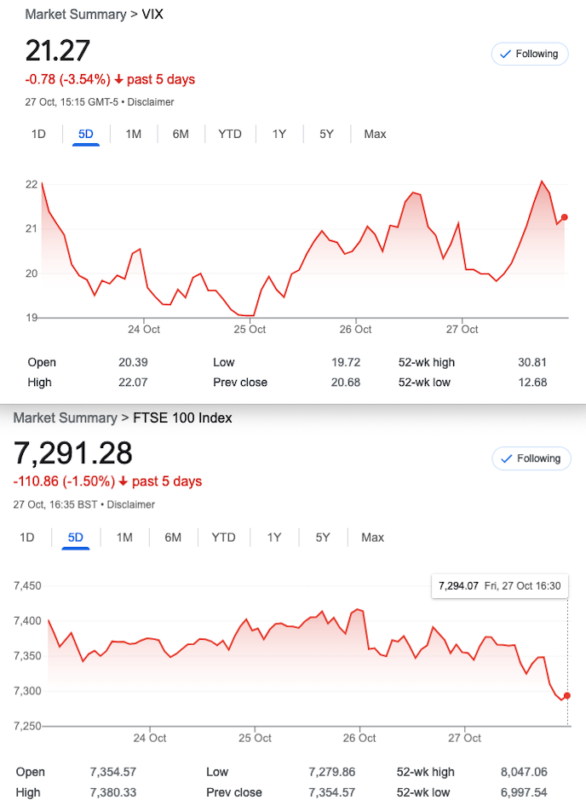

That Was The Week FTSE Weakened Again, the World Got a Little Unsafer.

So, global events are an increasing concern, but markets could turn on the proverbial sixpence. And there is always more cash ready to plunge neck deep into the ocean of the stock market. However October is known as the bear killer, and so far FTSE high to low is 400 points, the first of the month sees new money usually but who knows? I don’t think this is any kind of metric while there may be some truth in it. However this year has been weirder than most, some of us remember crazy, boring but not weird! We don’t like ‘weird’. I suspect hindsight makes us more comfortable with the past than we actually were at the time.

So again this week, the spectre of falling house prices, higher mortgages haunted some while capping bankster bonuses was ended. We see a reminder of the 2 tier economy. We also see minimum wage increases here and in the US. Good wages must surely create good working practice, but just having everyone on a fair living wage would be nice. I suspect that nobody was happy working in the 19th century. Grime misery and high mortality, while we reap the rewards of our antecedents’ efforts. And we must be thankful for our comfortable lives here in the UK, countered with the shocking Amazon workers’ exposé.Ouch! We see you.

Dumb Money – It’s a Film, Should You See It?

Yours truly is still a fan of actual cinema, and get a thrill from the whole experience, (not the backrow teenage fumblings, these days). The plot is based on the GameStop shenanigans, whereby people with Robin Hood accounts, access to Reddit and WallStreet Bets got to see a certain Mr Gill espouse the virtues of buying a beaten down no-hoper stock. Some mitigation as he was actually a stock analyst as well as a blogger, and saw value in the $3 stock.

However ramping it to >$400 was not the intention. ‘Sticking it to the man’ was the mantra of the many who were told the fat cats running hedge funds had shorted 110% of the stock! Gill bought $52,000 worth of calls. I admired his conviction, but the film portrayed a feeding frenzy, and showed the ugly undebelly of the market. Hedge fund managers looked like Bond villains. Students and nurses were the ‘good guys’ who bought a ticket to the greed train. It’s not a great film and has some annoying ‘teen flick’ touches unlike the Big Short. However it’s a good insight into another side, and frankly, the polar opposite of how we trade. Most pro’s are happy with 20% per annum, but hey retail? We can do what we like, and a low cost punt now and then can be fun.

Distraction Trades

ADA was $0.2506 now $0.2945 A bit of a rise, in sync with crypto in general

XRP was $0.51907 now $0. 54925 (Some upside)

DAX 4 no entries one one win +50 Some disappointment again.

UK Gilts were £15.83 Now £16.01 A step in the right direction…. A long old way to go

340, A Hallowe’en Trade. and 339 – One of My Personal Favourites

It’s simple, it’s spicy it’s got more front than Blackpool….. The good old Put Ratio Spread. But, this is wider than the Thames at Putney, it’s 200 points wide. Logic of the trade? It is very low cost, at 3.5 and could make 200. Here we go, we BUY one 7350 put for 101.5 and SELL 2 7150 puts for 49. Risk therefore at 6950 no upside risk and this may be a quick turn around if volatility drops like a stone, as it is wont to do.

This week- 132 and 53×2 gives us a credit of 26, we paid 3.5. Close out? NO

Trade 340 Bull Call Spread+

Watching yet another rather basic webinar, it occurred to me that the language is not really helpful, and I allude to bull and bear. Tis is a trade that would do OK in a flat market or moderate’ bull’ market. Losses potentially small. We buy a Nov 7250 call, for 126.5. We sell a 7350 call for 74.5. And then we sell a 7450 call for 39.5. Thus our trade cost is 126.5-(74.5+39.5)= 12.5. Our hope is that we make more than 12.5 and our max profit is 100- 12.5= 87.5 should the market roar to the upside we can adjust above the problem level of 7550. Twenty days to expiry…..It’s Witchcraft.

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.