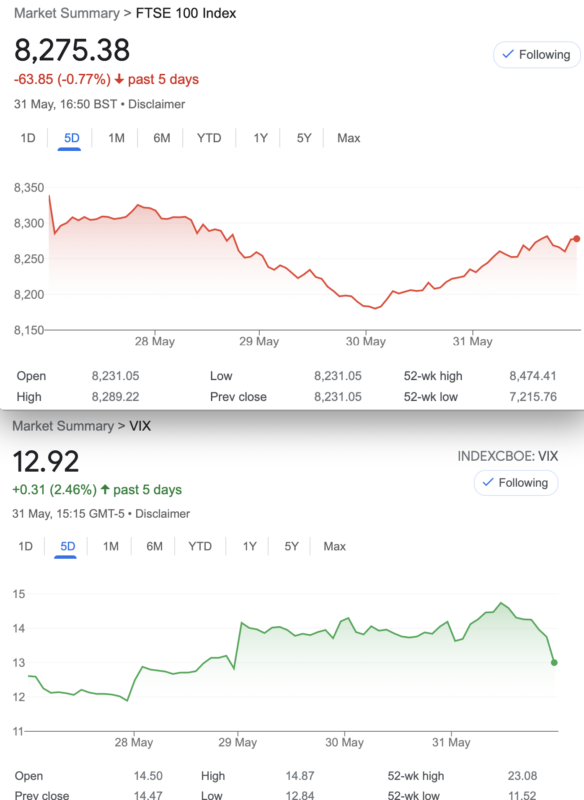

That Was The Week We Dropped 2% but Rallied

So the verdict’s in, Trump is of course guilty as the evidence and nothing but the evidence clearly demonstrated. However the Trump show deems it a heroic stand against evil. So, as the polar opposite of the UK’s historic Post Office trials, where the innocent humbly accepted the injustice, the rule of law is not in Trump’s orbit, it seems. However this was not a market moving event, just a global embarrassment. Although in the US PCE has dropped from 0.3 to 0.2% https://www.forexfactory.com/calendar#detail=136180 Inflation may have been reined in at last. Literally no clue what it means! However next week, the biggie is of course Non Farm Payrolls. This can be good news which is bad news or bad news which is good, or even a non event. But, the first Friday of the month at 1.30 our time is when our world holds its breath, briefly.

So, what’s going on that is helpful to us in having a bit of a clue about our irksome FTSE? The election promises from all quarters amount to a big fat zero, as the UK’s ‘problem’ is productivity. That is nothing new, but are we just a lazy lot or is it lack of investment? You have to think that UK companies are doing ok, while a few American companies went nuts, such as NVDIA +1,059.57 past 5 years. Our own BP? Down 11% in the past 5 years. Comparing apples with onions of course but we don’t have those tech stocks, or those banks, like Silicone Valley. The mainstream is not being helpful.

Evidently Egregious*

Rarely, we mention the options activity that is freely available https://www.ice.com/report/265 And this week a trading buddy asked me if there were any egregious trades on Friday. Yes, and NO! I noticed that July 8250 and Sept 8300 straddles had traded in the amount of 1,000 lots, that’s 4,000 options in total. However looking again today and they are gone. Without knowing the prices at the time of those trades we cannot know what happened. Were they short/long/ calendar trades? As delta neutral trades, were they a punt on theta? Honestly it’s a curve ball shrouded in mystery. There was virtually NO theta from 30-31 May as far as I can see. However those trades have been and gone. So, the word is: unhelpful. Open Interest helps with knowing where the biggest volume is and thus where the market may be drawn to at expiry.

*Love that Trump gets new words from his detractors, and then runs with them, like a puppy with a new toy. (Apologies, just an observation, other derogatory words are available)

Distraction Trades

ADA was $0.4640 now $0.4487

XRP was $0.5384 now $0.5201 Crypto minors seem out of fashion.

DAX 2 wins +250 2 no entries one loser

UK Gilts were £16.49 now £16.44 NB this is the VAN ETF with a yield of 4.65% Not encouraging, but it’s a sleeper.

Legacy Trades 363- 366 and new kid 367

Trade363 Can we Find something not totally rubbish?

