2017- In No Particular Order

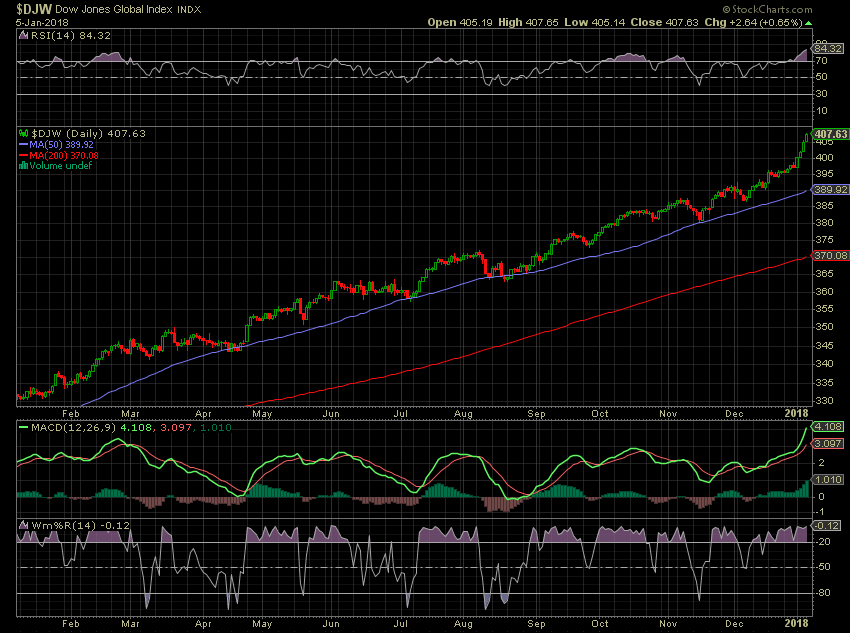

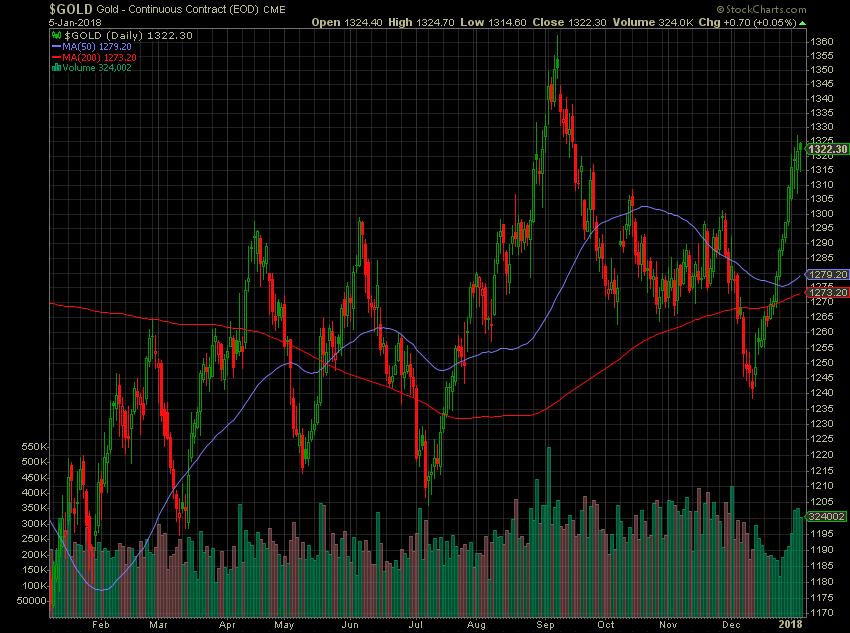

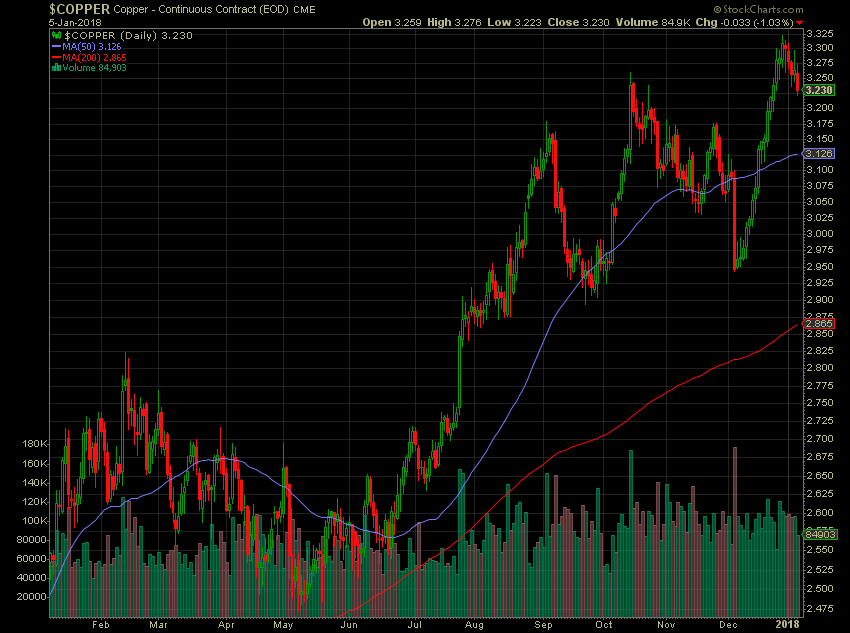

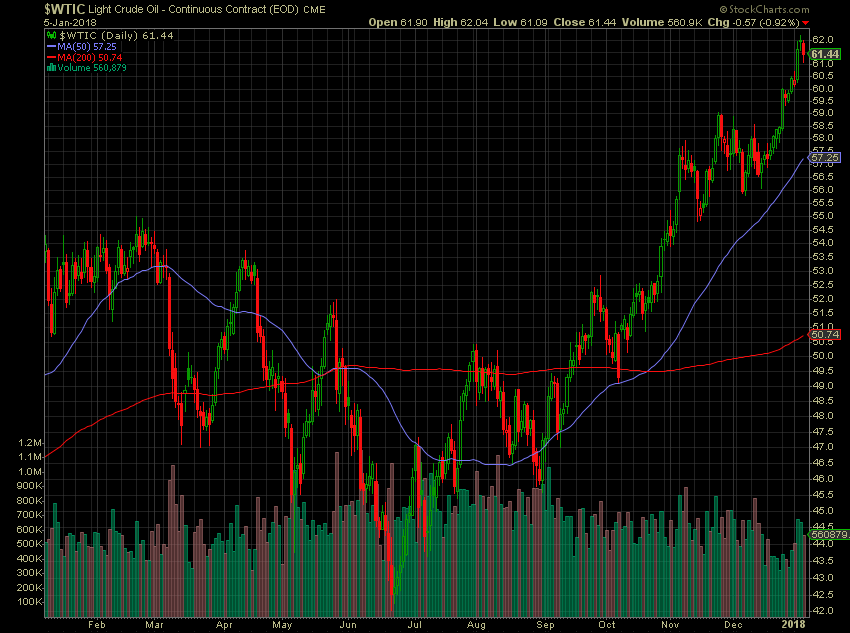

These charts sum up the year-left to right everything has gone up. Emerging Markets. Global Markets. Oil. Copper. Gold. So what’s down?

You knew this- the strength of the US dollar.

It’s down about 10%-that’s great if you export, which the US does. Therefore great if you have debt-which the US does, in spades. It’s great if the world prices commodities in USD, and you don’t happen to have USD. Is this the new normal?

2017 A Year of Misery For the Many

It’s been variable for us-our trades here seem to have done ok. We are forced to make a trade decision each week. Thus our entry is a fixed point. Exit, however, is the ‘biggie’. We can thus be choosy, taking early profits, letting things run. So we make exit decisions based on a price target most often as we cannot know if a trade will achieve the 100% we are aiming for. Good enough is, well, good enough.

What,Therefore, Have We Learned? What Have We Missed?

The new low vol era presents us with a much bigger problem than we like. Selling vol is the number one game for most options traders. Selling time decay is helpful, as is trading the relationships, the spreads. When prices are so terrible we are forced to look at going long and limiting losses. Being the ‘house’ or the insurer no longer rewards us, like it once did. We need to re-evaluate. We need to stop assuming this is like every other trading year. Paint me pink and call me Janice but this time it WAS different. We miss ……………………….. Volatility

2018 -Can we Make Money?

We are in such a different environment the old rules don’t help. Buying cheap vol has simply led to even cheaper vol. We need a plan………