this which might serve us well. We sell one call and 3 puts at the strike which is the value of the ATM straddle subtracted from the ATM (Futures) price, 8256. This gives us nothing much in the call but the put is all extrinsic value, ie if the put options expired today, they’d have no value.

We take in the premiums 271.5+ 50.5×3= 423. The dream is….. the market at 7700- 8300 for June expiry, ideally at exactly 8000!

Was: 466.5 and 18.5 x3 – not unexpected and those puts seem to be heading towards zero. Loss 0f 43 + those puts

Was: Still a loss, but we soldier on, now it’s 489, from our original credit 423

Previous week: 348+16×3 = 396. PROFIT!

Last week : 300.5+ 15×3= 345.5 Still winning but bigger!

Was: 270 and 8×3 = 294. WOW! We took in 423, WIN! Profit 423- 294= 129.

Now – incredibly 94+33.5=194.5 what does this mean when we took in 423? A staggering WIN 228.5

I had stated: Caveat -I have no entry criteria and this may not be typical and yes this profit is extraordinary.

Trade 364 Back to The Knitting

So, it’s too late to use the May expiry, but June is well within the parameters (<45 days to expiry) and we again choose a ratio spread, which is a firm favourite here. However there’s a twist and a fellow trader has done a lot of homework and come up with the following. Subtract the value of the ATM straddle (8450 for our purposes) gives us ± 8200, and that is where we write the short puts. And for the longs we go 100 points above, giving us 8300/8200 put ratio. Those premiums? 41×2= 82, and 62.5. Earth shattering credit it is not, but it may be in the ballpark for the long spread to produce the goods- a max 100. Risk below 8100. We must endure such horribly, absurdly low prices for now.

Last week 48 and 29×2 gives us debit 10. Our original credit was 19.5

Last week: 75 and 43 x2= 11, our credit was 19.5 So happy days again, will June play nicely?

Last week we had 49.5×2 and 90.5 =8.5 debit, our credit was 19.5 remember.

Now: 152, and 77.5 x2, gives us a small debit of 3

We want 8200 at expiry.

Trade 365 Calendar Ratio

Calendar time anyone? You know- sell the near month, buy the far month. We’ll do a simple comparison, between the 1 for 1 and the ratio spread, whereby we have a long spread in the far month.

Here we go: We sell the Jun 8250 put, we buy the 8350/8250 put spread in July. We have theta in our favour with a calendar, we have risk if FTSE drops below 8150, zero risk to the upside

Sorry if it ‘s a rinse and repeat a lot like 364, but as we’ll see the dynamics are different.. Oh, and the prices? Jun 8250 put 37, the July 8350/8250 put spread 88.5-61.5= 27 giving us a small credit of 10. The straight 1 for 1 calendar would cost us 88.5-37= 51.5 CORRECTION!!!!! sell: 8350 jun put 62.5, buy: July 8350 put 88.5= 26

Last week we had the debit in June: 57 and credit 38.5 for the July spread 18.5- 10 credit, gives us a loss 8.5

Was: 23.5 debit overall for the put calendar -jun short 8250 /July long spread 8350/8250

The straight one for one calendar was 127.5 – 97.5 = 30 a small gain from last week as we paid 26. Now 147-119= 28 ( we paid 26)

Last week: 58.5 for Jun 8250, July spread 146.5- 96.5= 50 a tiny gain.

Level calendar 8350 put jun 119, July 146.5 gives us 27.5 -Squeaking by

However, this week: 111.5 for jun put and 216 and 153= 63 for July spread –heavy loss !

Level calendar 196.5 Jun and July 216.5 =20 a small loss

Trade 366 This Takes some Cojones- it’s called a GUTS.

Here’s some fun and the GUTS trade is created as a deep ITM (in-the-money) strangle. We sell the 8000 call and the 8500 put. Think about those strikes and all points in between. At expiry they can only add up to 500. Here’s the kicker we sell those 2 options for…..542.5 So assuming FTSE does not exceed the 2 strikes at 8500 and 8000, we make 42.5* Mind boggling isn’t it!

*It’s known as extrinsic premium (where the 500 is intrinsic).

Was : 8500 put 230, 8000 call 300.5= 500.5 and we SOLD it for 542.5. We make 12, but run it of course.

Last week: 8500 put 244 the 8000 call 270 gives us 514 –we sold it for 542.5

As we can only make another 14 for max profit we have gained the lion’s share of the profit at 28.5. We run it to expiry.

This week: 341 and 175.5 =516.5 a little less profit but we’re running it to expiry, at least it’s not a loss.

Trade 367 Trading in a ‘Clueless Void’

We need to be aware that volatility is not helping, the FTSE seems to be flailing like a toy kite in a storm. So, here we go with a least favoured trade, the call butterfly, but here’s the kicker, we will run two. Remember the structure? Sell the body(x2) buy the wings(the middle strike). We have A) 8100/8250/8400, and B) 8200/8350/8500.

Let’s crunch numbers: A)212,103.5(x2) 38.5,= 43.5.

B) 135.5, 56.5(x2), 16.5 = 39.

We should not do too much damage, though delta and theta are no help until expiry week.

Was: A) 178.5 71 x2, 20= 56.5 (cost 43.5)

now: 54 (Trust me!)

B) 101, 31.5×2, 7= 45. 0. (cost 39.0)

Now 25.5 So- this makes the point that choice of strikes is critical. A butterfly OTM or deep ITM will always go to zero.

So far so good.

Trade 368, finding the Gems in the Rough

There is an expression about selling options : Picking up pennies in front of a steam roller. Let’s do exactly that! We will sell a far OTM Strangle for tiny but probably low risk reward. Here’s the deal: We sell the 7900 June put for 5, and the June 8500 call for 7. We take in 12 (£120) and likely the margin required would be £2,500. Annualise that and you’re looking at 50% return. Thus, we have effectively 9 fun filled trading days to expiry. And, while this is how people blow up from time to time, it’s a set and forget until Friday 21st at 10:00am.

So, how did this go? 7.5 and 1.5 for the call so all to play for at expiry

Trade369 New Expiry Month Looms as June expires Fri 21st

So, while we are utterly bereft of clues about the market should we try another strangle? Not the trade of choice but it’s hard to see what might work well and July expiry is only 34 days hence. Thus we go with the same strikes as Trade 368. Therefore we are saying we think/believe FTSE will find support higher than 7900 and resistance below 8500. We collect 39.5 for the put and 19.5 for the call We therefore collect 59 and sit on our hands for 33 and a bit days. Apologies if it’s a bit beige but we’ll try something a bit feisty next time.

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.