That Was The Week Low Volumes, Usual Nonsense

So, without too much apology, there is no point trading in this tiny volume week so 348 will be the choices of adjustment with the horror show that is 347. Inflation decided to wave a brief ‘ see you later’ as it’s such an unknown and given the epic QE∞ from 2008 it would be no surprise to see prices rise again. Of course we are not exactly privy to accurate numbers re: debt public private and the off balance sheet liabilities. However the gloom is not merited, we can expect no ‘growth’ next year which means actually going backwards. Should we celebrate? Conspicuous consumption may be the victim here, and so that’s no bad thing. We know that high end goods are not flying off the shelves, and even second hand cars have taken a drop in prices.

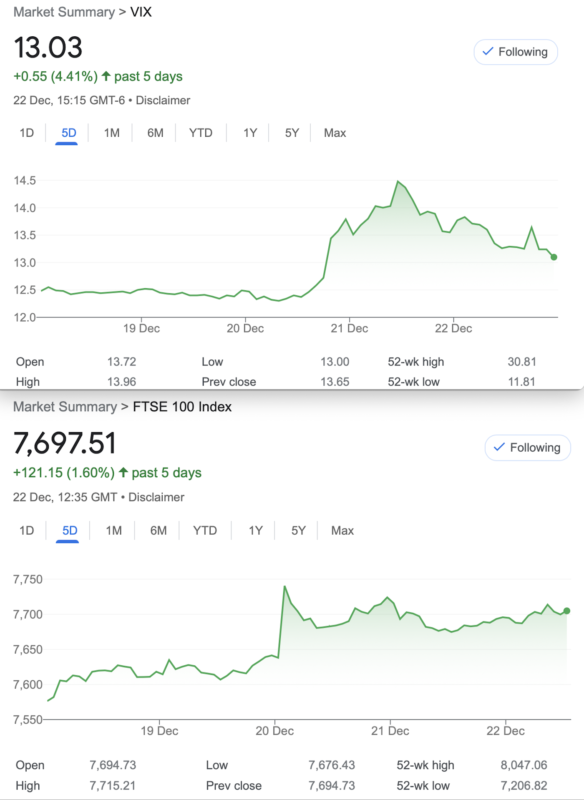

Vix watchers may have noticed the odd blip up causing the mandatory ‘buy the f*****g dip’ brigade to wade in. Of course when the only tool you have is to buy stocks, it makes sense. We don’t subscribe to that mode of trading, though as we have 3 main approaches for: 1. the market goes up 2. The market goes down. 3. the market goes nowhere. And a reminder- we DON’T need to know a direction or have a view to make profits. As each year the Ice.com boasts of increased volumes, the FTSE lumbers on and volumes in share trading seem to have diminished a lot. So we know the action is in the derivatives world. Check out the 4 big volume spikes on FTSE, they coincide with the quarterly expiry. Yes, occasionally the market goes postal and volumes do spike, check it out.

Some Thoughts From the Macmillan Camp:

Credit: Lawrence G. Macmillan, my edit, my words in Italics.

There have been several articles that are warning investors to be cautious because $VIX is “too low.” These articles make great fodder for the press, but in general are lacking practical trading sense. Just because $VIX is low doesn’t mean that the stock market is immediately going to collapse. It may be a precursor to some broad market selling further down the road, but a low $VIX is not a problem until $VIX begins to rise out of its “low” state… We look for a ‘sweet spot’ for our trades and currently that is proving elusive, we can even see reverse theta in calendar spreads. So, caution is the watchword, don’t fight the FED, don’t seek the non-existent trades we enjoyed back in the day. Remember being in cash is ALSO a position, ready to pounce on the low hanging fruit.

Happy Christmas

We hope you’ve enjoyed our missives again this year, and may have a few surprises next year. Of course it goes without saying but Merry Christmas and a Happy and prosperous New Year.

Distraction Trades

ADA was $0.6217 now $0.6066 both cryptos drifting lower, have we seen the end of the exuberance?

XRP was $0.6247 now $0.6168

DAX 1 break even +30, 2 no entries, 2 losers – silly week to try and trade.

UK Gilts were £17.33 now £17.59 Steady rises

Trade 346 In the Dire Volatility What Can We Do?

We often overlook calls as puts are the go to trade when Vol is in our favour, but now we are faced with the sole weapon in our armoury-theta. So, it’s a calendar trade whereby we sell near month and buy far month. Here we sell the Jan 7800 call for 29.5 but here’s a twist, we will do a level 7800 call in Feb, and also see how we perform with a 7700/7800 long call spread in Feb.

Those prices: Feb 7700 call 92.5, and Feb 7800 call is 57.5. So the spread costs 35, we sell the Jan 7700 call for 29.5 so our trade costs 5.5. (Risk around 7900)

The standard calendar trade- sell Jan buy Feb costs 57.5-29.5= 28

Jan 7800 call now 26 Feb 7700 now 95.5 and the Feb 7800 call is 59.5. So: the spread is now worth 36 minus the Jan call at 26, gives us 10, but we did pay 5.5, small win to date. Meanwhile: the regular calendar trade cost 57.5 – 29.5= 28 Now it’s worth 33.5. Of course we run this

Now? Jan 7800 call 52.5, the Feb 7800call 103 =50.5 the trade cost us 28 so a small win.

The other choice was to buy the Feb7700call 156.5 and sell the 7800call, now 103, gives us 53.5 against the sold Jan 7800 call at 52.5 gives us 1! We paid 5.5.

Trade 347 Silly Putty, or Silly Put Prices?

Going directional after our cheeky Santa rally combination -we sold the put to buy the call, but this time we go the other way- a risk reversal selling the 7800 call for 26 and buying the 7400 put for 27.5. We pay 1.5 and set ourselves in the ‘brace position’ for a bumpy landing! ( check this out, the call is 7800-7576= 234 points away from the money, the put 7576-7400= 176 )

Those prices now? the 7800 call 52.5 and the woeful 7400 put 10.5 So what’s to do as this is a disaster! It’s such a rubbish trade give seasonality and lack of volatility or any whiff a potential drop. So we can double down or convert our position to a strangle and simply sell a 7600 put for 35

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.