Trade 79: How Did We Do?

Remember?……. Straddle! 7725 call at 79.5 and 100.5 for the put. We buy both for a total 180. Close of play on Friday 107.5 and 71.5 =179. We can run this or close it, hard call but at least it is not haemorrhaging money. I think we may see the same again this week with hardly a move,as indecision rules the day. This is when you need to be burning theta(time decay) in a strangle(with some protection),iron condor or something directional but low cost

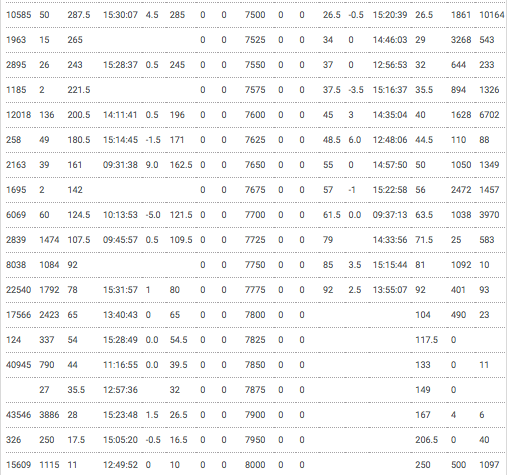

Trade 80 Look at The Chain

For our trade we are focussing on near-the-money calls.Third column in from the left,those are the closing prices. You may take a view that FTSE will hit 8,000. How could you trade this with modest risk, but low cost? The 7950 strike is trading at 17.5. What if we sold this to buy a spread that, when in the money would give us 50? The 7850/7900 spread would fit that bill. We would buy the 7850, and sell the 7900. This would be for a debit of 44-28=16. Would you be happy to spend 16? Sure, why not if that’s where you believe the market will be before the June 15th expiry. But let’s get cheap.

The Flexibility of Options

In our example,we are buying the call spread, but we can finance this with the sale of the 7950 call. Our risk is now at 8000, but our cost is now a small credit 17.5-16=1.5.So what if we are really wrong and the market drops? We keep the 1.5 and have a ‘cleansing ale’. What if the market hits >8000? We will have to adjust but remember we have the spread now worth 50. This is a war chest if you like, to purchase other insurance. The market gets to the sweet spot above 7900? You make 50, plus your 1.5. Rejoice, and thank your parents that you were born into such a fabulous time, where options are traded and SpaceX may give us all a ride to Mars.