The Lowdown on Trade 20

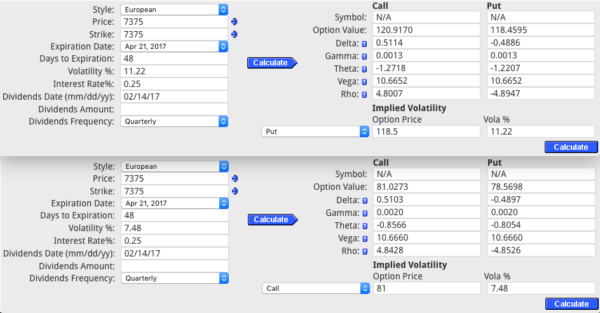

It’s a looooooong straddle. We would be buying the call for 81 and the put for 118.5. Total 199.5. WHY?

It’s All about The Vol

As shown in the calculation- (hope you can see the calculation) the volatility is pitiful. The premiums thus are too risky to sell, in my opinion.

What is low Vol?

I recently saw a chart of daily market volatility and it is troubling. There is no volatility. This may be due to algo trading which has divided opinions-some say they provide liquidity, others say they rig the market and front-run trades. There is not enough room to get into that debate. We live in an age of highly reliable tech,and the Doomsday scenarios never seem to materialise. Terminator remains in the realms of sci-fi.

Is There a Sound Basis for This Trade?

Honestly I don’t know-we are here to provide ideas, to show the nuts and bolts of real trades. Some may find it a little beneath their understanding,others may be struggling-and I hope they will ask if they have trouble. Options are about mindset. The old floor traders were not the smartest guys, they say, and I’m no genius. This trade could make a really quick 20% in one day. All it needs is an intra day event to move the market more than 1%. How likely is that? No idea. will this trade ruin us? No. Would the reverse of this trade make sense? NO. Would you close out at 20% loss? Probably. Bear in mind this has zero effect on margin it is a pure naked buy, (albeit for a cost of £2,000) with zero liability.

Options lingo: Straddle- at the money,(ATM) strangle..think of 2 hands around your neck*, options out of the money(OTM)

*Hope not!