That Was The Week The Dream Died

Yours truly, with no little smugness, was highly amused that the FTSE reacted like a toddler after the inflation report. However, there were concerns for fellow traders, though the Jan trades we showed here were predictably losers. So, we take the lessons and hope they serve to educate. You are well aware we consistently win and have small losers but the way we learn is from those losers. We know that butterflies and even worse, broken wing butterflies, are rarely worthy of our attention. The point of including such is that we cannot simply show a boring rinse and repeat formula that we use. Naked selling is absolutely not our terrain either. Gurus telling people just to sell, are crushing the premiums. Time is their friend in the trades. In time, however they see their account dwindle along with the faux confidence of the ‘free ride’ mentality, in my experience.

Trading is a journey and the hope is that our education makes traders think and step back before diving into those awkward trades. Combinations –selling a put or call to buy the opposite, is the same as a future. But worse! You must be right, and time decay and volatility must work in your favour. Generally that means selling a call to buy a put. In our example and in reality, the trade cannot be held onto. Butterflies are a special kind of annoying. You risk only the premium paid, but that is no consolation, with a low win rate.

The new Paradigm, Volatility is Set in Concrete

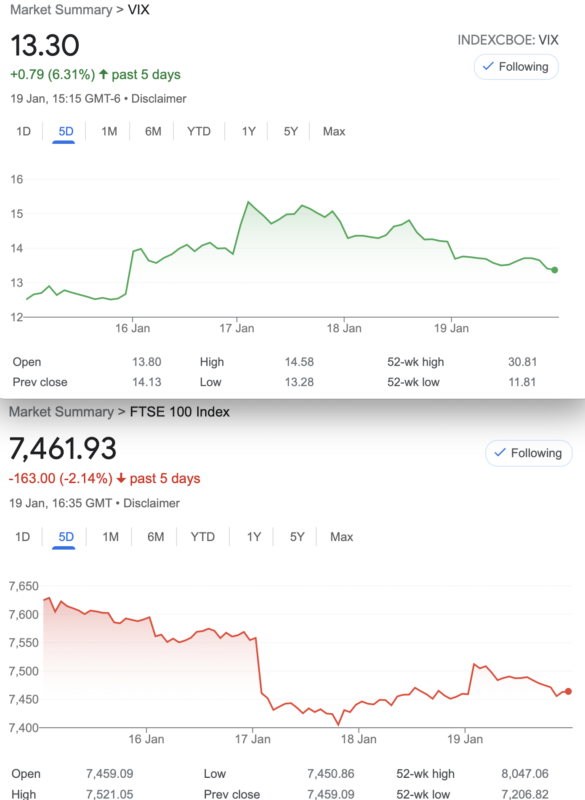

VIX, that fickle mistress, blipped up mid week but from a crazy low base. S&P500 hits a new high and it seems the US economy is basking in the sunshine. FTSE is a plodder, but you’d expect the drop on Wednesday to create a bit of panic.Wrong. Market makers seemed almost absent, as Bid-Ask spreads were ridiculous. Brokers, the few remaining stalwarts have expressed concerns that the UK market may be in the throes of premature terminal decline. We NEED options. we NEED market regulated products. It’s fine that we have spread betting, fractional shares, but this is a fickle game. Big players like IG seem solid enough, but when things do get crazy, traders may find they are unable to unwind positions. Covid created an unworkable market but yours truly was, however, able to close out a losing position that could have ended my career.

Retail is left behind but business is good for ice.com https://ir.theice.com/press/news-details/2024/Intercontinental-Exchange-Reports-December-Fourth-Quarter-and-Full-Year-2023-Statistics/default.aspx

Distraction Trades

ADA was $0.5505 now $0.5136

XRP was $0.57530 now $054915 – I’m told we cannot trade BTC ETF in the UK but the alternative sites will undoubtedly have their own version that follows 1 for 1.

DAX 4 no entries and one win +100

UK Gilts were £17.09 now £16.80 A hideous week and there is some concern over the value of government debt, here and in the US.

Legacy trades -And 350, third trade of this new year 2024

Trade 346 In the Dire Volatility What Can We Do?

We often overlook calls as puts are the go to trade when Vol is in our favour, but now we are faced with the sole weapon in our armoury-theta. So, it’s a calendar trade whereby we sell near month and buy far month. Here we sell the Jan 7800 call for 29.5 but here’s a twist, we will do a level 7800 call in Feb, and also see how we perform with a 7700/7800 long call spread in Feb.

Those prices: Feb 7700 call 92.5, and Feb 7800 call is 57.5. So the spread costs 35, we sell the Jan 7700 call for 29.5 so our trade costs 5.5. (Risk around 7900)

The standard calendar trade- sell Jan buy Feb costs 57.5-29.5= 28

It’s complicated!

So? Jan 7800 call 52.5, the Feb 7800call 103 =50.5 the trade cost us 28 so a small win.

