Expiry Week and A Roller Coaster

Expiry Week and A Roller Coaster

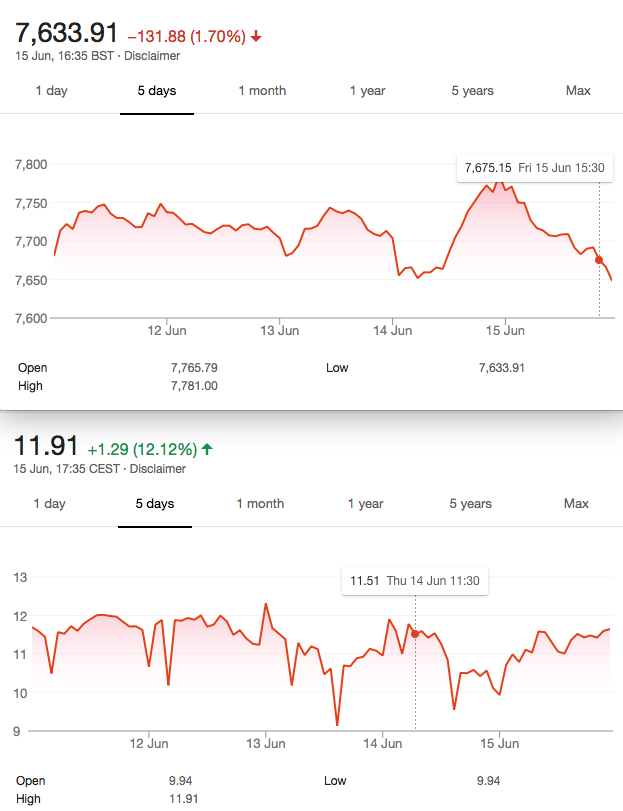

We saw a huge rise Thursday with a very clear signal on the one hour that price was being rejected. Friday saw the market down to just over the 7700 level for the expiry auction. Then the market dumped- who knows why- China/Trump? Maybe,-oils and miners took a hit though. Commodities can do that ahead of any actual event. It’s when we are reminded that the index is a safer place to be. Political events however, are usually transitory as the market has little regard for the shennanigans of our leaders. Note: We do not have leaders, they serve us they do not lead us. We are the free world.

When The Experts Get It Wrong

Equitable Life has just been sold for £1.8 billion.https://www.bbc.co.uk/news/business-44497168 Nice to know there is still some value for those poor investors. So, the story goes that over time it had not set aside sufficient funds to meet its obligations. Traders like us, do not have that luxury. We cannot hide our losses off balance sheet. We cannot fleece new customers like the banks who seem to seek ever more inventive ways of making easy money. Allegedly. Now, I understand, banks are being challenged for their will writing services, by ensuring they became the executors to deceased estates and charging 2.5% fees. Bankers know there’s biiiig money in death.

So What’s The Future Hold ?

In effect we have had a modest down week, but strangely volatility has not kicked up after Thurs/Fri reversal. VFTSE is still under 12 which does not make selling premium a great proposition.Or does it? Using the past to predict the future is all we have, but maybe not. https://www.bbc.co.uk/news/business-44471537

As a much younger person I loved Tarot and had the Alistair Crowley pack bought for me.

Summer Solstice

Mid-summer’s day approaches and we may wish to look back to previous years’ events in these low volume periods. Can we learn anything of value? June has seen drops recently and July sees a rebound. As always DYOR, and enjoy.