That Was The Week Markets Becalmed. The Populus, Not So Much

So, a lot of misery ahead and some crazy utility bills, but as an avid meter reader, yours truly had no surprises. However in percentage terms a rise of >50% is extraordinary. Householders on low incomes and with children will be hit hardest. The markets? Markets don’t care, no regard for the future, as Covid slaps China down, and the Ukraine invasion looks set to halve global growth. So fund managers simply brush aside the impending recession and massive inflation. And so must we.

Job watchers will know that non farms came in at 431k when 492k was the expected number. Buyers were in evidence, of course. Although the unemployment rate was down to 3.6%.

Why This Site Exists- Honest Education

BBC rebroadcast this: https://www.bbc.co.uk/iplayer/episode/p09pym51/instatraders

You may wish to look further at: https://im.academy And https://kb-trading-consultants.com/online-courses/

Aside from the obvious, they claim it’s ‘tricky’ to learn the compexities of forex. So now we’re rolling in the aisles. It’s a wiggly line on a chart and with the ‘aid’ of ‘technical analysis’ or more lines on a chart, it amounts to little more than guesswork. So quite what they waste people’s time and money on, is a mystery. Trading psychology? When you have a decent set of strategies and an edge you don’t need much psychology, you just need to manage risk.

It gets worse with Twitter ablaze with people who think they are options traders. They don’t even know the Greeks, they are gamblers, and they give us a bad name. Lazy people and their money are soon parted. Like many in our world we offer FREE education. We do not advocate spending money on some ‘mentor’ who has no track record. Traders like us are deeply saddened that people are taken in week after week. Rant over. Save your money and while the barrier to entry is high for options the prospects of making good profits far exceed anything else. You won’t blow the lot if you follow sensible strategies and manage risk wisely. Don’t panic!

Distraction Trades

DAX 3 no entries 2 wins total 230

ADA Cardano $1. 0967 now $1.1909

XRPUSD $0.8325 $0.8390

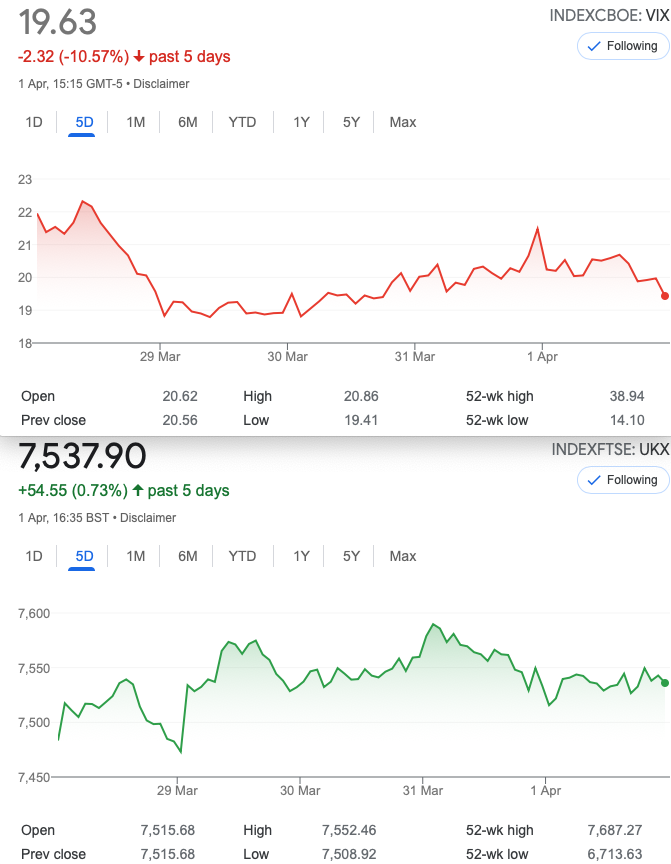

Legacy Trades and 261 with VIX Evaporating and No Clear Path

259 Where did the Fear Go?

We chose something moderately conservative(with a small c)

6825 put 36 7600/7650 callspread 50.5 and 36 =14.5,plus 36=50.5 CREDIT

So, what is it you ask? Zero upside risk and downside risk at 6775? correct, it’s a……… Jade Lizard.

Was 19 for the put and 18 for the call spread.

Now 5.5 for the put,18.5 for the call spread=24 -we could close out at 50% of max profit, but we will run it too.

260 A Somewhat Saggy Bottom in Sight?

Let’s say we see the next few weeks of calm heads prevailing, but optimism sagging. We look at a wide call butterfly, with huge risk/reward. These are a pain as they rarley do anything fun en route to expiry but our risk is limited to the debit

We are buying the 7300 call (243) selling 2x 7450 calls (134 x2) 268 and buy the upper 7600 wing (54.5). We thus have a debit of 29.5. Keen eyed followers will note the max profit is 150- 29.5=120.5 or 400%. (We can do without the hyperbole, we’d take 100% )

Now as expected 33.5 – some would declare this the trade of the century, making 13.5% in a week or >650% annualised!

261 Cheap Puts. Should We Leg in?

Though we are loathe to get directional in a big way, Vol has dropped so much maybe there are some cheap puts……

A fun trade we’re going to buy (spend money….I know I know…) buying a put spread, buying the 7450 put 51.5 and sell the 7350 put 32 so our debit is 19.5. We can sell something else to fund this in full or partially, and here we sell a 7100 put for 12

We now have risk at 7000 but a debit(max loss) of only 7.5 and max possible profit 100-7.5= 92.5

This looks fairly unlikely and this trade might be classed as a bit of a punt. We need a trade that might teach us something, and the possibilities to adjust will be under review during the week.