That Was The Week The Gloom Was Swept Away

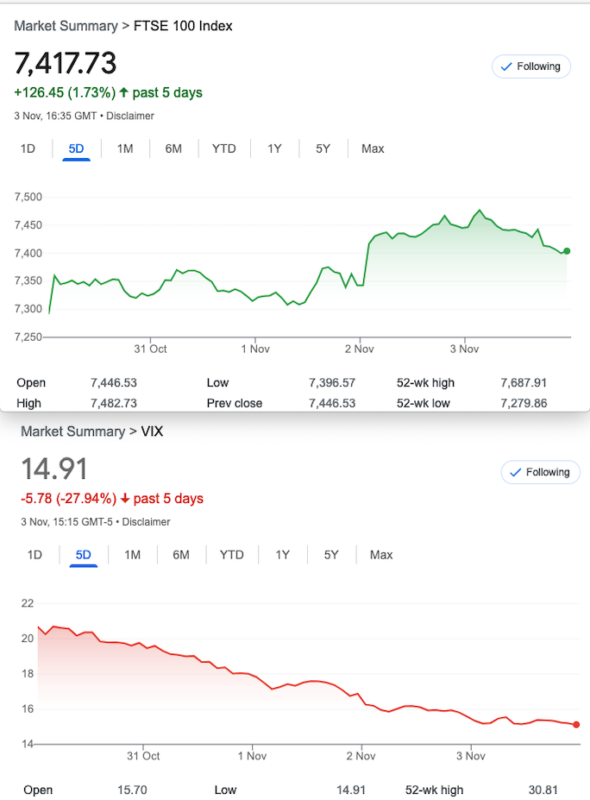

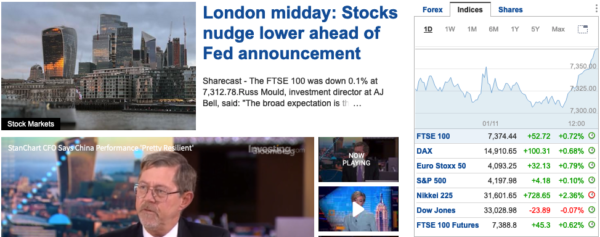

So, conflict is not news, poor job numbers are good news, it has been the biggest Volatility crush yours truly can remember. However you have to love the financial media:  So, if you’re looking for clues about market direction, the media are THE contrarian indicator. However that is not central to any of our strategies, we don’t really have much of a view. But, we like the simple idea of support and resistance which you can easily see on a daily chart with 6 months data. Interest rates are a hold, which is the green light for markets, but quite why FTSE went into reverse is anyone’s guess. However sterling has had a big rise, or in other words the $ has slumped. The Macro picture though still points to a downturn, one of the metrics is the Baltic Dry Index (prounounced beady eye!) you can see that here: https://tradingeconomics.com/commodity/baltic

So, if you’re looking for clues about market direction, the media are THE contrarian indicator. However that is not central to any of our strategies, we don’t really have much of a view. But, we like the simple idea of support and resistance which you can easily see on a daily chart with 6 months data. Interest rates are a hold, which is the green light for markets, but quite why FTSE went into reverse is anyone’s guess. However sterling has had a big rise, or in other words the $ has slumped. The Macro picture though still points to a downturn, one of the metrics is the Baltic Dry Index (prounounced beady eye!) you can see that here: https://tradingeconomics.com/commodity/baltic

Like anything else you have to take it in context and note that it relates to raw materials, it maybe of value to compare it to the index.

