Trade 74 Let’s try something

What are we looking at? A strategy that might make some sense, or not. This is a first and I have to confess it’s a crazy idea. It’s NOT my idea, but it could be a monster strategy with careful monitoring. The 4 calculations allude to the 7175 strikes for April and May. So what on earth is it?

Buy 3 Sell 2 Gives You 1 Extra.

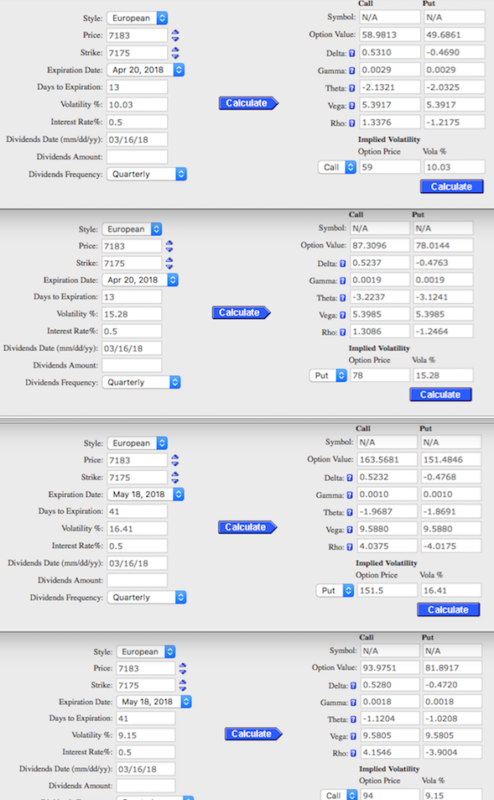

Simple principle- we are buying straddles 3 x April 7175 straddles and ………..selling 2, yes that’s TWO of the May 7175 straddles. Remember a straddle is a call and a put ATM– at the money. So why do this? What is the entry? Where is the exit? The entry is obvious as shown here April (59+78)x3= 411 May (94+151.5)x2= 491. We are entering for a credit. 491-411=80, a big credit.

Why Are We Doing This?

On the face of it buying the near month and selling the far month is just dumb. Agreed. Theta is not in our favour,but we cannot hold this unto expiry anyway- if FTSE is at 7175 on Friday 20th April we are toast. The idea is that we have one extra option, whichever way the market goes, and a big move may make us some serious coin. This is not a regular trade for us it’s a fun demo and I have only done this once before and it was cracker.

Caveat

For the first and perhaps ONLY time, we claim no credit/responsibility for this trade. We have no way of quantifying our entry without extensive back testing which we have yet to do. There is something very important to state here. Options trading is complicated. At its basest level you can just buy and sell naked, but without insights you are just whistling in the wind. Hope will eventually lose out to reality. You would not fly a plane without lessons. Same with your hard earned cash in the options world. But…we can boldly go with paper trades. Enjoy