A Week of Economic Data

A great free resource https://www.forexfactory.com/calendar.php

and this: https://www.bls.gov

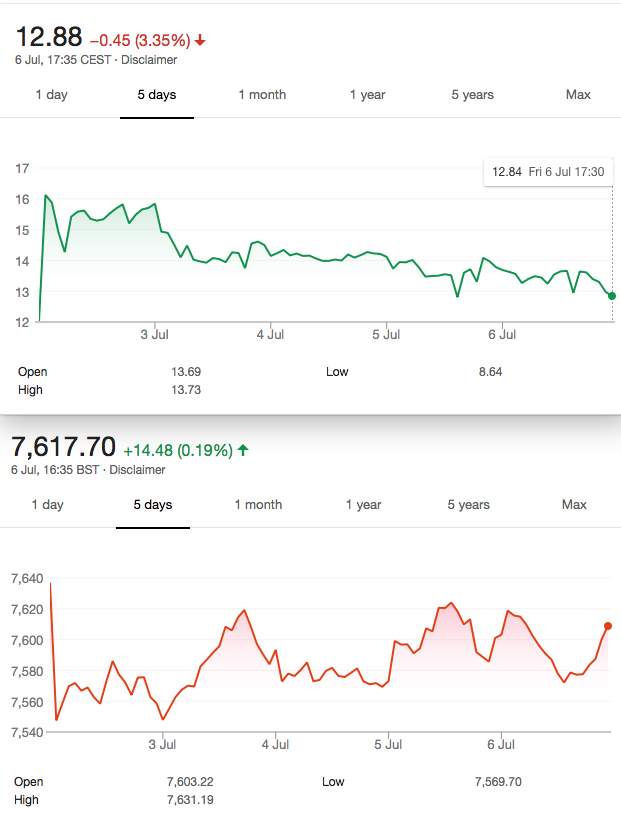

Meanwhile in our own special corner of the globe, the FTSE’s volumes have dried up somewhat to around 600 million daily. We used to see 2 billion daily, long ago,but this time of year, the bosses go away. The junior manager left to oversee things is doubtless told to keep it simple and small. I oversimplify, but this seems to be how the market runs in the Summer. There will be crazy days of course.

What Does The US Data Tell Us?

Retail jobs are going fast here and in the US. I doubt this signals the end of commerce but the changes are significant. While our opinions are divided about the retail experience, we all love the convenience of the internet. Big shopping malls are either a liability or an asset depending on location, it seems. The pound sterling though has had a rapid decline against the greenback. This was good for FTSE but commodities took a hit recently about 5% drop in the DJ commodities index (DJCI) since end of May. Doctor copper was once believed to lead the stock markets, but with so much less used these days, it may not be so reliable. However………

Significant Factors

This decline in the copper price looks dramatic on a weekly chart. RSI has gone over a cliff. Plumbers may be using plastic pipes, and copper tanks are a thing of the past. My own forays into home improvement show me that copper ismuch less used nowadays. I once met a commodities broker who told me back in the 90s that there was not enough Cu in the world to make a TV for every Chinese family. Now the tech has improved so much that doesn’t bear scrutiny. Fortunately as options traders we have little need of economic tittle tattle, we have VFTSE and VIX. And we know when expiry dates are.

Anyone remember the Sumitomo copper scandal in the 90s?