Trade 2 from last week- we sold the 6250 call, and bought the 6450 put for zero. I did not like the trade as I always look for a credit with these, and it would have made at best 5 on Monday, but currently it’s a loss of 4. So what’s the take away here?

Trade 2 from last week- we sold the 6250 call, and bought the 6450 put for zero. I did not like the trade as I always look for a credit with these, and it would have made at best 5 on Monday, but currently it’s a loss of 4. So what’s the take away here?

It’s All Greek to me

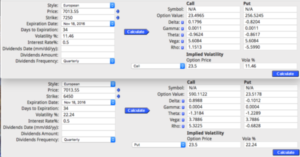

Well the entry was terrible-why? It takes time to get used to this, but look at the Greeks– start with delta. For every 1 point the FTSE moved, the call would move 0.1796, but the put only 0.1012, now the rate of this change of delta (gamma) also is dismal for the option that we own-the put. Time decay (theta) again was working against us unless the market took a big dive immediately. That was our one hope, and it didn’t happen. I’d have closed this out and taken a tiny loss/profit personally, but I will run it and show what we can do when a trade gets ugly. When you have only winning trades you learn nothing. However the prices now suggest we could do better with the same upside risk, selling the 6250 call and buying the 6550 put with FTSE at 7020, for a cost of zero, again. Make this Trade 3. There is an old adage about trading- never add to a losing trade, but that is precisely what we are doing here. It’ll get interesting at some point,and of course the US election looms large and may be a massive market mover.

Let the Market Come to You

Unlike futures or shares, we wait until the option prices fit our criteria by waiting for the market to move our way-so we aim to have knowledge of strategies for different scenarios-up,down, or a drifting sideways market. Market commentators mostly talk rubbish about volatility. We have https://www.google.co.uk/finance?q=VFTSE&ei=IBjOVPhV59nBA4vRgIgK and http://www.bloomberg.com/quote/VIX:IND

Volatility is key to option pricing-and typically it moves opposite to the market. This combo trade will benefit if the market has a quick sharp shock and volatility spikes up in tandem with the put price increasing while the call price shrinks.