Previous week, the other choice was to buy the Feb7700call 156.5 and sell the 7800call, now 103, gives us 53.5 against the sold Jan 7800 call at 52.5 gives us 1! We paid 5.5.

Last week, Jan 7800 call now 53,5 Feb 7700 call 163, Feb 7800call 105 the level calendar is now 51.5 cost 33.5, so profit 18. The spread credit -5.5.

CORRECTION: Error in initial prices, so the level calendar was 33.5 debit, the jan short/long Feb spread was Debit 10

[ trade 346 initial prices 7800 Jan call 26 7800 Feb 7800call 59.5 Feb7700call 95.5]

Of course being calendar trades we run them

Now: Jan 7800 call 20.5 Feb: 7700call 118, the 7800 call 69.5.

Last week: Standard calendar 69.5-20.5= 49, minus our debit 33.5 gives us 15.5, the variation- the long Feb spread is worth 48.5, Jan call is 20.5, debit to open 10. Gives us 18 (both WINS)

Now: Jan 7800 call, 3.5 Feb 7700 call 70.5, 7800 call 36.5

Standard calendar 33.5 -actually a break even as we paid too much(33.5) for the trade. The spread is now a credit 30, and our cost was 10. We’d take that

Case closed!

Trade 347 Silly Putty, or Silly Put Prices?

Going directional after our cheeky Santa rally combination -we sold the put to buy the call, but this time we go the other way- a risk reversal selling the 7800 call for 26 and buying the 7400 put for 27.5. We pay 1.5 and set ourselves in the ‘brace position’ for a bumpy landing! ( check this out, the call is 7800-7576= 234 points away from the money, the put 7576-7400= 176 ).

However,those prices were? the 7800 call 52.5 and the woeful 7400 put 10.5 So what’s to do as this is a disaster! It’s such a rubbish trade give seasonality and lack of volatility or any whiff a potential drop. So we can double down or convert our position to a strangle and simply sell a 7600 put for 35

So, last time we looked 7800 call 53.5 7400 put 7.5 7600 put 23.5 -so this is a nothing burger as expected. The puts lost more premium, and in this nothing burger week there was er, nothing to trade.

Thus, the sobering position now, and as we expected, 7800 call 20.5 7400 put 5.5! loss of 15. Had we sold the 7600 put, it’s now 25.

Overall if closed out now we’d lose 1.5 debit plus (15-10= 5). 6.5 –we’d take that loss but we’ll run it for fun. However experience says when these go belly up almost immediately they never go well.

Now- A loss of 1.5 the 7600 put is 26 (sold for 35) Run this options salad to expiry.

Case closed- Expiry was 7486 making that short 7600 put 114

Trade 348 – A FlutterBy -Far From a Pretty Trade

Yes it’s that time again, we have not had a butterfly for some time. We go for a big juicy 150 points, with a 7600/7750/7900 put butterfly, we will also get really crazy and try a broken wing put butterfly with strikes 7550/7750/7900. Those prices: 25,86(x2),206, gives us a debit of 59. The broken wing 16.5/ 86(x2), 206= 50.5 and risk of debit plus 50

This is expensive and may be a disaster, in a nutshell because we MUST be right. The journey towards expiry is unlikely to give us a nice exit point.

Now: 270, 126, 26, 13 which means the butterfly is now 270+26 minus 126×2 = 44, it cost us 59. Or, the broken wing ‘fly is 31, and cost 50.5 This week will be interesting! I should mention that an expiry below 7600 makes this worthless, and below 7550 is the worst case scenario for our least loved strategy.

LOSER! Even worse was the broken wing butterfly and this is why we don’t like them.

Trade 349 Another Calendar Variation

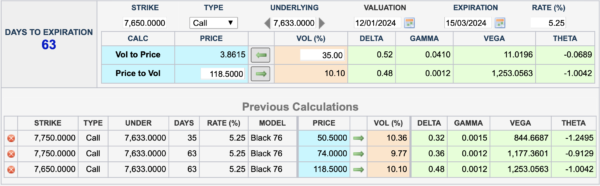

Here we go again and yes, we consider calls overpriced. We sell February 7750 call and buy the March 7650/7750 call spread. We have a small credit of 6

Overall Delta is 0.20 so we may have to manage this, but note it was too late, in our own experience, to place a Jan expiry trade. Extrinsic premium is woeful. We may look at closing out before Feb expiry.

A fun trade the spread is now 21 and the Feb 7750 call is 11 This is our kind of trade and now the choice is a) close out for profit 16 b) Buy back the short call for 11 c) Run it.

Trade 350 A Numerical Milestone

Well, we threatened! YES we’re going to trade a FTSE covered call. Here’s what we have, using Friday’s FTSE cash close 7461. We buy a future at £10 a point and sell a 7600 Feb call for 37.5. We really don’t like this, it’s for fun, and of course if the call expires worthless we keep the £375 credit And the future? That’s the fun part. Expiry, 16th February at 7600 is the ideal. Logic of the trade? We can wait!

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.