Directional But Here’s Why….and How

This is a christmas tree but it’s,er, April. I think it’s a helpful visual as this week’s trade, is known as a Christmas Tree. The visual is key and I love that numbers and patterns are a part of options trading and making music. Both of which I do badly! The mathematical symmetry delights me but serves as a mnemonic (cool word) a reminder about ‘where we are relative to others’. So what do I mean? Let’s take look.

Trade 24 -Starts Cheap and Gets Cheaper

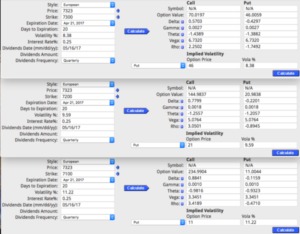

We start with a long put, the 7300 at a cost of 46. We then sell short the 7200 put for 21. Now we have a long put spread that cost 25. Imagine those are the top and next lower branch of the christmas tree. Now, we are going to sell the next branch down- in our case the 7100 put for 11. Why? OK It’s not everyone’s cup of tea but I’m cheap. By the way a christmas tree or ladder can as far as I know,be a whole series of shorts and longs. Going down the chain for puts, and up for calls. You aim to sell expensive options and buy cheap (like life really). So let’s take a look at what we have:

To cut to the chase: the deltas: 0.4297, 0.2201,0.1159. We own the big delta, so subtracting the other two, gives us 0.0937 in our favour. The other factors-gamma ( flat) theta (0.75 against us) and vega(1.69 against us).

There is nothing horrible in this trade from the perspective of the Greeks.The trade makes 100 if FTSE expires above 7100,for a cost of 14. Risk £140 to get £1,000? Not bad if we are right.

What if We Are Wrong?

We lose 14, more if FTSE drops below 7000. All clear?

interesting move today- looks like the 7300 put may have some value in it at expiry, the trade is now 18-20

ok currently this trade is worth about 10- but it’s there to run to expiry- it’s cheap enough not to worry about