The Top Is In……. Or Is It?

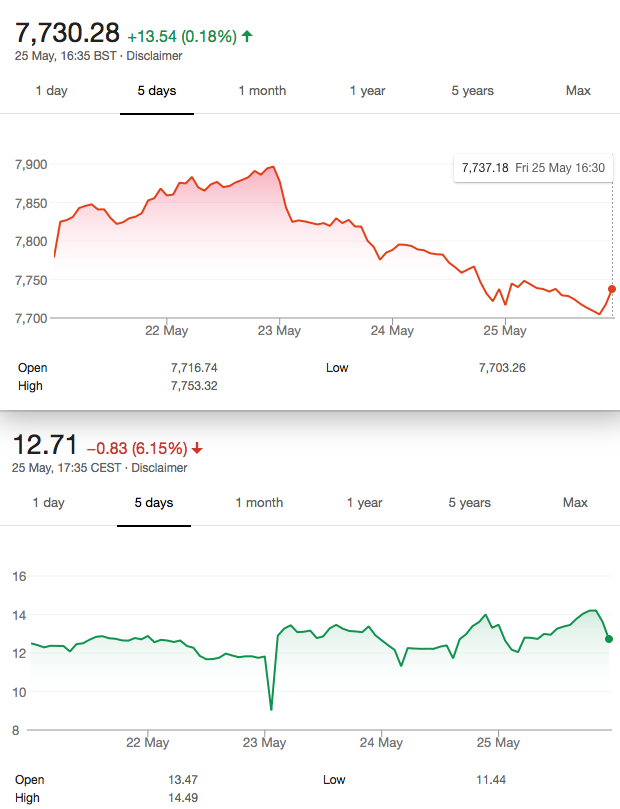

We witness a curious week. The drugs kicked in on Monday, a smidge up on Tuesday, then………. back to planet Earth. So, I did say FTSE is not expensive. I did also say it’s credit fuelled exuberance, too. We cannot know what drives the market outside of the facts. This reminds me of a conversation I had recently with a renowned economist. The media loves to report after the fact. The pundits like to talk the gloom and doom story. And misery loves company! My own take on the market is that I am deeply suspicious of any good news. Personally I find the whole glossy finance industry a little perverse. The overt self publicity, high rise buildings, and lavish entertaining. The ‘Wolf of Wall Street’ is a far cry from the bowler hats, and sober suits of a few decades ago.

So, What Can We Expect… Should the ‘Bulls’ Run?

Direction-it’s a funny thing. Quite often the market goes nowhere as you’d expect when buyers and sellers agree. So while there is no point paying £1 for something that is worth £1, the market is reckoned to be a voting machine. In the long run it’s a weighing machine. So the difference from the low of 2009 to the high of 2018 is some 4,300 points. That is voting with someone else’s feet! Good old QE. While it has not gone directly into banks or stock markets it has made a circuitous journey. Interest rates may become a problem sooner than people think. Emerging markets are starting to look iffy according to a certain infamous trader (AK). Yet again Argentina shows the world how not to run a country. An endless line of hopeless ‘leaders’, another Peso crash- down 30% since January. Interest rates at 40%.

London Property

The bubble in the UK is London property-up 100% since 2009. I really hope that it doesn’t burst, but it will end. We need to be super alert to these exogenous events. While we don’t trade houses like options, we may find that options are suddenly priced like houses. Be safe,look outside the box.