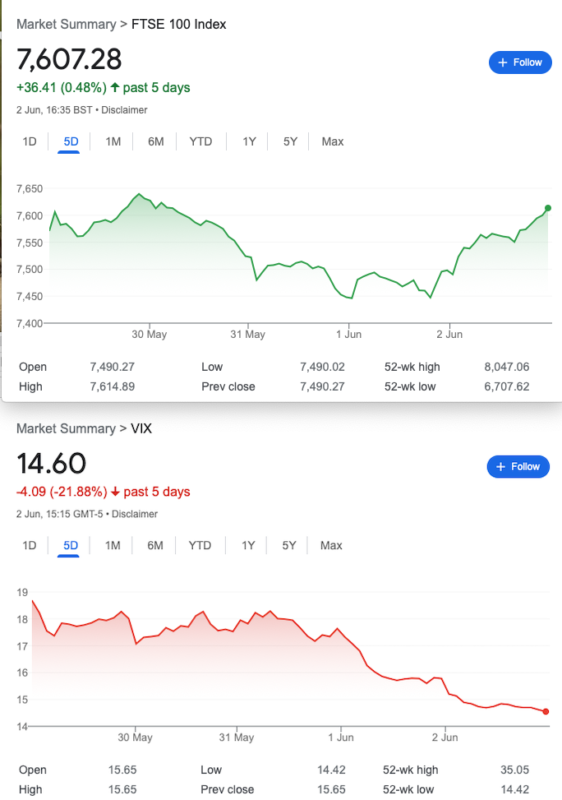

That Was The Week The VIX Died

What kind of index drops 22% in a week? VIX is at a 2 year low and as it is mean reverting, I will leave the conjecture to our esteemed readers. So, what moves VIX?…. Options prices (weighted) for the next 30 days. Thus the market is saying ‘we’re going up big time’ . Meanwhile options traders are saying ‘puts just got cheap’. Looking back to 20th June 2021 there were no disasters following the VIX low. The US market is talking up the ‘skip’ whereby the Fed does not raise interest rates. Meanwhile our own B of E may have to take a different view given the persistent high inflation.

In a rare outing on Youtube I was taken with this presentation from the John Mauldin camp. https://youtu.be/nV6XqmwxXWE

The 4 addictions:

China, Tech, Easy Money and Debt. John Mauldin’s highly recommended weekly freebie email also gives us a few insights from the Strategic Investment Conference he manages. China has been getting busy subsidising house purchases, AI is the new ‘cyberpariah’, the debt ceiling as we know just got a lift. Debt, public and private seems to be creaking at the seams somewhat, but what’s new? House prices are dropping here, the US may have had a slight wobble. Hard to know the real picture.

There seems to be some dissent and disbelief at the US jobs data, after so many gloomy predictions. The ‘R’ word:recession is still lurking in the wings. We don’t need to interpret data, we stick with the knitting, the real prices the market gives us. And on that note, yours truly closed out a very profitable longer term trade only to see the value more than double. Well, a profit is a profit, they say and trying to second guess the market is a mug’s game. Did I mention I’m not the sharpest knife in the drawer?

Time Not Timing

That is the mantra of the Motley Fool the once mighty forum for newbie traders. However it also applies to options. We can use time to our advantage in so many ways. Primarily there is theta, time decay. Then there is combination /spread trading. We can buy/sell in any time period. Here’s an eyebrow raiser- a certain trader sold the Dec 2024 9000 call for 120 not so long ago. During the week it was a cheap as 40 to buy back. In our own trading we tend to look 3-6months ahead in addition to our current month trades. In fact one of our readers asked how he could get insurance against a 1,000 point drop in the FTSE. My answer? Take a look at much longer time frames. We are NOT a get rich quick scheme.

Distraction Trades

ADA $0.3759

XRP $0.51915 Crypto limps along, nothing to see here.

