FTSE’s Tiny Range.(+150) Lower Volatility

FTSE cash index- 7368 open close 7512 high 7519 low 7368 ( last week 7453 open close 7368 high 7487 low 7339 )

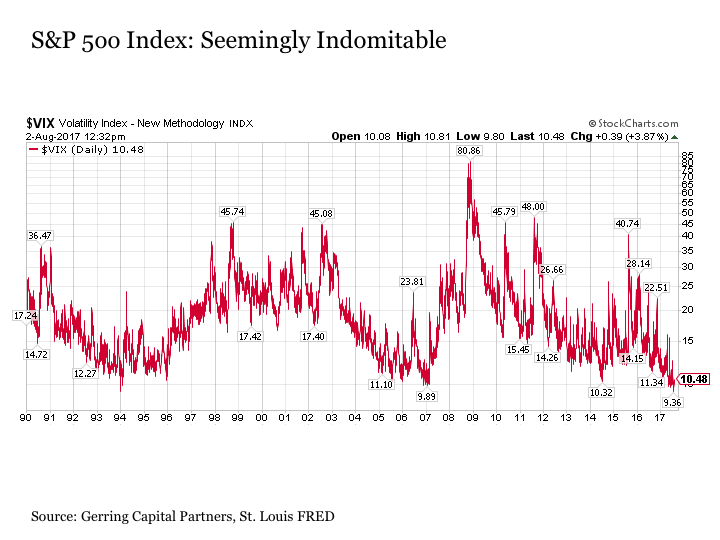

FTSE volatility- open 10.30 close 9.36 (last week open 10.13 close 10.30 )

What Trades Would Have Done well?

Anything(I mean Puts) utilising theta (Time decay)

Market Volatility

from 9.02-10.92 ( last week 8.77 to 11.36 ) Options volatility curve looks like it’s gone from a smile to a grimace!

News

The Trump circus produces more crazy stuff, but this fails to move markets- Oh Wait!!!! That was last week’s news. This is now on repeat.

Non Farms….. http://www.economiccalendar.com/2017/08/04/sp-500-futures-rise-on-solid-payroll-data/

Summary

Trade 41– got that wrong…..

7400/7300/7100 broken wing put butterfly prices 118, 62(x2), 16.5= 10.5 debit- NOW 23,9.5(x2)3.5=0.5 -ugly

7200/7300/7500 broken wing call butterfly prices 137.5, 68.5(x2), 6.5.= 7 debit- NOW 270.5,175(x2),28.5= 51 -horrible,worse than ugly!

So the Put trade- just a small loss, you’d hang on to it as there is no value in closing. The Call trade- some choices to be made here -let it run in the hope that the market takes a drop. Adjust – the long 7200/7300 spread is worth 100,the long call is worth 28.5, so you have a ‘war chest of 128.5 and a short call that is currently worth 175. You could roll this into Sept expiries x2 7450 Calls. You could roll into Oct or Nov. You could sell 7400 Puts,and 7550 Calls. Personally I have never liked these trades and on reflection the Call strikes were way too much ITM.

We are here to learn as much as to inform, so the choices for adjusting amount to this: 1. Take a hit of 60 and close out, looking to sell something else to compensate (my own choice). 2. Never mess with short ITM calls! We will be back on this one.

I have been unwell again and so Trade 41 was against any kind of judgement! I was unable to monitor positions this week but the Broken Wing Butterfly is a trade with little merit for me. It’s an object lesson in why we don’t trade when ill.

Even looking back at what might have worked with calls is a thankless task- the 7400/7500/7700 would have cost 12 and as of Friday’s close…. credit of 32.

Easy to be right in retrospect. I would always favour the butterfly which cannot cause losses beyond the premium paid. With 100 point wide strikes with the BWB you can of course lose another 100

I enjoy what you guys are usually up too. Such clever work and exposure! Keep up the superb works guys I’ve added you guys to blogroll.

Heya i’m for the first time here. I came across this board and I find It really useful & it helped me out much. I hope to give something back and help others like you aided me.