When Vol is Neither Big nor small

We sometimes like to go directional, but an outright purchase of options is not …a great option. We could buy a put, a put spread,a call or a call spread. This would be safer than a combination (risk reversal for US traders). A combo is the buying of options and selling of opposing options. We thus have an alternative to a future which is a purely directional play. We normally trade futures using stops. I would typically be looking to make at least 2 for every 1 at risk, with a future.That is not an easy prospect. You are going to be wrong quite often.

Naked Is Never a Really Great Idea

However, when we trade a future (£10 a point,remember) we can quickly get stopped out. I recall we had a strangle a while back. We had sold the 7150 call which would now be underwater big time. So, when we are wrong with a combination, it means making an adjustment. We ‘morph’ the short side with whatever is left of the long side. We don’t like having naked shorts in any scenario really.

Trade76 -The Details:

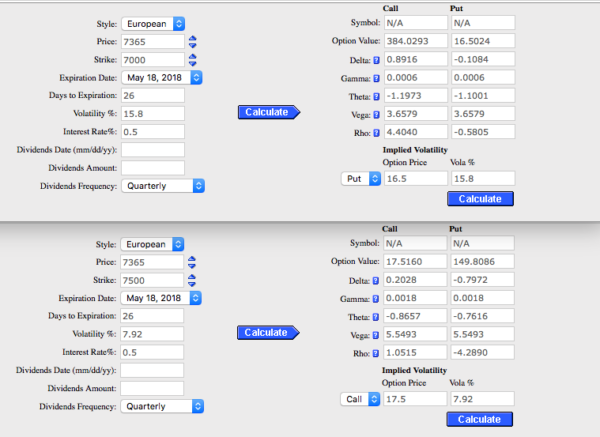

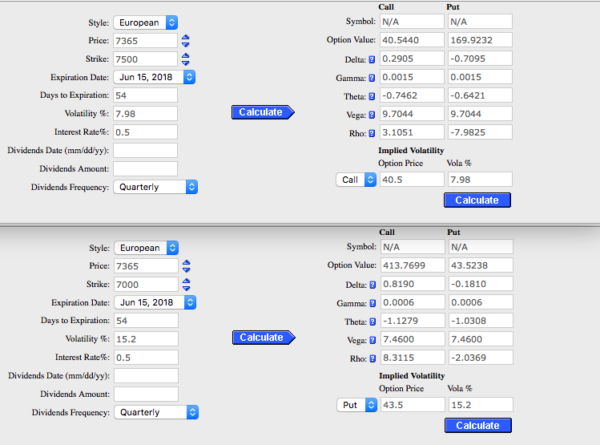

May prices: 7500 call sell for 17.5 and buy the 7000 put for 16.5 This can go wrong in all sorts of ways. June prices a little different: 40.5 and 43.5 respectively. Debit of 3. But which is best?

The Greeks

I don’t really like this trade,but I used to make money with these, and in some ways it’s better than a future. Thus the Greeks give us the big picture and it’s far from ideal. For me the deltas are a bit off but a 50 point drop in FTSE might see a nice profit. 100 points even better. 200 points best