That Was The Week

So, a wiffle here a wiffle there- typical grinding away with no direction. However, most of the time markets go nowhere, but we don’t mind as we do not have to pick direction. So how can we profit from market inaction? Time decay favours those who are premium sellers. Though we have a problem in that every premium seller thinks they are a genius, with so many winning trades. The trade typically takes advantage of absence of market motion. Until it doesn’t. This is why calls have higher margin. A stock can go, theoretically to infinity but can only drop to zero. So… if you sold a BP put at 500 you could only lose 500(at £10 per point)The compensation would be the £145 you got for selling the November 500 put. Infinity liability with a short 500 call for about £50 compensation would be harsh!

What Caught My eye This Week

You have to think that charging interest on money is no longer a thing. It makes sense to get that capital working doesn’t it?Anyone who has ever been refused a mortgage would rightly think ‘the money is better used in buying a home than lining a bank vault’. There seems to be no downside, except……… there is. UK public debts have increased 36%. Three cheers for tiny interest rates, until something changes. Government debt has to be attractive to buyers and nobody should be paying to lend their own money. Negative yield bonds are still selling, however.

The private sector?

Here’s a great link showing things are not awful. Despite the bleatings of the anti-government people. https://www.ceicdata.com/en/indicator/united-kingdom/household-debt–of-nominal-gdp

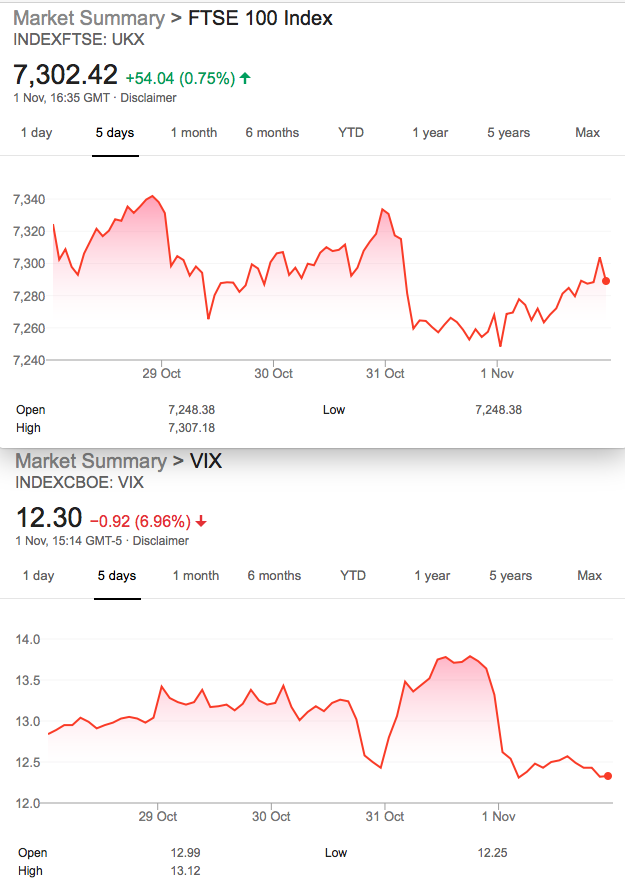

Many of us expected a recession in 2019 many of us expected…. Brexit! Situation normal, nothing much to see here it seems

Those Legacy Trades and 154

Our trade 150 How did the adjustment do? Butterfly is of course 7250/7150/7050(160,106.5×2,69.5)=229.5-213=16.5. We are short some 6800 puts though….. 24×2= 48. We’d be underwater for 28, remember we have a credit of 3.5 from the adjustment, hence 48 – (16.5+3.5)=28debit. Credit 12 for the butterfly short puts are 4×2=8 so still ugly –losing (28-4)= 24,but not a catastrophe. Now…

7250/7150/7050 ‘fly= 49.5,24×2,13.=14.5 6800 puts are now 4×2=8. Our loss is now 24- (14.5-8)=17.5 loss

Trade 153

Long put spread 7000/6900 ( 56-36.5)= 19.5 We bought the 7000 put and sold the 6900. You say ‘that’s a bit pricey’-ok, so let’s be a little cheeky and sell a 6750 put for 20. For a tiny credit of a halfpenny.

We note those prices now 7000 put=9.5, 6900 put=6, short 6750 put 3. Neutral

Trade154

On my chart 7422, – it looks like quite strong resistance yet the pathway seems upwards. Speculator that I am on levels, I think we can get short at 7450, but long below it. You ask how? 7400 @28.5 7450 @ 15.5 or 7500 @8

Picking the bones out of these strikes and prices we can construct a long 7400/7450 spread, and sell above it. Personally I favour a ratio spread –selling 2 of the 7450calls for each long 7400call. Thus we collect (15,5×2)-28.5= Credit 2.5 You could opt for long 7400/7450 spread and sell the 7500 at 8, giving a Debit trade of (28.5-15.5) -8= Debit 5

The ratio is now 10,4.5 x2= CREDIT 1. The other choices are losers frankly!

Trade155

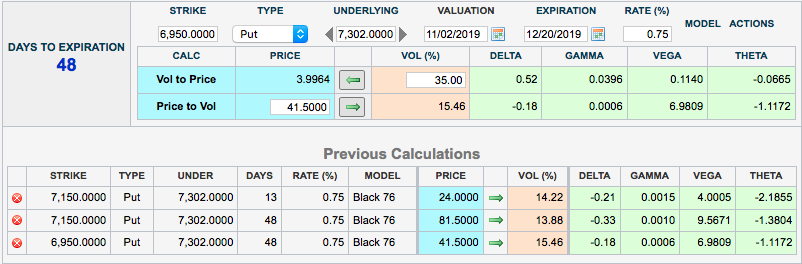

Should we be looking at the theta curve?

We all know that time spreads(calendar spreads) take advantage of the above. Time decay in the last 10 days(Nov) is huge relative to the time decay 45 days(Dec) hence.(We have 13 and 48 days) Calendar trades are tricky however, we are paying up big for the far month, and expect little sympathy selling near month. Here’s a rather pricey trade: Buy the Dec 7150 put , sell the Nov 7150 put

Expensive but possibly a great trade,with very limited profit potential. Personally I’d like more help with the cost, and we can of course get help in many ways. I’ll leave this open but we could sell 6950 Dec put for 41.5. In fact.Let’s do this.

Our debit is now 81.5-(24+41.5)=16. Max profit 7150-6950 put =200 after expiry! Currently we are buying a Dec spread that costs 40 and selling a Nov put for 24