The Week of Going Nowhere

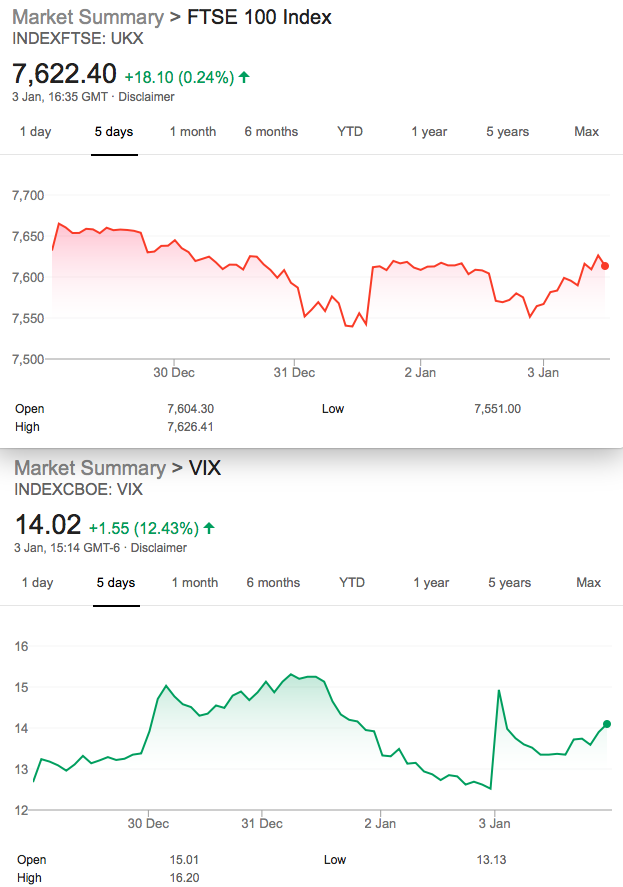

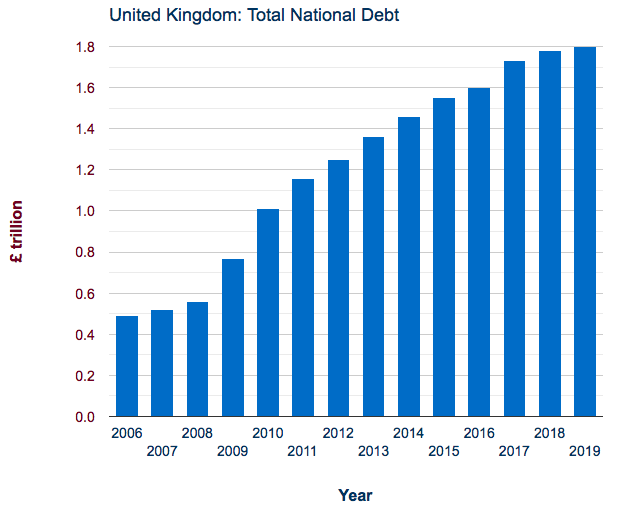

FTSE’s inertia was hardly surprising given a quiet week for trading and tiny volumes. We ‘take stock’ with each new year and this new decade is a big milestone. Ten years ago we saw FTSE at 5413, up about 40%. The nation’s debt is up 80%

So, if the UK government were running your fund you might have a few issues. Our simple comparison however is frivolous,and means nothing. Unless you bought an index tracker.However FTSE with dividends reinvested would probably outperform UK debt. Inflation is a bigger issue with long term investing. Thankfully that is not our concern. I have been intrigued by these predictions:

Highly recommended: http://newsletter.vantharp.com/public/viewmessage/html/10920/4bdl35uj8edxo6n02pi071j8gnikc/c6464088301e6408d91566b614e180b9

Some More Gentle Reminders

So, why do we only trade the index? Advantages are manifold over stocks. We don’t have to be directional, and while one can be neutral on a stock, a sudden move can see you assigned or exercised. Company bosses sometimes do crazy things and the stock thus fluctuates wildly. Dividends need to be factored in alongside surprise announcements about dividends. Surprise announcements are not good for restful sleep. One or two stocks in a hundred doing bonkers stuff causes no problems. Cash is the method of settlement at £10 a point, some stocks are based on lots of 1,000 or 100. Thus we are crystal clear that an option trading at 3 (pence) is worth £30. Good luck with that on your stock-are you sure it’s based on lots of 100 or 1,000?

Psychology plays a part- we can all get ‘married to the trade’. Endowment theory tells us we overvalue that which we own. You cannot love an index of stocks that trade globally. BP stock however may invoke notions of ‘patriotism’ or Britishness. Gold miners- well gold’s up why isn’t my stock? You get the picture,right?

Trade 161 Our Only Legacy Trade

Our calendar spread cost us 7.5 and we were left with a long 7100 Jan Put. Last week I said the following:

We could sell 2×7000 puts at 6×2=12. Thus we’d now have a credit* of 4! Or a butterfly 7200/7150/7100, giving a free trade. So we sell the two 7150 puts and buy the 7200 put.(9.5×2)-11= 8

Butterfly now: worthless, but the ratio spread while also worthless at least gave us that credit*.

Trade 162 When is a Jade Lizard* The Right Trade?

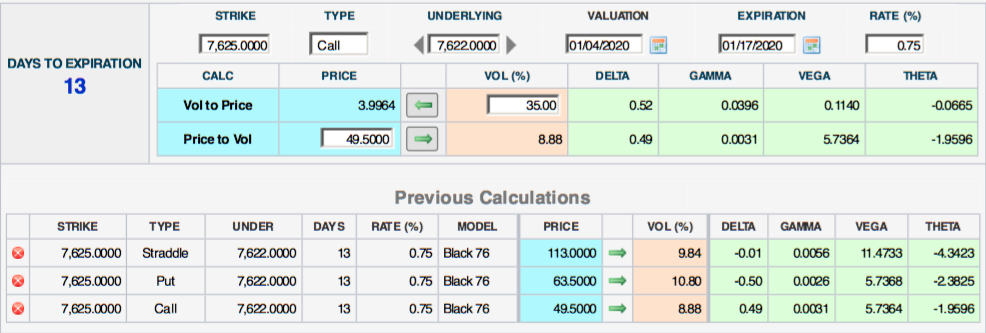

Short 7700/7750 call spread 36.5 and 20= 16.5, short 7550 put for 33. Giving us a total credit of 49.5. Thus our max risk to the upside only 0.5. The spread can only go against us for maximum of 50. And our risk below is at 7500.5. ( 7550 strike minus the 49.5 credit we took in).

* A combination of a short call spread and short put,whereby premium=upside risk in a bull market.

Currently: 19-8.5= 10.5, plus the short put=36. Total 46.5

Trade 163 Forlorn Long Straddle

The market may react with increased volatility with global events. FTSE shrugged off the news,spat on it, and promptly kicked it to the kerb! So this is cheap relatively at 113, and I don’t think we’ll see 7735 or 7509 but a big one day move might see this worth 20% more.