Education x3

A lot, and unseasonably large amount of links to educational events. I will state here that while not all the content may be your cup of tea, ALL of these come from legitimate and worthwhile sources. I always have time for these events which generally occur at useful times of the day.

https://www.metastock.com/traders-conference?pc=EQ-Roundtheclock

https://mailchi.mp/technicalanalysts.com/sta-agm-papers-1299097?e=4e8dea4756

https://cboe.zoom.us/webinar/register/WN_ooFMuLP8QEKO8nBLJzrJ7A#/registration

https://mailchi.mp/masterinvestor/future-events-104168?e=d8dfffc5d3

https://www.optionseducation.org/events/upcoming-events

As always, while we have an impressive track record of trade wins, they are conincidental, as our passion for options education is paramount. We also hope you love the journey, whether paper trading or smashing it out of the park with the big £££

Distraction Trades

ADA was $0.2945 now $0.3241 Actually a real gain of 10%

XRP was $0. 54925 now $0.61360 making strides again

DAX 2 wins +120 total 3 no entries, but missed by a whisker the massive rise on Thursday.

UK Gilts were £16.01 now £16.37 Another step in the right direction…. A long old way to go

340, A Hallowe’en Trade. and 339 – One of My Personal Favourites

It’s simple, it’s spicy it’s got more front than Blackpool….. The good old Put Ratio Spread. But, this is wider than the Thames at Putney, it’s 200 points wide. Logic of the trade? It is very low cost, at 3.5 and could make 200. Here we go, we BUY one 7350 put for 101.5 and SELL 2 7150 puts for 49. Risk therefore at 6950 no upside risk and this may be a quick turn around if volatility drops like a stone, as it is wont to do.

Last week- 132 and 53×2 gives us a credit of 26, we paid 3.5. Close out? NO

Now those prices: 48, and 12×2=24 We watched this during the week and it did much better, well 30+ intraday.

Trade 340 Bull Call Spread+

Watching yet another rather basic webinar, it occurred to me that the language is not really helpful, and I allude to bull and bear. This is a trade that would do OK in a flat market or moderate’ bull’ market. Losses potentially small. We buy a Nov 7250 call, for 126.5. We sell a 7350 call for 74.5. And then we sell a 7450 call for 39.5. Thus our trade cost is 126.5-(74.5+39.5)= 12.5. Our hope is that we make more than 12.5 and our max profit is 100- 12.5= 87.5 should the market roar to the upside we can adjust above the problem level of 7550. Twenty days to expiry…..It’s Witchcraft.

Ooer, missus! didn’t see that coming. Prices now 165.5, 90.5, 39.5 = 35.5 a nice profit, and yes, we’d probably close out, but we always run to expiry

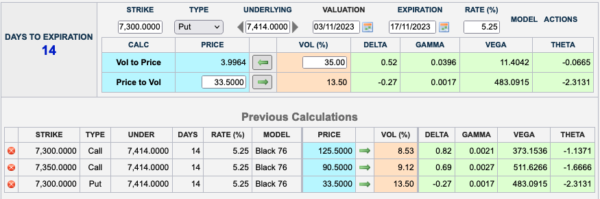

Trade 341 Neither a Jade Lizard, nor a Twisted Sister

While it irks yours truly to sell cheap puts, this looked ok in light of the major market moving events now out of the way. We buy a call spread and sell a naked (!) put. And yes, you’re right, eagle-eyed readers, Tuesday was 45 DTE for the December expiry and Tasty Trade would be looking for the 1 sigma strangle. We’re not! Here’s the calculation for our trade: So, those prices: We pay 125.5 for the 7300 call, we sell the 7350 call for 90.5, and sell the 7300 put for 33.5. Our cost therefore, is 1.5 our maximum reward is 50-1.5=48.5. We have theta on our side and Delta is miniscule but the spread that we own is in the money. Is the Santa rally on? The telly adverts are already annoying!

So, those prices: We pay 125.5 for the 7300 call, we sell the 7350 call for 90.5, and sell the 7300 put for 33.5. Our cost therefore, is 1.5 our maximum reward is 50-1.5=48.5. We have theta on our side and Delta is miniscule but the spread that we own is in the money. Is the Santa rally on? The telly adverts are already annoying!

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.