DAX 2 wins +200 2 no entry, 1 loser -30 A very strange week with some whipsaw action.(Still nothing new to trade, maybe Nasdaq is worth a look)

Legacy Trades After The Debt Ceiling Debacle and 319

Trade 317 It Was A New Expiry Month

A homage to Liz and Jenny once more as we borrow from the esteemed Tasty Traders, the strategy known as the Jade Lizard. This trade has no upside risk, as we perceive the danger may lie that way. June expiry. We sell a call spread: Sell the 7800 call for 68.5 and buy the 7850 call for 45. We sell the 7550 put for 27.5. Maths scholars will note the call spread credits us with 23.5, add this to the credit for the put we sold, gives us 51. Figured out the upside potential loss? It’s the value of the call spread,which is 50. Downside risk at 7550 minus the credit 51= 7499

Last week: So, the drop was unexpected but we now have 53.5 for the 7550 put and 7.5 for the call spread. Gives us: 61, a loss of 10. I had messaged during the week about my concerns and possible adjustments, then this appeared somewhere in my ‘net travels:

To quote from last week: Adjustment should not be a knee jerk, we need a plan. So where are we? 5, 2.5 gives us 2.5 for the 7800/7850 call spread and 35 for the 7550 put. The trade is tenuously in profit and it might make sense to close out the call spread, as it’s only 2.5 but let’s keep it straight.

Trade 318 Time for One of Our Hybrids

We are going to sell a put in the June series and buy a put spread in the July series. June 7400 put 28.5 July 7550 put 101 and the 7400 put is 70. So we pay 101 for the 7550 put and for the 2 puts we sell, we get 70+28.5= 98.5. 101-98.5= 2.5 so that is our cost. We are short at 7400 in June and July, but long the 7550 put in July. The logic of the trade is that we will have a ‘free’ put spread for July, so long as June expiry is above 7400. We have risk at 7400-150(the value of the put spread). This means we have risk of loss at 7250. Max reward is 150 minus our cost 2.5.

We have for the July put spread 49.5 and 80.5,=31 minus 2.5 that we paid and 13.5 for the 7400 put .Thus we have a profit of 15 but we run to expiry.

Trade319 A Comparison

Here’s a quote I picked up this week: ‘Comparison is a thief of joy’ while that might apply in everyday life, it’s interesting in our trading. As regulars know, we DON’T like the butterfly trade but in this market we don’t have any clues though the 7600 level may be a magnet. Or a figment of our imagination.

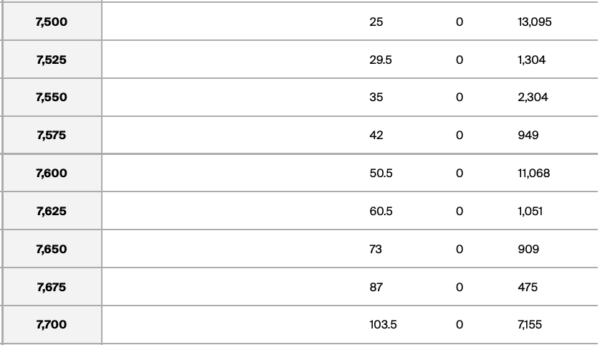

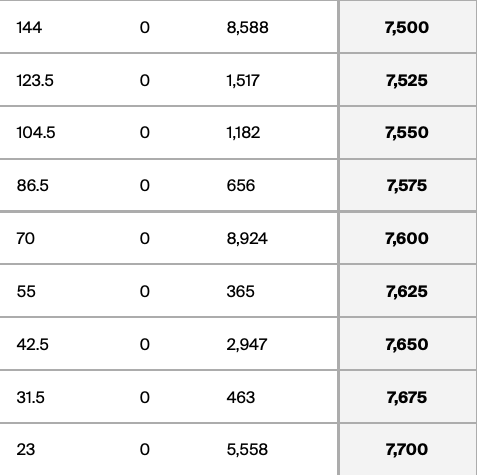

As always calls on the LEFT, puts on the RIGHT.

We are creating a butterfly and using 7600 as our centre. buy the 7500 call, sell 2 x 7600 calls and buy the 7700call. Prices: 144, 70(x2) and 23 gives: 27 For the puts buy the 7700put sell 2×7600 and buy the 7500 put. Gives us 103.5, 50.5×2, 25, gives: 27.5 We will be interested to see how market action/inaction affects the two.The joys of comparison, but with the same levels will there be a difference? We hit the jackpot at 7600, but a wild card-the 7850 butterfly (7850/7750/7650) is a meagre 13.5 to buy. NB A butterfly has zero risk beyond the premium paid as it is a long spread versus a short spread of equal max value.

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.