Treading Water With Some Strange Days

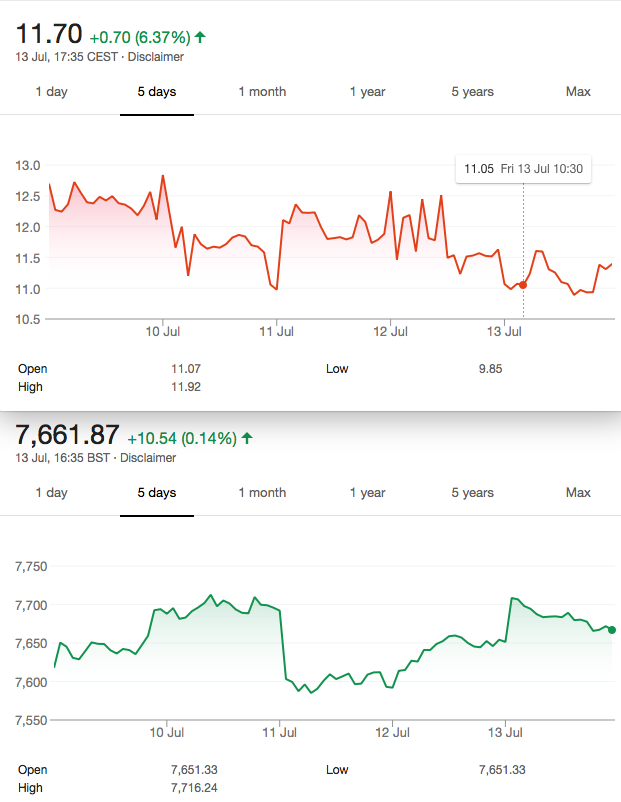

With the bizarre 1.3% drop on Wednesday and the ‘buy the dip’ crowd on thursday, FTSE went from 7688 to 7662. I have mentioned before the 7650 level which seems to have some kind of attraction. These moves are great when we are selling premium. So personally I have all 3 of my positions, barring global catastrophe, poised to make good profits. So, I could have done better. I give myself a B minus. In trading good enough is good enough. Nobody scores a bullseye every time.

The Options World Is Looking Curious

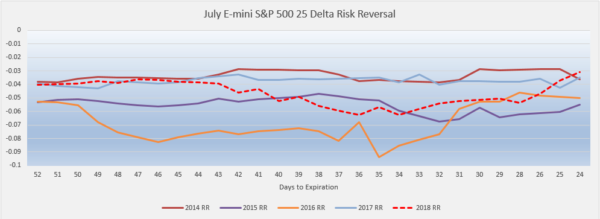

This came to my attention this week:

What is it you ask? I’ll tell you. It is a 25 delta risk reversal chart. That’s what it says in the title- not helpful! Ok the trade is an old chestnut that kept me fed and watered for some years. In the UK it’s called a combo, in the US it’s called a ‘risk reversal’.(Sell a call to buy a put). So why all the fuss ?The fuss is because of the pricing. Typically when we look at 25 delta calls and puts,the puts are way more expensive. Calls are now being priced higher than puts,for the same delta. Yet the risk is usually to the downside, so you’d expect to pay more for puts. We have the volatility curve that almost always shows greater vol in puts. They are insurance, good housekeeping if you like. I would to explain how we have arrived at this

Two Words- Irrational Exuberance

Alan Greenspan coined those two words ( do your history homework, fellow traders)when he referred to a stock market that was way overvalued. Back in the day when value was relatively cheap in the 90s,compared to now. Cheap? There was no debt mountain like there is today. QE stood for Queen Elizabeth. Yield hungry traders again have junk bonds as the weapon of choice. Never mind the company prospects, check out the yield. Bank of mum and dad is on the sidelines, what could go wrong?

https://www.mckinsey.com/featured-insights/employment-and-growth/debt-and-not-much-deleveraging

I am always ready for an unlikely 10% drop in FTSE- you?