It’s unseasonal but it’s a pitchfork!

Ok so here’s the trade, and everything is wrong about this which might serve us well. We sell one call and 3 puts at the strike which is the value of the ATM straddle subtracted from the ATM (Futures) price, 8256. This gives us nothing much in the call but the put is all extrinsic value, ie if the put options expired today, they’d have no value.

We take in the premiums 271.5+ 50.5×3= 423. The dream is….. the market at 7700- 8300 for June expiry, ideally at exactly 8000!

Last week: 466.5 and 18.5 x3 – not unexpected and those puts seem to be heading towards zero. Loss 0f 43 + those puts

Last week: Still a loss, but we soldier on, now it’s 489, from our original credit 423

Last week: 348+16×3 = 396. PROFIT!

This week : 300.5+ 15×3= 345.5 Still winning but bigger!

Trade 364 Back to The Knitting

So, it’s too late to use the May expiry, but June is well within the parameters (<45 days to expiry) and we again choose a ratio spread, which is a firm favourite here. However there’s a twist and a fellow trader has done a lot of homework and come up with the following. Subtract the value of the ATM straddle (8450 for our purposes) gives us ± 8200, and that is where we write the short puts. And for the longs we go 100 points above, giving us 8300/8200 put ratio. Those premiums? 41×2= 82, and 62.5. Earth shattering credit it is not, but it may be in the ballpark for the long spread to produce the goods- a max 100. Risk below 8100. We must endure such horribly, absurdly low prices for now.

Last week 48 and 29×2 gives us debit 10. Our original credit was 19.5

Last week: 75 and 43 x2= 11, our credit was 19.5 So happy days again, will June play nicely?

Now we have 49.5×2 and 90.5 =8.5 debit, our credit was 19.5 remember.

Trade 365 Calendar Ratio

Calendar time anyone? You know- sell the near month, buy the far month. We’ll do a simple comparison, between the 1 for 1 and the ratio spread, whereby we have a long spread in the far month.

Here we go: We sell the Jun 8250 put, we buy the 8350/8250 put spread in July. We have theta in our favour with a calendar, we have risk if FTSE drops below 8150, zero risk to the upside

Sorry if it ‘s a rinse and repeat a lot like 364, but as we’ll see the dynamics are different.. Oh, and the prices? Jun 8250 put 37, the July 8350/8250 put spread 88.5-61.5= 27 giving us a small credit of 10. The straight 1 for 1 calendar would cost us 88.5-37= 51.5 CORRECTION!!!!! sell: 8350 jun put 62.5, buy: July 8350 put 88.5= 26

Last week we had the debit in June: 57 and credit 38.5 for the July spread 18.5- 10 credit, gives us a loss 8.5

Now: 23.5 debit overall for the put calendar -jun short 8250 /July long spread 8350/8250

The straight one for one calendar was 127.5 – 97.5 = 30 a small gain from last week as we paid 26. Now 147-119= 28 ( we paid 26)

Trade 366 This Takes some Cojones- it’s called a GUTS.

Here’s some fun and the GUTS trade is created as a deep ITM (in-the-money) strangle. We sell the 8000 call and the 8500 put. Think about those strikes and all points in between. At expiry they can only add up to 500. Here’s the kicker we sell those 2 options for…..542.5 So assuming FTSE does not exceed the 2 strikes at 8500 and 8000, we make 42.5* Mind boggling isn’t it!

*It’s known as extrinsic premium (where the 500 is intrinsic).

Now: 8500 put 230, 8000 call 300.5= 500.5 and we SOLD it for 542.5. We make 12, but run it of course.

Trade 367 Trading in a ‘Clueless Void’

We need to be aware that volatility is not helping, the FTSE seems to be flailing like a toy kite in a storm. Who, here we go with a least favoured trade, the call butterfly, but here’s the kicker, we will run two. Remember the structure? Sell the body(x2) buy the wings(the middle strike). We have A) 8100/8250/8400, and B) 8200/8350/8500.

Let’s crunch numbers: A)212,103.5(x2) 38.5,= 43.5.

B) 135.5, 56.5(x2), 16.5 = 39.

We should not do too much damage, though delta and theta are no help until expiry week.

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.