Cutting To The Chase

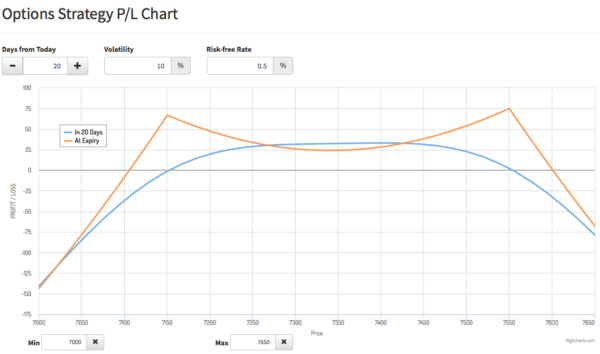

It’s a ratio calendar strangle and it looks like this:

Trade 57 Nuts and Bolts-Let’s Speak Greeks

The best offer and it’s not flippin’ Black Friday! We have done the maths and while the graph looks pretty darn good….. How’s things in the back office? Delta: 0.111 against, Gamma: 28 against, Theta: 1.9636 in our favour, Vega: 0.3948 in our favour.

A bit of a mixed bag but theta is working for us in a big way. Gamma is huge and this is related to the expiry date. It’s only a problem if one side gets ugly. Based on volatility recently it seems it is not going to be an issue. Famous last words, along with “iceberg? What iceberg?”

What is The Exit Strategy?

More important many would say, is the exit strategy. Entry into this trade is a debit of 23.5

(we’ve done the numbers again). Selling Dec 7150 put 7550call ( 21+11)x2=64, Buying Jan 7150put, 7550call51.5+36=87.5. So that’s the cost of entry, we’d look to make at least 100% of premium paid, so at least 50. Because we have sold more options than we own, we have to put up margin too.

What is The Logic of This Trade?

The last ratio calendar with puts did brilliantly, but we face the ‘Santa rally’. Thus we may want to be trading calls too. Back to the exit, however. A calendar trade can only run to the near month expiry. It has no more positive time value, so we exit before expiry, taking whatever profit we deem sensible.

A minor gripe- this site is for enlightenment, for serious people who wish to trade options and make money. Many hedge funds have closed due to this awful market. they have lost billions. We’ve shown you how to make 100%+ a year. Just sayin’

This has made a tiny profit to date but we run calendar trades to expiry where possible to use up all the time value