With Thanks To Stock Twits

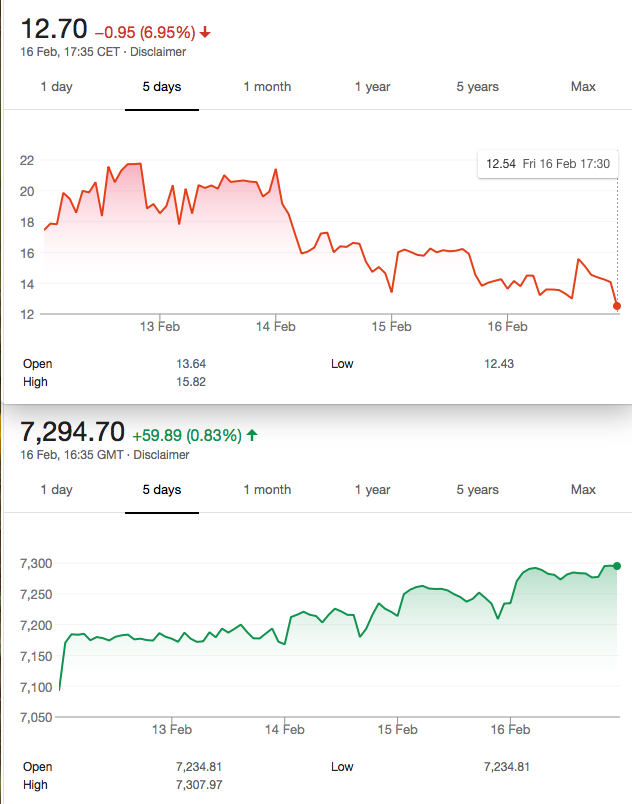

This what happens when you short VIX.

This is what happens when you trade a strategy: Margin increase from 16% of account to 50% of account. Trade went £2k per lot underwater. Don’t panic !!!!!! VIX spikes are temporary, and we can adjust. Outcome: Trade profitable £300 per lot.Unnecessary adjustment cost £50 per lot. Great trading ? No.

Another Week of this:

What Next?

Theories abound about why the market crashed- we review previous trades-some losers. No disasters.

Trade 63 Call ratio spread debit 11. Loss 11….. Annoying.

Trade 64 double calendar- complicated, as we would ‘morph’ this into a put ratio spread-so at expiry the Feb puts were 2x 69.5. We own the March 7350/7150 put spread,valued at: 140 – 56= 84. We could take a loss here of 139-84= 53, or we could sell another March 7150 put for 56, giving us a tiny credit and putting us into a put raio spread that could do very well. Risk at 6950.

Trade 65 -still in business- it’s a March Iron Condor(currently a loss of 1.5!)

Trade 66 Put Ratio spread the 6400 put=5.5 and 6200 put (2x 3.5) =7. Close out- Credit of 20, debit of 1.5 to close=18.5 profit. So long and thanks for all the fish*.

Have We Learned Anything?

The recent turmoil smashed a lot of accounts. Margin exploded, which for many would not be manageable, so trades got ‘busted’. So if there are lessons, it’s ‘watch your margin’ ‘don’t be caught naked’ and ‘do not expect the same market conditions to prevail forever’. Thus, the key is to adapt to the new character of the market. Can we prepare for these events? Certainly-we have recently been looking at September trades, which are no longer viable due to contraction of vol. Sadly. Markets take a bath twice a year-mostly. So, being in that arena with a massive margin of comfort in the trade would be great-like your insurance company paying you for the privilege of insuring you.

*Hitchhikers Guide To The Galaxy fondly remembered.