That Was The Week: Brexit, Coronavirus, Trump

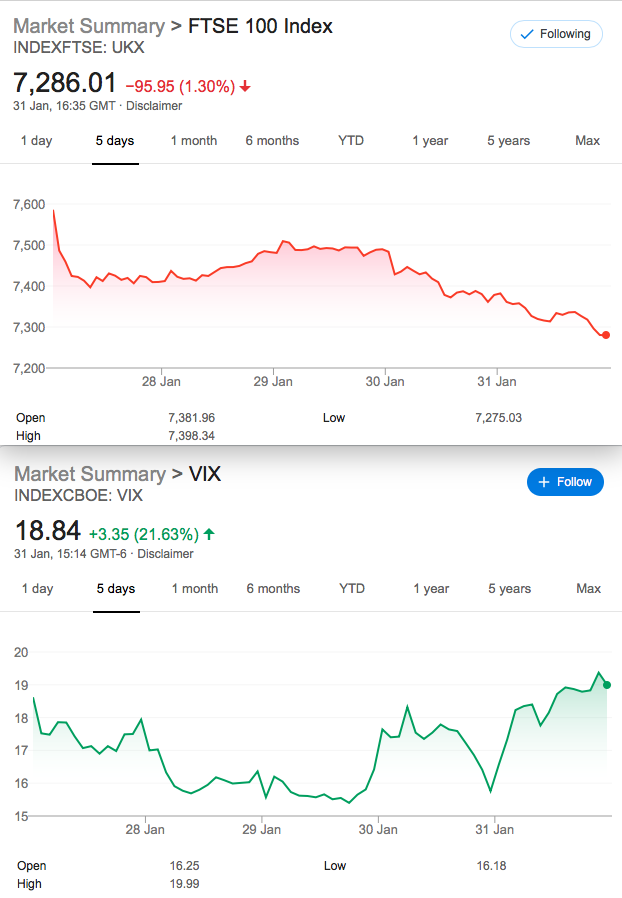

As the chart shows the FTSE and indeed global markets got spanked this week. FTSE dropped 4% this week and while the virus is an unknown, things may be somewhat dicey. The £, curiously, is $1.32 so it’s not clear if there is a lack of confidence in a divorced UK. Most commentators seem positive, and see the UK as innovative, trustworthy but rather stodgy. Growth and productivity remain anaemic, however. Road’works’ for example-we all know how that goes.

Usual Commentary Pared Down.

Brexit- it happened. Trump’s impeachment- it’s not going to happen. Coronavirus- who knows what will happen? Commentary on such turmoil is somewhat flippant so we will digest new information as it happens. The market may now be in a new paradigm, and that is hard to adjust to.

Legacy Trades and 167

Our own Trade 166 has seen such a huge market drop it is high time we looked at a loser and how we may adjust.

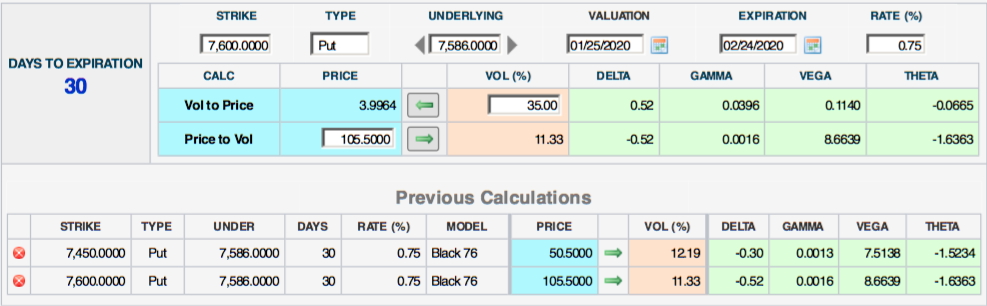

Trade 166 Quelle Horreur. Even Worse The Expiry Date Was Wrong*- Apologies.

*should have been 21 Feb not 24th– somehow the calculator defaulted to the 24th,and this was not spotted.

The backspread, who took it? – congrats, as you’d have made a monstrous 92+4.5(credit to enter) =96.5. This would not have been on our radar, due to the size of the spread and potential to get it horribly wrong. Horribly wrong is what we actauly were!

We are facing a situation where the 7450 short puts are also in the money -and we are looking at loss of 96.5. Of course it’s a mirror of the back spread.

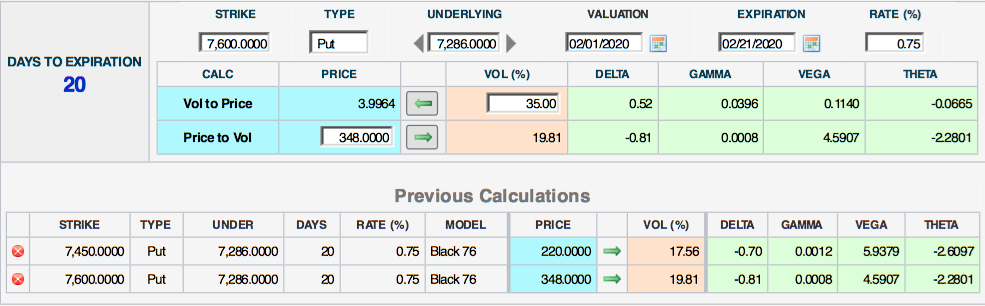

So, what’s to do? Let’s examine a few of the manifold strategies.

- Traders with a will of iron may just take the hit– close out, look for the next opportunity. Hardcore- my admiration.

- We can convert to a butterfly -we would have to buy the 7300 put at 125.5 – savage unless we do something like sell 2×7150 puts (66.5×2) or a March 7150 put (121) We could also look at selling calls, 7450s are trading at 34.5. We are now in a whole new area of risk, though rolling into next month might be kinder to one’s mental health.

- We could close out the long 7600/7450 spread for 128, look to swap out the short 7450 put for March 7350 at 215. Buy a 7500/7350 put spread,(cost 102) thus lowering our risk to 7200. This trade could also give a max profit of 150, and we took in a little 26 extra of course(128-102)

- The whole position could simply be swapped out for March 7350/7250 put ratio spread (215, (162.5×2))=110 credit

- These are just a few suggestions but the received wisdom is to sell while volatility is high. We know this is usually a condition that does not generally last long.

- However that does not mean that the whole position has not shifted. It most definitely has. Support becomes resistance and so on.

- Sit on your hands- wait and see if the market moves gently back in our favour

Trade 167 Going All In Eating Vol

Strangle or short straddle, one can choose either or actually any number of strategies to capture the big volatility. Confession time, however as we are a little adrift with the market, but again we can show adjustment as and when.

Straddle time it is. Closest to the money 7275 call=95 put=113.5. We sell both for credit 208.5 looking for quick vol shrinkage as the market digests news and moves on.Risk at 7066.5 and 7483.5. A little blip up, vol drops and we are done, looking for a modest profit.

Getting A Wake Up.

Winners we have had aplenty, whilst we have cruised along. This has never been an idle boast about our prowess. The magic of options- that is what inspires us. This new development must be faced as it reveals occasional ugly nature of trading. This 4% drop in the week has been a proxy for a swift kick in the pants. Humbled we are.