That Was The Week Words Failed Again

I have few words on the political turmoil here and abroad, but easily avoidable mayhem seems to be the weapon of choice. We may be deserving of such governance. We may have taken our eyes off the ball. However a small number of people are creating misery in every direction. I see no possible explanation or excuse for people who daily ‘spit the dummy’. We deserve better. Then there’s this :

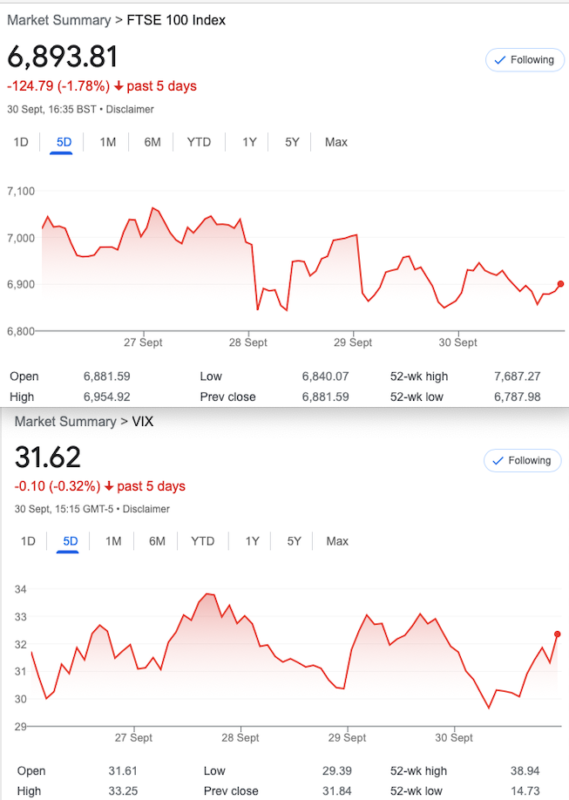

Traders, fund ‘managers’, markets, currencies, it’s all a bit bonkers, and we have grown complacent. We have been underexposed to real volatility.

I found an older article that addresses that issue, and how targeting volatility creates volatility https://www.philosophyofmoney.net/intellectual-virus-bubble/

Off Topic -But Briefly

Your intrepid author has just finished in reverse order, the excellent writings of Yuval Noah Harari. His historical perspective and future musings re worthwhile reading. Books! Who knew? Check out Sapiens and Homo Deus. I may have deviated from the central message but sometimes waiting for options to expire, is time that needs to be made productive. This trader has positions near and long dated, as sitting on unused margin is almost a crime.

Capital is subject to time decay too. However, fear, greed and hope are not part of a strategy, and I cannot emphasise this enough, we manage risk.

Distraction Trades

ADA $0.433

XRP $47467 -a reversal of fortunes as Cardano slides back. Honestly, as I closed out my position at a 70% loss I cannot get excited about crypto.

DAX 3 No entries, 1 loss 30 1 win 100 Market volatility kept us out ofthe big moves, but then I am always dubious of those who claim to catch all the ‘biggies’.

Trade 284

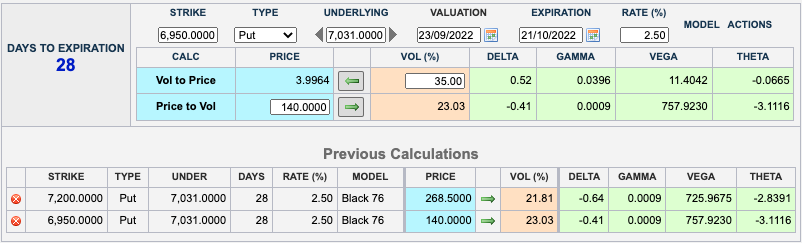

Let’s take a look at an old staple- the ratio spread. We buy a higher strike put then sell two or more further out-of-the-money puts. As we have a legacy 7200 put from Trade 283 let’s use that and so we have 2 scenarios: We carry on with our free put, and sell 2 of the 6950 puts or we just open this as a new trade 144.5 – (2×73.5) A tiny credit to enter, or we are banking 177 as a continuation of trade 283.

Where’s the risk? We’d get a bit fidgety at 6700 and if the market lifts off again we may bank only a modest profit, but we have 2 lots of time decay versus one.

Last week. Yowser!!!!!

The 6950 puts were now 140 , the 7200 put is 268.5 . So, a loss currently (140×2= 280) Gives a debit 11.5

Cut losses and move on? The eternal question- whither the market? We don’t know but let’s take a pragmatic look, bring on the Greeks:

The Greeks!

Those Deltas 41×2- 64= 18. So at £10 a point for every 1 point the FTSE moves against us, costs £1.80, but that is an oversimplification, gamma, theta and vega will all need to be factored in, so by close of play on monday we may see a little buying coming in. Thus, we may see our position go positive. Rho can chill for the time being! ( Yes I got the interest rate wrong but it’s really academic) Calculator from CME https://www.cmegroup.com/tools-information/quikstrike/options-calculator.html?utm_source=LINKEDIN_COMPANY

This week: our short 6950 puts are 174 x2, and our long 7200 put is 330. We are still seeing a small loss of 18 but we soldier on, and look at how we morphed into 285, and did it fare any better?

Trade 285, Ladder Time

Juicy premiums, yes, but again let calmer heads prevail and we can connect with Trade 284 by buying the 6700 put which creates a 7200/6950/6700 butterfly. But we don’t want to pay 69.5 for that 6700 put so we will finance it by selling 2x 6500 puts. We take in 80, giving us 11.5 credit. Now our risk is lowered to 6500 but we are in a 2×1 ratio, we are short 2 puts. We could also have looked at a strangle: selling a 7350 call (35.5)and a 6700 put (40) We would have upside risk >7350 but if the market did shoot up again, we could take some profits from the put position. This is going to be fun running to expiry with updates along the way. Hope everyone’s keeping up, but to summarise:

Long 7200 put and 6700 put.This week: 330 and 88.5 = 418.5 Ouch! shorts are now 452 or 5.5 in credit if we had sold a call

Short 6950 put x2,174×2 = 348 6500 putx2 = 52×2 or (or 6500 putx1, 7350callx1) ( 52 and 13 )=65

Trade286 Playing Safe, FTSE =6893

Assuming margin is an issue then using regular spreads is the way to go. Regular followers will know where this is going. Iron……. Condor! We sell the near month options with strikes nearer the money(the index) and we buy a protective put and call

Here we go: we sell the 7250 call for 25.5 and buy the 7300 call for 18.5 AND we sell the 6700 put 88.5 and buy the 6650 put for 77.5 Mental arithmeticians will know how this pans out. 25.5- 18.5= 7 and 88.5-77.5= 11. 11 plus 7= 18. Our risk therefore is 50-18= 32.

Where is the risk? 7268 and 6682 Anywhere in between gives our max profit 18. There are 14.2 trading days in which to be wrong!