That Was The Week

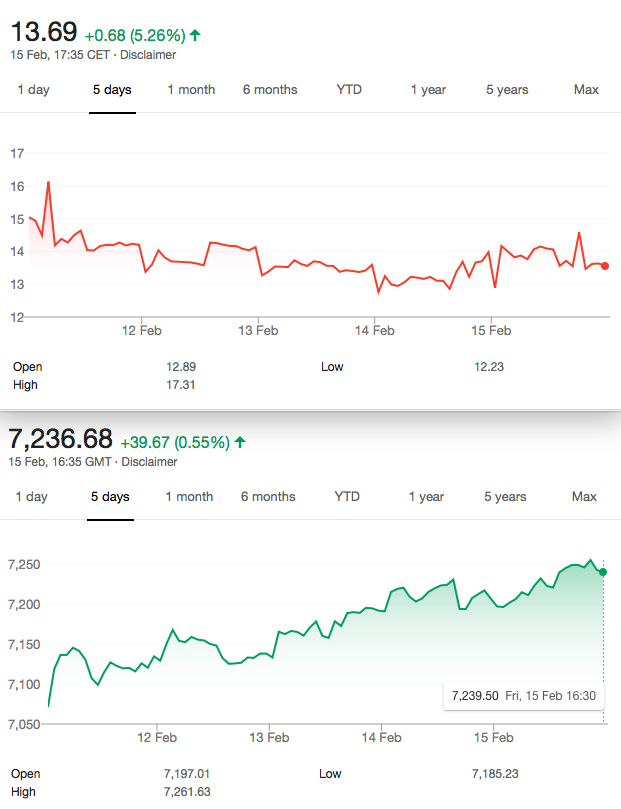

FTSE rose from 7071 to 7236 up 2.3% because everything’s peachy. Typically, as ‘permabear’ I always assume the market is wildly optimistic, as real results often disappoint. So, retail sales seem to have bounced back as people bagged the 70% off bargains. Thus I think if shops can sell stuff at 70% of and still make money, we may need a rethink about our perception of value. A certain Mexican chain restaurant charged me £12 for about 20 tortilla chips. Yes, the ones they used to give away whilst one is deciding what to order. We have never lost the epithet ‘ripoff Britain’.

So again this week, a trader I follow who is seriously astute, points out the manipulation with intraday market moves in quiet times. Thus again my faith in options trading is reinforced as I cannot be doing with the intensity of sitting at a screen for 8 hours while my stops get hit. Yes I get trades wrong, and have out of date opinions. But,options allow the freedom to adjust and have a rethink. Getting stopped out, day in day out, is soul destroying. Therefore I give my unwavering admiration to those traders.

Just look at that ramp up.

Meanwhile in Trader Land- Last Week

Trade 118– we are looking at (again not my favourite) an Iron Condor. We were selling a 6750/6700 put spread and selling a 7300/7350 call spread for a total credit of 6.5+7.5=14.

This Week

Call spread 15 put spread now 2. Thus if you had bought, you’d be indifferent. Had you sold, you’d be mildly in a loss making position. So we need to run this before making any decisions,as you’d expect.

Trade119

I think we can only ignore the ‘B’event as the market seems to have done. So we should probably be looking at something low risk and low cost. I see key levels: support 6950 and poss resistance 7270,so maybe the 7150 level might be a good place to get long. Was I a directional player, I’d wait for a drop, as the 7150 call is currently 123. However, the butterfly giving 100 point wide strikes would be 7250= 70, 7350 =35. The maths 123+35-(70×2)= 18.

Again this trade has a while to run but it’s £180 to get a max £1,000. Logic? It may be that in the next few weeks we see a non-event and if the FTSE smashes up over 7270 we only lose our stake but might be able to adjust, to get something more out of this. Given the absurdly low volatility it’s not easy to sell premium. The risks are huge, the rewards modest,so let’s keep those under control. Remember stops with futures/spreadbets get blown away and a sudden move will not always see you get a reasonable closing price.

Other Considerations

The market is ignoring, in addition, the record amounts of personal debt

One email recently pointed to the fact that recession always follows high personal debt, which can no longer be serviced. The gig ecomony is forcing people to work in less than ideal situations. I feel for those who have no choice, and the benefits system no longer seems to offer much of a safety net.Stay safe, trade only when you have a plan.